All Posts

O setor de utilities, incluindo energia elétrica, água e gás, está passando por uma profunda transformação digital. Esse movimento é impulsionado por mudanças regulatórias, descentralização da geração de energia, crescimento do Mercado Livre, pressões ambientais (ESG) e a necessidade de maior eficiência operacional. Nesse contexto, a IA no setor de

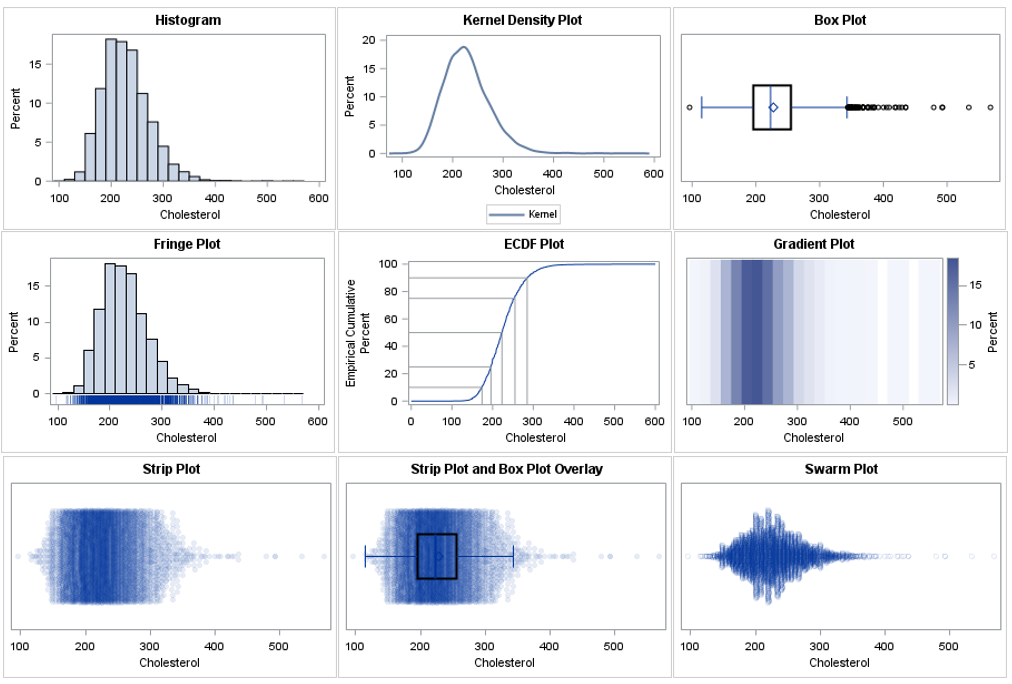

There are many ways to visualize the distribution of univariate data: histograms, kernel density estimates, box plots, and more. Visualizing a distribution leads to better insights than merely displaying statistics such as the sample mean, standard deviation, and quantiles. In fact, there are many well-known examples of data sets that

Now that AI has entered the business world, I believe the next stage involves combining AI technology with significantly greater computing power. Quantum AI represents the next step, opening up exciting prospects for organizations by enabling speed, precision, efficiency and innovation in areas where classical technology reaches its limits. Traditional

This article was co-written with Sundaresh Sankaran. The Artificial Intelligence (AI) era is here. To prevent harm, ensure proper governance and secure data, we need to trust our AI output. We must demonstrate that it operates in a fair and responsible manner with a high level of efficiency. As builders of

A era digital, com suas conveniências e inovações, trouxe consigo um desafio: a sofisticação das fraudes. Diariamente, milhões de brasileiros são alvos de golpes que se reinventam, explorando vulnerabilidades humanas e tecnológicas. A impressão que temos é que a criatividade dos fraudadores parece não ter limites e é nesse cenário

In 2025, I wrote about 60 articles for The DO Loop blog. My most popular articles were about SAS programming, data visualization, and statistics. This blog post lists some of the most popular articles from 2025. Read on for the Reader's Choice Awards in various categories! SAS Programming The following

단순한 경쟁을 넘어 사회적 문제를 해결하고 인류의 삶을 개선하기 위한 혁신의 장인 글로벌 SAS 해커톤 대회가 지난 9월 중순부터 10월까지 한 달 간의 흥미로운 개발 여정을 마쳤습니다. 올해로 5회를 맞이한 'SAS 해커톤 2025'에는 전 세계 66개국 708개 기업 및 대학, 그리고 SAS 파트너사에서 2,058명의 인재들이 등록하며 뜨거운 관심을 입증했습니다. 이

Obliczenia kwantowe (informatyka kwantowa) to jedno z najpopularniejszych haseł technologicznych ostatnich lat – wydaje się jednak, że nie bez powodu. Komputery kwantowe są w stanie zaoferować wykładniczy wzrost mocy obliczeniowej, co oznacza, że potencjalnie będą w stanie rozwiązywać problemy nierozwiązywalne w skończonym czasie nawet dla najpotężniejszych klasycznych superkomputerów, a niektóre klasy

When I first started as a data scientist, there was a gap. I met with dozens of organizations who would invest time and resources into building accurate and tuned models and then ask, “What now?” They had a fantastic model in hand but couldn’t get it into a place and

¿Qué es FRTB? El FRTB (Fundamental Review of the Trading Book) es una reforma integral del Comité de Supervisión Bancaria de Basilea (BCBS) para corregir debilidades del marco previo de riesgo de mercado, evidenciadas en la crisis financiera de 2008. Sus objetivos principales son: Marco más robusto: metodología más precisa

Nueva taxonomía para Solvencia II La revisión de Solvencia II que entrará en vigor en 2027, mediante la Taxonomía 2.10, introduce cambios clave en capital, provisiones y reporting, reforzando la resiliencia del sector asegurador. Estas modificaciones exigen una adaptación tecnológica y operativa para garantizar el cumplimiento normativo, especialmente en áreas

Tecnologia pode impactar na relação de marcas com os seus clientes, construindo ou reforçando essas relações Em um cenário de constante transformação no marketing, martech e confiança do cliente ganham relevância diante de tantas novas tecnologias disponíveis. De um lado, a fragmentação das ferramentas de martech impõe barreiras à construção

Technology advances fast, but meaningful innovation still comes down to one truth: systems work best when they’re built around people. In risk, fraud, and compliance (RFC), this means designing tools that understand intent, reduce friction for investigators, protect sensitive data, and adapt as fraud evolves. The Grace Hopper Celebration (GHC)

En el mundo empresarial, pocas fugas de capital son tan silenciosas y costosas como el fraude en los procesos de compras. De acuerdo con la Association of Certified Fraud Examiners (ACFE), este tipo de irregularidades ocupa el segundo lugar entre las formas más comunes de fraude corporativo a nivel global.

In my first article on hyperparameter autotuning, I used a cake analogy to show how to use hyperparameter autotuning with Optuna and the sasviya.ml package in Python to improve detecting Higgs bosons in a particle accelerator. SAS Viya Workbench now supports hyperparameter autotuning in SAS code with a variety of