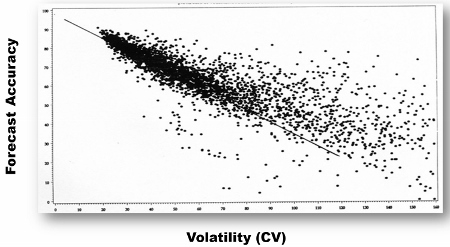

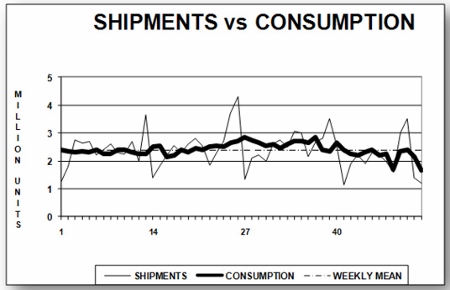

Aphorism 6: The Surest Way to Get a Better Forecast is to Make the Demand Forecastable Forecast accuracy is largely dependent on volatility of demand, and demand variation is affected by our own organizational policies and practices. So an underused yet highly effective solution to the forecasting problem can be