All Posts

In my previous post CAS-Action! Simply Distinct - Part 1 I reviewed using the simple.distinct CAS action to explore distinct and missing values in a distributed CAS table. Welcome back to my SAS Users blog series CAS Action! - a series on fundamentals. I've broken the series into logical, consumable

Data should alleviate strain instead of causing new pain Recent research from SAS and Accenture underlines what many of us already knew anecdotally. Marketers are increasingly frustrated by their inability to obtain and leverage insights into customer behavior. Marketing teams have data – heaps of data – but they are unable

La Inteligencia Artificial es actualmente uno de los términos más mencionados en el mundo (la búsqueda de IA (iniciales de Inteligencia Artificial) en solo Google arroja más de mil millones de resultados). No debiera ser diferente: estamos en plena era de la cuarta revolución industrial y quien aspire por lo

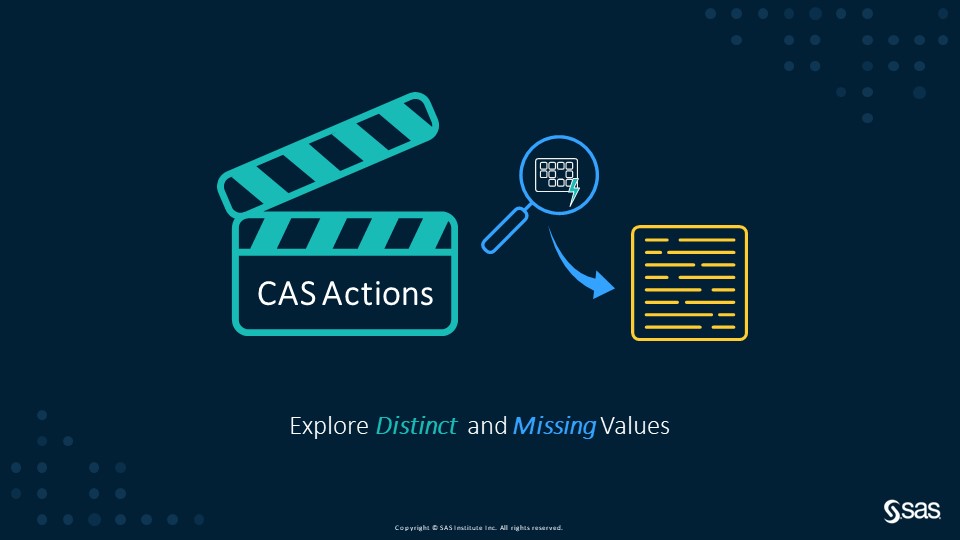

Word embeddings are the learned representations of words within a set of documents. Each word or term is represented as a real-valued vector within a vector space. Terms or words that reside closer to each other within that vector space are expected to share similar meanings. Thus, embeddings try to capture the meaning of each word or term through its relationships with the other words in the corpus.

“What’s for dinner tonight?” The absolute LAST thing anyone wants to think about after an exhausting day of mind-numbing meetings, traffic jams, juggling kids between after-school activities and tackling homework. So how do you avoid this situation? Meal planning of course…probably the next to last thing anyone wants to think

Written by Valeria Ravani Since the pandemic began, travel has been restricted to help curb the spread of COVID-19. We’re all eager for the days when we can travel again – for work, or for pleasure! Until that time comes, we’re going to take you on a virtual world tour,

The field of probability and statistics is full of asymptotic results. The Law of Large Numbers and the Central Limit Theorem are two famous examples. An asymptotic result can be both a blessing and a curse. For example, consider a result that says that the distribution of some statistic converges

The term "fuzzy matching" describes a method of comparing two strings that might have slight differences, such as misspelling or a middle initial in a name included or not included. One of my favorite functions to compare the "closeness" of two strings is the SPEDIS (spelling distance) function. Have you

Actuarial practice has always been analytical—so how much is advanced analytics disrupting this element of insurance? We discussed this issue in a recent #SASchat. The importance of competitive pricing Analytics is now being used in more and more areas in insurance, and particularly to tailor pricing more precisely to customers’

A recent report suggests that the current state of climate change is alarming. Climate change puts billions of people at risk of events like extreme hurricane seasons and rising sea levels. However, data and analytics play a critical role in informing us about the situation, planning ahead, and raising awareness

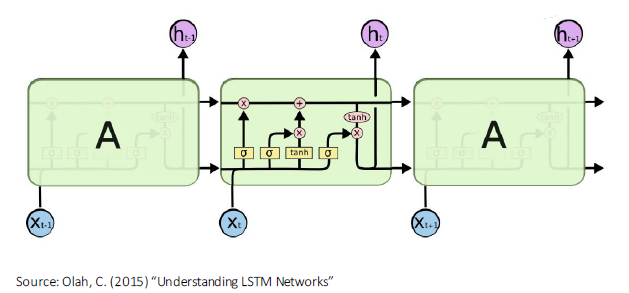

The SAS/IML language supports lists, which are containers that store other objects, such as matrices and other lists. A primary use of lists is to pack objects of various types into a single symbol that can be passed to and from modules. A useful feature of using lists is that

Earth’s natural capital deserves protection – for our sake and for the future. Analytics can help.

In this Q&A with MIT/SMR Connections, Iain Brown, SAS’s head of data science for the United Kingdom and Ireland, discusses technical readiness for AI, customer adoption trends, IT’s changing role, and mission-critical considerations for technology and talent. Q: What does it mean, from both a technology and a cultural standpoint,

I’m a Leo and love the sun and the sea! There is something magical about the ocean breeze, the sand between my toes and the glistening sun on the ocean waves as they easily flow in and out in a rhythmic, calm manner. I imagine the seaweed beneath the water’s

Welcome back to my SAS Users blog series CAS Action! - a series on fundamentals. I've broken the series into logical, consumable parts. If you'd like to start by learning a little more about what CAS Actions are, please see CAS Actions and Action Sets - a brief intro. Or