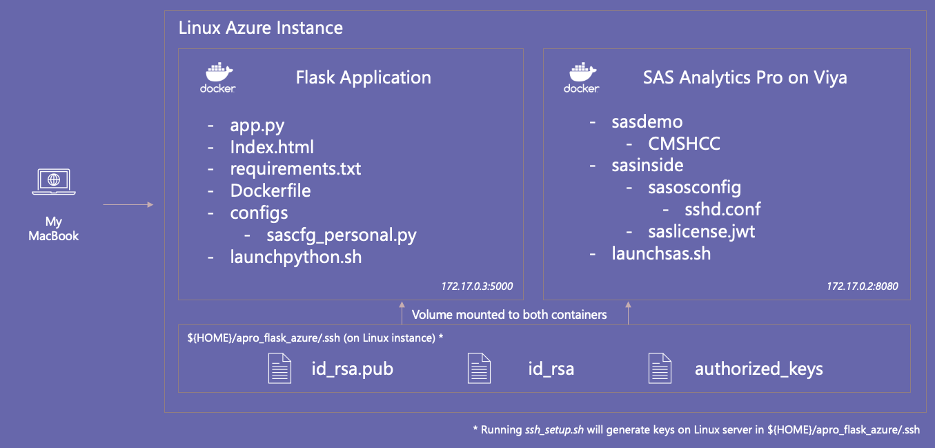

In this third article, we will introduce an alternative approach that surfaces the CMS-HCC Risk Adjustment Model execution through SASPy integration to a Flask application. We will demonstrate how this integration allows a user to score an individual patient/member on-demand, using inputs to an interactive web form to execute the model score code, surfacing the resulting score to the user.