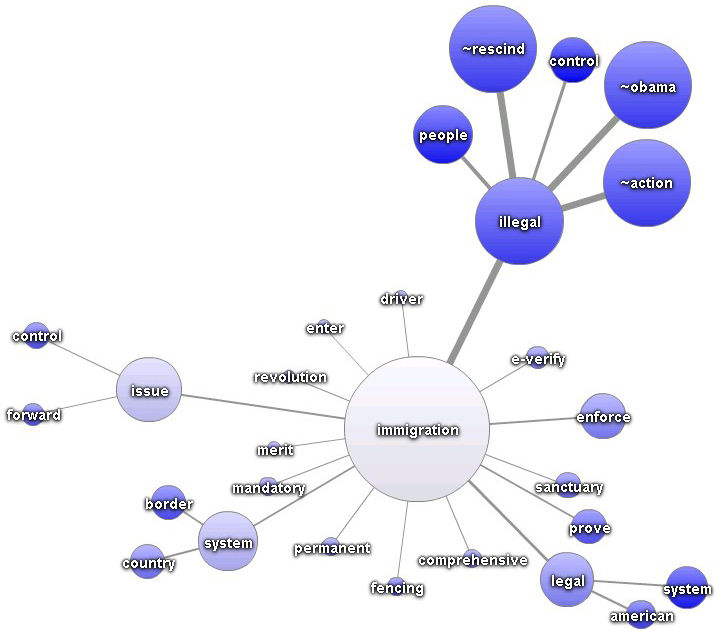

A hot button issue this election season was the need to determine the eligibility of people for various government programs like the Affordable Care Act (ACA), Medicare and Medicaid, or entry into the United States as a migrant refugee. “Look, we’re facing the worst refugee crisis since the end of