How insurance companies can use synthetic data to fight bias

Stop bias in its tracks – learn about the value of synthetic data for insurance.

Stop bias in its tracks – learn about the value of synthetic data for insurance.

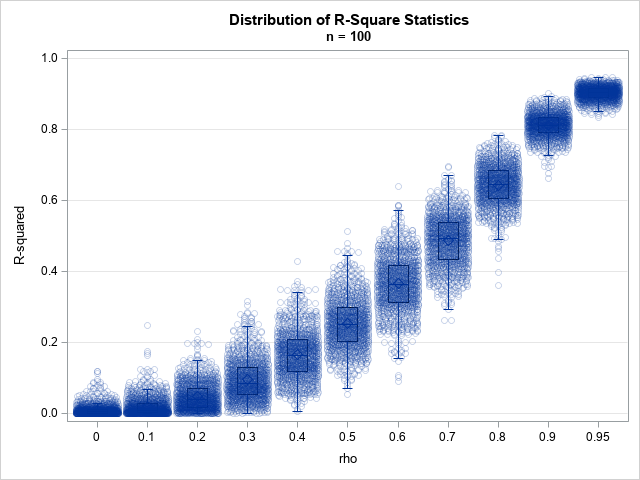

A SAS analyst ran a linear regression model and obtained an R-square statistic for the fit. However, he wanted a confidence interval, so he posted a question to a discussion forum asking how to obtain a confidence interval for the R-square parameter. Someone suggested a formula from a textbook (Cohen,

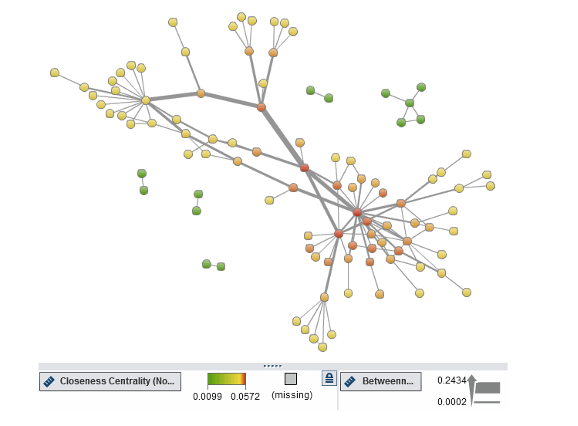

Detecting illicit financial flows require much more than using traditional business methods. At this point, using centrality metrics in investigation and analytical models will provide wider detection approaches.