Reading McKinsey's article How Banks Can Supercharge Technology Speed and Productivity, released around the same time as SAS' From Data to Decision: Increasing AI Productivity with SAS® Viya®, sparked an epiphany for me.

My last job before entering the technology industry was as a product manager at a super-regional bank. I was tasked with launching a new line of credit cards alongside two colleagues. We followed the standard product management process, analyzing our portfolio to identify strengths and weaknesses. We reviewed our data and noted what we liked and didn’t like about our cards. We researched our competitors, conducted focus groups, consulted with internal stakeholders and collaborated with our credit card network.

After finalizing plans and specifications for revamping our entire credit card portfolio – retail, wealth, and small business – we faced one final hurdle: IT. We were shocked when they estimated it would cost several million dollars and take 2.5 years to complete. This was unacceptable for an initiative with a very profitable business case and a strategic focus for the bank.

SAS Viya and the Futurum study on increasing productivity

Now at SAS, recalling that experience gets me excited about how much SAS can do to help banks gain deeper insights from their data and boost productivity. Banks leverage data and AI to drive decisions, enhance innovation, deploy products and maintain competitiveness.

The transition from data to actionable insights occurs through the data and AI life cycle, encompassing data management, model development and insight deployment. However, this process often faces challenges related to complexity, time and resources. It also requires collaboration among technical and non-technical teams – a challenge I frequently encountered as a product manager.

At SAS, we know how great our products are, especially our core platform, SAS Viya – but not everyone knows what we know. To validate what we believe about SAS Viya, SAS engaged research firm The Futurum Group to conduct a comparative evaluation of three data platform environments:

- SAS Viya.

- A competing commercial platform.

- A non-commercial approach.

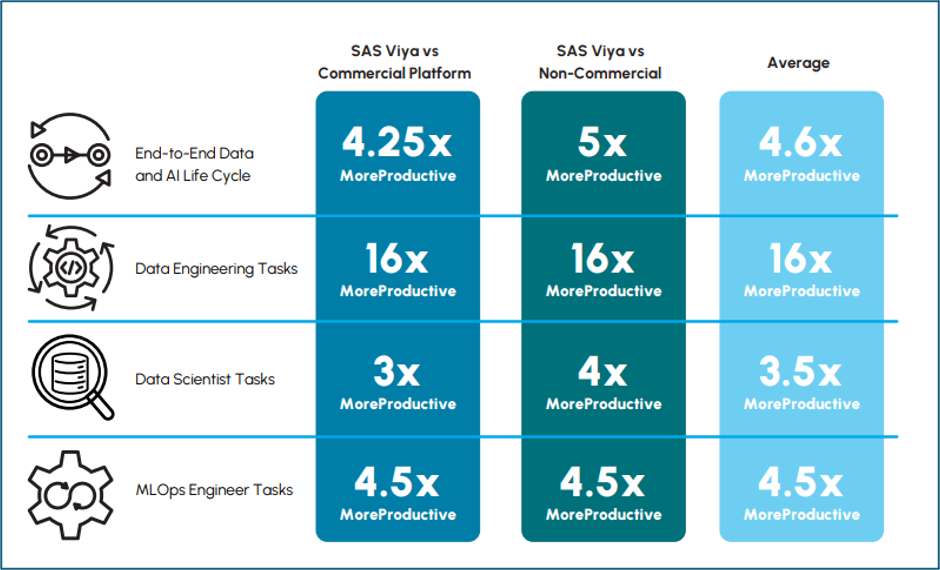

The study analyzed productivity across the data and AI life cycle by performing a customer churn prediction analysis. Analysts assumed the roles of Data Engineer, Data Scientist, MLOps Engineer and Business Analyst to measure usability for both technical and non-technical stakeholders.

Results of the study showed that SAS Viya improves productivity at each stage of the data and AI life cycle. Key to its productivity advantage was a measurement of engineering time spent completing each task.

On average, companies can achieve 4.6x more productivity with SAS Viya. That is an outstanding figure. What would change at your organization if these key roles were 4.6 times more productive than they are today?

How banks can become more productive

The good news is that banks can boost innovation by improving the productivity of their software engineering teams without increasing IT budgets. With technology powering initiatives like AI-driven personalization, digital payments and process automation, banks face tight budgets and growing operational complexity. Conventional cost-saving measures, such as offshoring, are no longer enough to create financial flexibility.

Leading banks are adopting a developer-first approach inspired by digital-native companies. By maximizing the portion of technology staff focused on coding and optimizing their efficiency, these banks achieve significantly higher technology capacity – defined as the team hours available for innovation – compared to their peers.

According to McKinsey, high-performing banks allocate 39% of their tech capacity to software development. That's 50% more than the industry average. This increased focus leads to faster feature delivery, higher-quality products, better customer experiences and improved business outcomes.

This approach starts with measuring engineering productivity, which helps identify inefficiencies and opportunities to streamline workflows. By automating non-core activities, reallocating resources and fostering a better engineering environment, banks can enhance team efficiency. These improvements typically yield 20%-30% productivity gains within 18–24 months. Over time, this creates a positive feedback loop, enabling sustained innovation and growth without additional spending.

Reflections on a credit card relaunch

SAS Viya wasn’t available when I was a product manager, but these reports clearly show that banks can significantly improve tech innovation and the productivity of their engineering teams without increasing IT budgets.

How did my credit card relaunch turn out? After extensive negotiations, we secured an acceptable timeline. The project took about 12 months to launch once we officially started the project with IT. It was very successful, though you’d need to see my resume to know the full details. While the credit cards are no longer sold due to mergers and acquisitions, some cardholders may still carry the product I helped design.