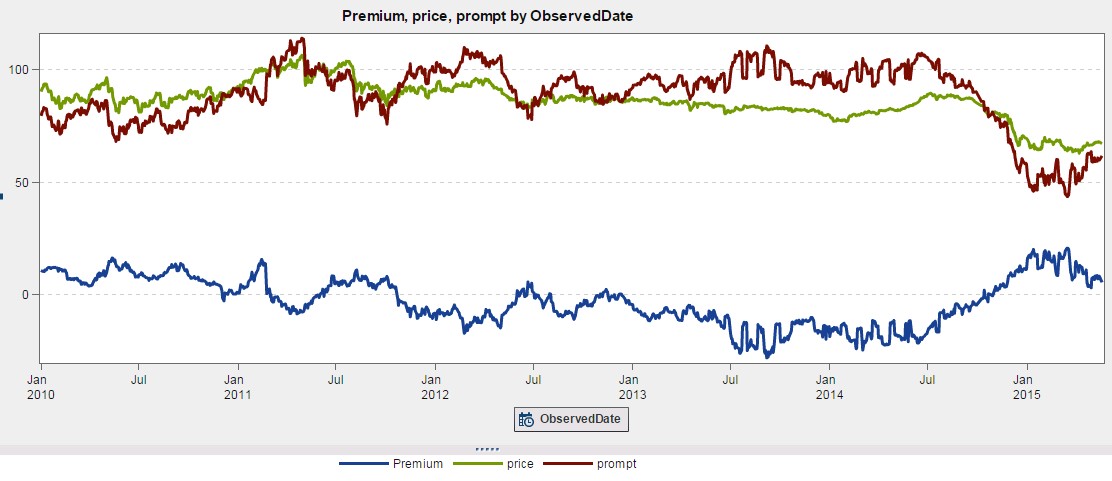

This month we take a fresh analytical view of our hypothetical VirtualOil portfolio by comparing the forward price of WTI (the green line) to the prompt month price (red line). The resulting graphic (chart 1) demonstrates the relative stability of the 48-month forward price in contrast to a very active spot