Here is a four-stage approach to financial forecasting. I urge you to seriously consider adopting at least level 1, then next look at how layering on the other stages might transform your approach to business planning. The four stages are: (1) Multiple Forecast Inputs, (2) Marco Polo, (3) Driver-based forecasting, and (4) an Economic Model of your business.

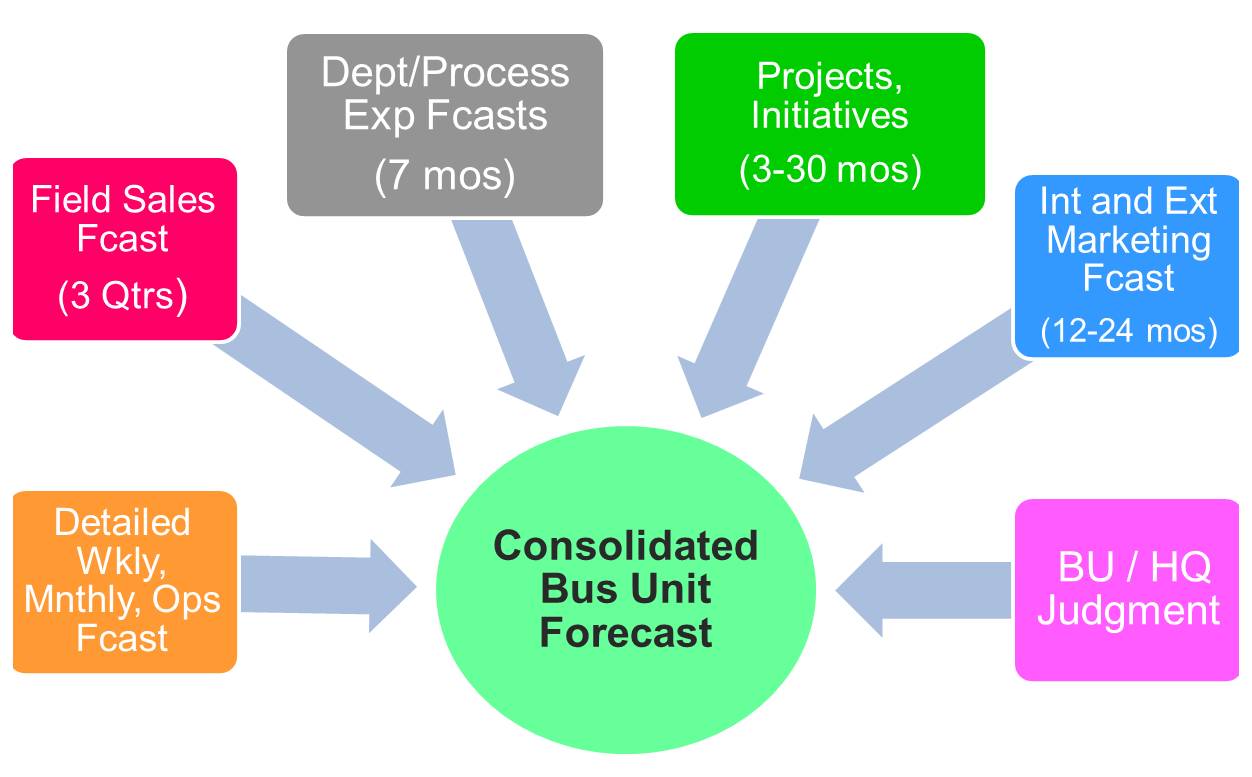

Multiple Forecast Inputs: No mystery here, this approach means just what it says – instead of relying on a single, primary forecast input to drive your planning and budgeting processes, such as a monthly field sales forecast, realize that there are many different valuable sources of forecast input data, each of which typically covers a different time horizon.

- Point of Sale information, with its hourly, weekly, seasonal and cyclical bent

- ERP, which typically locks down procurement and production on a scale of daily to monthly (1-3 months).

- Backlog, that ~50% portion of ERP data that is 98% guaranteed.

- Financial markets, with forward pricing on commodities and currencies in the 30-90 day range.

- Departmental cost center expenses, good for about 180 days.

- Human Resources, who know both the termination history and the current recruitment activities for a couple of quarters out.

