If you're looking for advice on developing an analytics strategy, there's no shortage of resources, including this from SAS: Building your data and analytics strategy. If, on the other hand, you're looking for advice on how to apply analytics to strategic planning, your search has likely to come up wanting. I intend to rectify this oversight immediately.

As context, I will define strategy in line with John Gaddis, author of On Grand Strategy, and who characterized strategy as the alignment of ends with means, of objectives with resources. Also for context, you will notice a running theme across most of these applications: risk and variance. Furthermore, I cannot possibly do justice to such a broad topic in a mere blog post. I anticipate expounding in more detail on a few of these elements in the future, linking to previous posts I’ve written on the subject, as well as conversing with you about this in the real world.

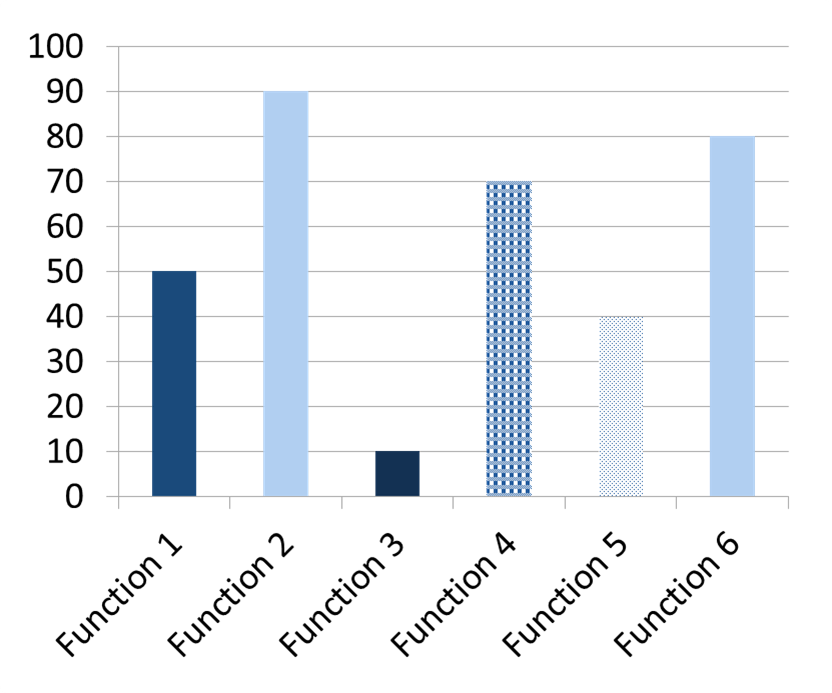

If you're looking to effectively apply analytics to inform your strategic planning and decision process, I suggest that the most profitable elements would come from this list, in descending order of likely impact:

- Operational risk

- Forecasting

- Data-driven decisions

- Core competencies

- Workforce analytics

- Marketing – positioning

- Agile strategy

- Insights

Let's look at each of these categories in more detail and explore how analytics can improve each.

Operational risk

There are three components to any significant business decision: how much, how soon, and how certain. We are quite competent at evaluating the first two of those, the result typically being a net present value or internal rate of return calculation, but we generally ignore that last one – how certain – which quantifies and allows us to ascertain and evaluate the risk in our business or investment decision.

Answering the first two questions doesn’t require complex analytical techniques, but the last one, how certain, falls clearly in the analytical domain of variance and variability. It’s not terribly complicated, but it is critical if you want to avoid making business decisions as if all risks are the same and are accounted for in the cash flows.

I go into more detail in this piece, Operational Risk: Answering the “How Certain" Question. What I will leave you with for now is the statement that taking such a risk-based approach to strategic business decisions will change not just your outcomes but your entire operational mindset.

Forecasting

Your finance and operational teams are of course using forecasting at the tactical level for everything from meeting customer demand to assuring adequate capital. If your overall forecasting accuracy is, say, 80%, that remaining 20% can become a matter of strategy. Your operational teams are making tactical decisions all the time on how to best handle that last 20% – build inventory, overtime, add a second shift, outsource, discounts, bundling, shaping and shifting demand. It would behoove the strategic planner to understand the magnitude of that difficult 20% and whether or not strategic decisions should be made regarding the available options, such as building overseas factories, outsourcing production or divesting certain assets or product lines.

