In my last blog I detailed the four primary steps within the analytical lifecycle. The first and most time consuming step is data preparation.

Many consider the term “Big Data” overhyped, and certainly overused. But there is no doubt that the explosion of new data is turning the insurance business model on its head. There is more data and more access to data than there has ever been and it’s growing. The challenge for insurers is how do you take advantage of all this data to price better, expand your market and improve the business of underwriting risk and handing claims.

In the past insurance companies have relied on “old data”. Information from policy administration solutions, claims management applications and billing systems, often supplemented by 3rd party data such as census data, motor vehicle records (MVRs), medical reports and Dun & Bradstreet to name but a few. However today, insurance companies are incorporating “new data” such as credit scoring, social media such as Facebook and Twitter, telematics from in-car data recording devices and geo-spatial information like Google maps. Unfortunately many insurers are drowning in this vast amount of data and struggling to digest it for meaningful insight.

To combat the existing silo approach and to alleviate problems with growing amount and diversity of data, insurers are undertaking enterprisewide data management projects. One organization that successfully implemented an enterprise data warehouse is Zenith Insurance. Due to a period of rapid growth the management team were relying on reports and information pulled from numerous departments and disparate systems. Because of the manual process, inconsistency in data, as well as the time and resources required to collate the reports, was proving inefficient. To resolve this problem Zenith rolled out a coherent data-management strategy and brought all the company’s data into a SAS Enterprise Data Warehouse. Read more about the Zenith Insurance success story.

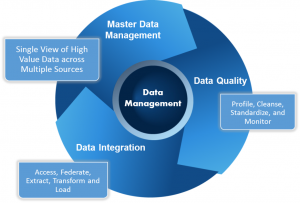

The foundation of a successful analytics operation is quality data, and superior data management. There are many examples of where data defects and inaccessibility to data can result in increased operational costs, potential customer dissatisfaction and even missed revenue opportunities. Clearly there is a business case for creating a single, unified environment for integrating, sharing and centrally managing data for business analytics.

To learn more download the white paper “Data is King”

Unleashing the full power of business analytics should be on the short list for every insurer. According to a recent survey 63% of insurers are planning to increase their spending on analytics in the next 12 months. The path to maximize the investment in business analytics is data. Data management and data quality are no longer optional components of an analytical environment they are essential.

I’m Stuart Rose, Global Insurance Marketing Director at SAS. For further discussions, connect with me on LinkedIn and Twitter.

1 Comment

Pingback: The steps to using analytics…successfully - The Analytic Insurer