- Field Sales, who seldom have a clear view of closing new business beyond about three quarters.

- Service operations, who have both an annual outlook on maintenance contracts and are often the first to spot problems developing with customers.

- Industry and analyst forecasts that usually cover estimates for the upcoming year.

- Projects, where the cost-to-complete estimates range from months to multi-year programs.

- Marketing, typically with 18-24 month new product launch windows.

- R&D, who may be looking three to five years out for product development.

- Government and external forecasts, which can span most of this range, from 30-day interest rates to 90-day CPI and labor forecasts to multi-year trends in weather and political stability.

- Internal management, who have their own experience judgment to bring to bear.

This list is why I insist that the forecasting process be separated from budgeting by a robust business planning and scenario process. Knee-jerk reactions to any single set of these numbers are uncalled for when you what you should be doing is considering ALL of them and filtering them through a planning process that weighs their impact on your business in alignment with strategy.

Marco Polo. This is the brainchild of Jason Webster, president and founder of Archetype Consulting. Remember playing Marco Polo in the swimming pool as a kid? You, with your eyes closed, call out ‘Marco” and everyone else answers back with ‘Polo” before attempting to evade your tag. Tons of fun until some smart-alecky teenager comes along and yells ‘Marco, Marco, Marco, Marco, Marco, Marco, …’ Kinda takes the fun out of it, doesn’t it. But when it comes to the business world, this is exactly what you should be doing. Pinging the environment, pinging the market, pinging your customers, as often as makes sense. Which doesn’t mean going from quarterly to weekly sales forecasts at it, it means taking a good look at the list above in Multiple Forecast Inputs and see how you can combine them to increase the frequency of your interactions with the market.

Driver-based Forecasting. I covered this previously in “Stop Me before I Forecast Again”. In summary, this means that if you know what the key half-dozen drivers of your business are, and have a handle on the other 15 or so that also have a lesser but noticeable impact, then you can stop trying to forecast 20-30 lines items per cost center times hundreds or thousands of costs centers, and concentrate instead on getting those drivers right. Business analytics is more than capable of doing this for you – identifying which drivers are correlated with your business results and which are not, and what exactly is the cause-and-effect relationship. Analytical forecasting can automatically match each input with the variables you want to forecast, determine multiple driver influences and weight them, and calculate the model parameters.

Analytical forecasting is a world away from being stuck with trying to use a single input, headcount for example, to drive all of your forecasts and budgets through an overly simplified cost-per-person model. Analytical forecasting tells you that yes, headcount is a factor when it comes to travel expenses, but it’s only one piece, only 40%, only one variable out of several, that might also include revenue, location , function and/or job classification. Analytical forecasting can automate this process for you, freeing your FP&A team to focus on fine tuning those input variables from up in item #1 above.

Economic Model. At this most advanced level, your scenario planning process will have evolved to include a scenario that looks a lot like an economic model of a national or regional economy. It won’t be the only scenario your FP&A team is building and monitoring, but it will be unique in its objective – modeling the business activity of the company on the basis of forecast drivers. The truth is, as much as you might like to think your business is different, it probably tracks pretty closely to the bull and bear trends of the economies in which it operates. GDP increasing? Then so too is the same likely for your revenues. CPI flat except for volatile energy? Then probably the same for your costs. Bond yields and currency futures will likely have the same impact on your firm as they portend for the economy at large.

But neither does this mean that you would not include firm specific factors, such as product launches and marketing campaigns as inputs to your economic scenario (just as you would also include field sales inputs), for an economic approach forces you to also consider the impact of changing technology overall – your competitors aren’t standing still either. I can’t say for sure how easy or hard it may be to get to this level, but what I do know is that it cannot be done without items 1 and 3 above: a variety of forecast inputs over time frames appropriate to their role, and analytical, driver-based forecasting. And if you can play Marco Polo while you are at it, then you have clearly made it to the top of the FP&A vision.

4 Comments

Pingback: Finance in more than two dimensions - Value Alley

Pingback: Relationships, relevancy, and changing the subject - Value Alley

Pingback: Rolling forecasts, or Who ordered that? - Value Alley

Pingback: "A favorable product mix caused us to miss our forecast on the upside", said no one ever - Value Alley