Bright Data

Analytics that enlighten your mind from the CEE region

Il contesto che stiamo vivendo oggi è rappresentato perfettamente dalle parole di Moshe Vardi, professore di Computer Science alla University of Texas e esperto mondiale di robotica. Secondo Vardi, i progressi della scienza robotica e dell’intelligenza artificiale produrranno cambiamenti così drastici e repentini nel nostro modo di vivere e di fare business

Obecnie większość firm, operujących na danych, korzysta z mniej lub bardziej zaawansowanej analityki. Ten trend przestaje być przywilejem wielkich korporacji, a staje się standardem dla wszystkich, także małych i średnich firm. I tak jak potrzeba korzystania z analityki rozprzestrzenia się wśród firm, tak dzieje się to także wewnątrz organizacji, zwiększając

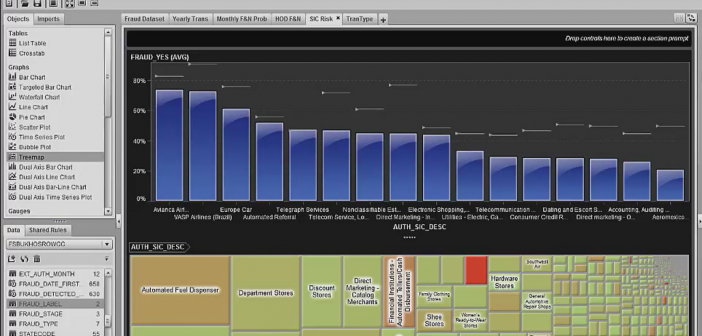

From national security agencies, law enforcement organizations looking to terrorism and criminal activities, internal security, audit and compliance departments, to hospitals and public health organizations guarding against disease outbreaks, there are many common needs and constant challenges, e.g.: Detect an event of interest in the early stages. Investigate suspicious events