I have more to say about that 20% in this piece: The Beatings will Continue.

Data-driven decisions

While you're likely aware of Daniel Kahneman’s book, Thinking Fast and Slow, you may not know that his and similar dual-system theories are not the final word on the matter. Intriguingly, some recent research, including what's documented in The Enigma of Reason, suggests that we don’t use our reasoning processes like we think we do.

Unless we are specifically engaged in a mathematical or scientific endeavor, the vast majority of the time what we call our reasons are simply after-the-fact justifications, explanations, and reinforcement for our less logically structured intuitions. It’s not that these intuitions are necessarily bad or wrong – they’ve served our species well for over 250,000 years – it’s that we give them undue weight when we defend them with “reasons.”

The lesson here is the straight forward one: Make sure your important business decisions are supported by data – analytically derived or otherwise.

Core competencies

A perennial strategic decision is how to address gaps in your core competencies. There are three factors to consider in any such evaluation:

A perennial strategic decision is how to address gaps in your core competencies. There are three factors to consider in any such evaluation:

- The level of risk.

- The importance of the capability to your objectives

- Whether or not you have the competency in-house.

While the latter two are by nature going to be more heuristically decided, the risk component is something you can quantify and enhance via an analytical approach. I dive more deeply into these three components in this article: Normal Accidents.

Workforce analytics

HR executives are already well-equipped to competently manage the basics – recruiting, hiring, on boarding, payroll, benefits, training, etc. They will find that analytics can greatly assist them with the more strategic issues, like:

- Are we better off keeping our geographic sales structure after the acquisition, or do we now have sufficient critical mass and concentrations of expertise to take an industry-centric approach?

- Can we predict how the increased average age of our skilled workers, their upcoming retirement and the massive replacements by inexperienced workers will affect the business?

- The increased production and sales capacity is going to make R&D the bottleneck. what are the critical technical skills we’re going to need and what is the optimal mix of hires, layoffs and retraining to counteract that bottleneck? (I have more to say on the matter HERE.)

Marketing – positioning

Your marketing teams may or may not be employing a technique known as perceptual, preference or positioning maps. If they are, you, at the strategic planning level, would be well advised to understand the insights and conclusions these teams are drawing from such maps.

P-maps use an analytical technique called principle components analysis to segment the various brands in the market along the most important differentiators. Strategically it is important to understand where your brand lies with respect to the market, the “white spaces” in the market, and your associated options.

Agile strategy

The Agile methodology has been around for more than a decade and was designed as a flexible, self-organized system for software development. Today, it's used for everything from marketing to child rearing.

There are more details and links to the Boston Consulting Group’s agile strategic style methodology HERE, but the upshot of the article is that you need to take different strategic approaches to your business based on its predictability factor. See, there’s that risk and variability theme cropping up once again.

Most managers and executives have no real quantitative feel for how bad things can get in the normal course of business, especially at the disaggregated lower levels of brand, product category, region or business unit. We are systematically and notoriously biased and overconfident. As the BCG study concludes, “You can’t choose the right strategic style unless you accurately judge the predictability of your environment.” Agile helps you do that.

Insights

You’re probably surprised that I put insights at the bottom of the list, but at the level of strategic planning, functional insights are going to be less valuable than they are for marketing and operations. If anyone were to present you with a graph of a strategic growth trend over the next five years, ask to see the error bars, ask to see the confidence intervals. You won’t get them, mostly because they won’t fit on the paper, in fact they likely won’t fit between here and the orbit of Jupiter.

Where analytic insights would be of strategic value would be in cases where your functional teams have identified statistically significant “signals” among the noise (Tell me something I don’t know). You can’t immediately turn these weak signals into multi-year forecasts, but they can form the basis for goal/objective-oriented discussions among the executive team. Determining if there is any “there” there is of course the hard part, but at least it’s a quantitative starting point for the organizational long-term vision setting.

Analytics evaluates your certainty

In nearly every example I’ve provided above, the how much and the how soon parts will come from finance, operations and marketing – the how certain will come from analytics – and making the risk/variance/how certain aspect of the business decision standard practice will forever change how you approach your strategic planning and decision making.

1 Comment

What a great summary, it's too much behind it but the effort to present it in that mental structured way is awesome, thanks.