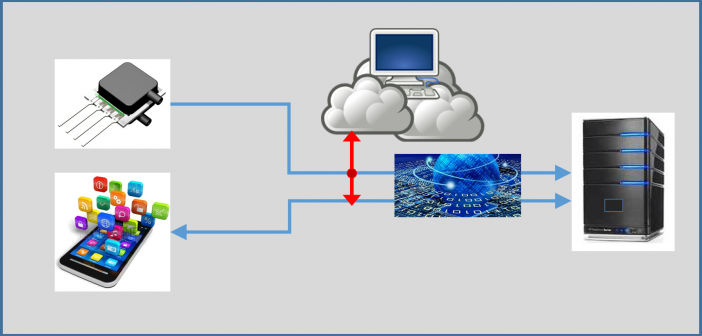

Staying competitive in a big data world means working fast and making decisions even faster. You need to assess conditions, approve access, stop transactions and reroute activities quickly so you can seize opportunities or prevent problems. With increasing data volumes from the Internet of Things (Cisco predicts that fifty billion