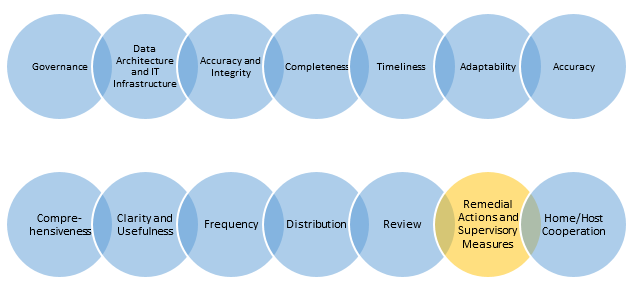

Principle 13: Remedial actions and supervisory measures - Supervisors should have and use the appropriate tools and resources to require effective and timely remedial action by a bank to address deficiencies in its risk data aggregation capabilities and risk reporting practices. Supervisors should have the ability to use a range