The realities of today’s digital transformation are pushing organizations across all industries to expand and accelerate their decision-making processes. Adaptability and precision remain essential, while decision complexity is accelerating.

In response, organizations are changing the way they approach decisioning – leveraging technology in concert with human potential for obtaining the highest value. There are two approaches: the most familiar one is augmented decision making – where humans take analytically driven insights to make a decision, for example in call centers; and the second - automated decision making – where the machine makes the decisions, for high-volume transactional systems like credit origination, next best offers, and logistical routing.

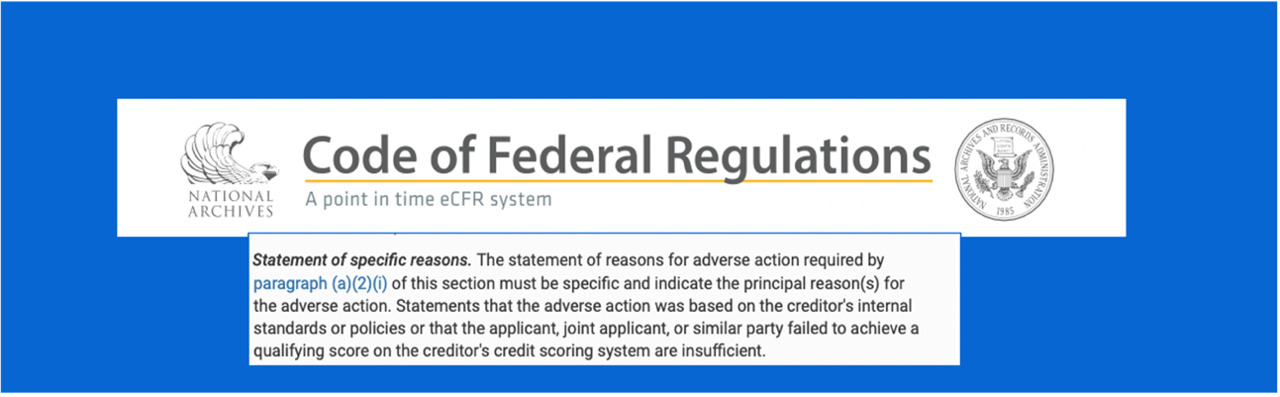

As these analytically driven approaches are embedded into decisioning operations, the impact on people and companies is far-reaching including the need to ensure fairness and eliminate bias in the process. This need is highlighted by Federal institutions, like the Consumer Financial Protection Bureau, who, as recent as May 2022, issued a reminder for creditors of their legal responsibility to provide specific and accurate reasons for adverse actions when using AI technologies in credit decisioning applications. (See details of the Consumer Financial Protection Circular 2022-03 here)

This prompts decisioning software providers, to ensure their data-driven systems are designed with clear bias mitigation and fairness in place.

SAS applications already include explainability and fairness features as part of a well-functioning analytics lifecycle. Navigating from customer questions to data-driven decisions is part of the ModelOps implementation at SAS.

SAS Intelligent Decisioning provides users the ability to create, manage and govern robust analytically driven decisioning at scale, with the use of a low-code, user friendly decision builder, model management integration, custom code integration, open-source support (Python), and a variety of publishing destination options, for both batch and real-time processing.

SAS Intelligent Decisioning on Viya can be used to satisfy an extensive number of diverse operational decisioning use-cases that span an organization. Different domains, like Fraud, Underwriting, Compliance, and Marketing all benefit from the use of SAS Intelligent Decisioning to meet risk and compliance requirements.

SAS Intelligent Decisioning is part of a unified stack of applications on top of the cloud-native SAS Viya platform, which enable companies to make the best decision, in the moment, for every moment, while ensuring fairness and bias mitigation.

To see this in action, you can attend the SAS Explore event on Sept 27-29 or view the recording at your convenience. This session will showcase the use of SAS Intelligent Decisioning, SAS Model Manager, and SAS Visual Analytics on the SAS Viya platform for a solution that helps mitigate inequitable credit decisions.