How much of your business performance (profit) is driven by external factors versus internal? A figure of 85% compared to 15% was mentioned at last month’s Manufacturing Analytics Summit, and although I could not find the study mentioned to confirm, it feels about right to me. Certainly more than half, right? So, how much of your dashboard reporting and KPI metrics incorporate external data?

I have to say that I have never much liked the saying, “managing using only internal data is like driving using just the rear-view mirror’, but until now I’ve not contemplated the logical flaw in the argument nor attempted to devise a better analogy (although, if I haven’t in the past written a blog entitled, “Forecasting – Your one forward-looking piece of data – Treasure it!”, then I should have). The reality, however, is that’s not how we run our businesses nor how we utilize internal data. Our use of internal data is more akin to IFR flying or sailing a ship – our chosen strategy gives us a goal, a direction, and we use our internal data as feedback to make course corrections. As long as the strategy / direction is periodically evaluated and revised, and the skies / seas remain reasonably clear and calm, relying mostly on internal data is a (barely) passable approach to management.

I have to say that I have never much liked the saying, “managing using only internal data is like driving using just the rear-view mirror’, but until now I’ve not contemplated the logical flaw in the argument nor attempted to devise a better analogy (although, if I haven’t in the past written a blog entitled, “Forecasting – Your one forward-looking piece of data – Treasure it!”, then I should have). The reality, however, is that’s not how we run our businesses nor how we utilize internal data. Our use of internal data is more akin to IFR flying or sailing a ship – our chosen strategy gives us a goal, a direction, and we use our internal data as feedback to make course corrections. As long as the strategy / direction is periodically evaluated and revised, and the skies / seas remain reasonably clear and calm, relying mostly on internal data is a (barely) passable approach to management.

Except of course that the skies are anything but clear, and we’re not so much flying or sailing as we are navigating a much more complex surface terrain. You can’t just set a course and go – there are obstacles, obstacles with names like ‘competition’, ‘suppliers’, ‘customers’, ‘regulations’, ‘weather/climate’, ‘financing’, ‘politics’, and ‘markets’ just to name the most common. At a minimum you need radar, more generally you need vision (maybe even the business equivalent of ‘night vision’), and at best you’d like to be able to predict / forecast what’s over the hill and around the bend.

Google’s driverless cars provide a better analogy than does the rear-view mirror: 300,000+ miles with only two accidents, neither of which were the car’s fault (one happened while it was being manually driven by a human, and in the other case it was rear-ended at a stoplight by another driver). It navigates busy city streets utilizing an interconnected system of frontward, backward and sideward radar, 360 degree cameras, and GPS coupled with a stored map of the local topology. If it even has a rear-view mirror it’s only there to placate the redundant human.

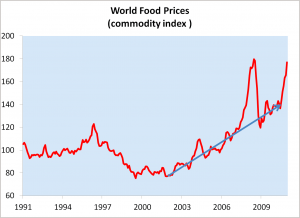

Dun and Bradstreet was one of the sponsors at the Manufacturing Analytics conference, and spoke about their expansion into external data collection and analysis beyond just the customer/supplier credit scoring they are most known for. They now make available a veritable treasure trove of data that can be used for customer segmentation, prospecting and supply chain risk management. Nielsen and others have long provided syndicated media and POS data. From financial institutions and organizations like Thomson Reuters there is an abundance of financial data regarding interest and currency rates and commodity prices / indices. Government and trade association data is available on subjects such as weather forecasting, market size and trends, risk management, and other industry and market news. A local North Carolina firm of my acquaintance, Enlight Research, specializes in external data targeted specifically at the needs of the Board of Directors. A number of consulting firms are even in the business of providing quantitative political risk assessments.

If 85% of your business results are driven by factors external to your organization, this kind of information needs to be an integral part of your executive dashboard and KPI’s. Immediately. No if’s, and’s or but’s. That’s the bare minimum; that’s the radar; that’s what keeps you from colliding with the garbage truck abruptly pulling out of the alley.

But by itself, it is not enough. It doesn’t tell you where to go nor how to set or adjust strategy, goals and direction. It lacks the ‘vision’ and ‘prediction’ components.

If the aforementioned BI / dashboard / radar elements were married to a data visualization and analytics capability, then you’d really have something. Such a platform would allow you to combine your external and internal data (even if they are siloed) for integrated reporting, KPI’s and metrics, forecasts, root cause analysis, and exploratory/insight-focused analysis. Because it’s unlikely that the answer to your vision quest is in column H, row 53, page 16 of either your internal or external reports. Because the right/best metric is likely one that uses external data in the denominator (or numerator). Because 85% of your results are going to be impacted / driven by external factors that don’t go away just because they aren’t being surfaced on your dashboard.

A couple of weeks ago I wrote about developing, managing and changing corporate cultures (“Changing corporate culture is like losing weight”). I talked about the various types of “cultures” an organization might aim for, such as: learning, analytical, innovative, customer-centric, quality, risk-taking, agile, or continuous improvement. But I left one out, an important one. If I had to pick just one culture to focus on, it might very well be one built around the awareness and usage of external data as a primary component of the organizations decision making process. It's not just about being data-driven - it's about being driven by the right data.

1 Comment

Pingback: Big Silos: The dark side of Big Data - Value Alley