“More than $2.2 trillion in [commercial real estate]debt is maturing before 2028” according to the Wall Street Journal.

This oncoming freight train commands the attention of banks and life insurers who must quickly evaluate their investment portfolios.

Why did this happen?

Post-Covid work-from-home trends have put commercial real estate on its heels. Famously, Warren Buffet and the late Charlie Munger tag-teamed this trend with a simple exchange in the May 2023 Berkshire Hathaway shareholders meeting:

“The buildings don’t go away,” Buffet said. “But the owners do,” Munger finished.

If you’ve been anywhere that used to attract hordes of working professionals (shops, restaurants, etc.), it’s easy to see what they meant. Downtown San Francisco, for example, is a ghost town and may never recover.

Yes, building owners and businesses have attempted return-to-work strategies with some success. But ultimately, their workforces may not benefit from – and will likely resist – such efforts.

The crisis response: AI decisioning

With this crisis looming, a two-fold problem has emerged:

- What to do with the office space?

- How to rebalance the investment portfolio knowing there’s a cliff coming fast?

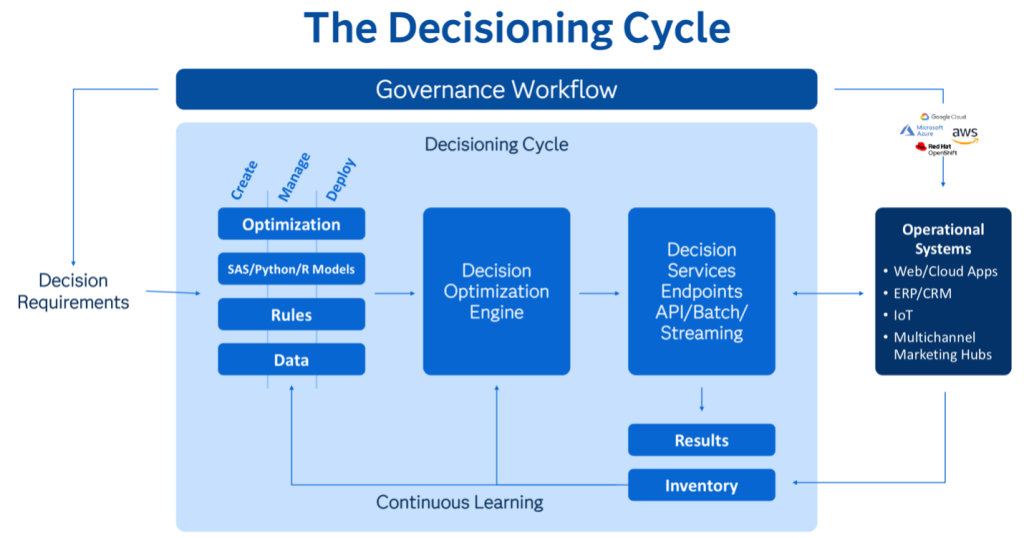

Enter the need for powerful, lightweight, artificial intelligence (AI) decisioning software.

An AI-driven view of investment decisions

It’s possible to manage the evaluation of macroeconomic trends through decision flows and various inputs that affect commercial real estate occupancy. Factors like the unemployment rate, for example, can be assigned values in the decision flow. And other decision flows can be set up to examine elements of corporate policy or public statements made by officers of the same company.

All this detail can be managed and then synthesized into an objective, AI-driven view of investment decisions. Then banks and life insurers could evaluate 15 or 20 different investment alternatives and make recommendations to divert or rebalance a portfolio to a more stable, sustainable and revenue-driving asset.

The same macro-level inputs used to evaluate investment portfolios can be used with the same decision flows to redirect building owners into different uses for their structures. Maybe a building’s best use would be residential housing, a data center, or even storage. (Allstate Insurance’s former corporate headquarters has now given way to data and logistics centers.)

This is a better way to take the guesswork out of billions of dollars of decisions. Using the power of AI-driven insights, banks and insurers can nimbly react to any doom loop – commercial real estate or otherwise.

Keeping the humans engaged with AI

A recent report from Microsoft and LinkedIn found that 68% of people struggle with the pace and volume of work and 46% are burned out. This spells a different type of doom for any business looking to keep workers engaged.

Another study revealed that 54% of early career employees’ decision to work for one employer versus another would be influenced by access to AI.

Providing these tools to people trying to solve real problems enriches their experience, for sure. But wait, there’s more.

Having access to, and understanding how to use AI tools effectively, builds an organization’s resiliency on two fronts:

- The power to solve complex issues like doom loops.

- Creating the next generation of AI-powered financial services professionals.

Machines versus humans

Machines are great at ingesting large data sets, performing complex calculations, and automating tasks. However, they are unilaterally bad at common sense, intuition and creativity.

Solving the biggest problems of our time demands a combination of humans and machines. By combining advanced analytics and decisioning capabilities, computational work can be automated while still having a human involved in the process – striking a balance between automation and human decision-making.

Humans and machines are better together

- The machine can quickly analyze vast amounts of data to identify key patterns and trends as well as points of interest…

- Freeing up the human to take time to make sense of these revelations.

- The machine can optimize logistics and processes…

- Allowing the human to handle exceptions and make strategic decisions.

- The machine can test complex scenarios…

- Allowing the human to assess the effects of policies, procedures, actions and decisions.

A better test of an AI tool’s effectiveness should include its ability to seamlessly integrate with a person’s expertise and reduce the burden on that individual to deliver results. The result? The individual saves time and gains the satisfaction of a job well done.

Downside risk and data

Financial services firms have access to incredible amounts of data. When that data is fed into a decisioning model, downside risk is potentially created.

All information carries some inherent bias, which, if not accounted for, can lead to bad outcomes. Consider the example above of evaluating investment alternatives and examining public statements:

- Could the model exclude investment alternatives from minority owned or controlled businesses?

- Could the same be said about occupancy decisions for small businesses?

The answer is yes.

With any data, there exists the possibility of information exposure:

- Data that was intended to be masked or anonymized could be reidentified.

- The data could be used in ways that were never intended.

Integrating AI tools, decision engines or products into existing IT infrastructure can be complex and time consuming. If the data behind the AI is poor quality, unstructured or inaccessible, it will be difficult to realize lofty outcomes. Ultimately, the desired return on investment will not be achieved.

Industry-specific expertise increases the effectiveness of software implementations because industry experts understand the problem being solved from the onset of the project. Having an intimate knowledge of the data and the underlying IT architecture reduces missteps and miscues.

Doom-loop problems are too big to afford stumbling. Working with the right team – those who understand the data and downside risks – is critical to solving the big problems.

Time to decide

Interest rates may fall, they may rise… doom loop notwithstanding, other issues will persist due to the constant repricing in commercial real estate. Every financial institution should have access to decisioning software and put it in the hands of skilled employees. Doing so minimizes downside risk by design and ensures companies are prepared for any situation.

The economy performs cyclically – this has happened before and will happen again.

AI decisioning solutions from SAS incorporate trustworthy AI capabilities across the entire data and AI life cycle: robust data management, model interpretability, bias mitigation, model risk management, model management, and more.

Whatever your needs, remember: Not all AI is created equal. A decision to deploy AI can make or break your organization’s future.

Albert Qian and Stephen Greer also contributed to this article