The reverberations of SVB’s collapse continue to be felt in the banking industry. Markets remain jittery and the negative news headlines keep coming. First Republic Bank had its credit rating downgraded into junk territory by S&P Global, causing its share price to plummet by 47 percent before rallying. On the opposite side of the Atlantic, the cut–price, ”shotgun merger” of UBS and Credit Suisse – two firms in the G-SIB list – illustrates that the challenges are not confined to financial institutions in the US.

Opinions vary as to whether recent events constitute a crisis. While conditions are unquestionably uncomfortable, we’re thankfully not [yet]at 2008 global-financial-crisis levels. The current safety mechanisms should prevent widespread systemic failure, meaning bankers, regulators, investors, customers, and politicians shouldn’t lay awake at night in anticipation of Armageddon.

If we’re not hurtling at high speed on the road to ruin, then where are we?

The answer depends on which one of these groups you fall into.

- Politicians across the world are holding a common line: “our country has a stable banking industry and customers (voters) shouldn’t panic.”

- Customers largely appear to be heeding this guidance, the recent Twitter-fueled run on SVB being the obvious exception, and a rushed return to hiding money under the mattress isn’t happening en masse.

- Investor sentiment can be gauged by stock indices and the rollercoaster plot lines on the charts, which of late have resembled a terrible liar taking a polygraph test and failing spectacularly.

- Regulators find themselves in the spotlight, either partially or fully, keen – or perhaps anxious – to ensure they’re not sitting on a ticking timebomb with compliance failure acting as the fuse.

- And the bankers themselves? Well, they’re busy on multiple fronts, some of which is business as usual and some of which represents unchartered or seldom trodden territory, given the relative rarity with which problems of the current magnitude occur.

Steps for avoiding collapse

Nobody wants to be the next Credit Suisse, Signature, Silvergate, or SVB. However, bank failures are more common than one might imagine. According to Forbes, 565 US banks have failed since 2000. While the global financial crisis was the catalyst for the majority of collapses, crashes can occur even when conditions are benign. Accident prevention is therefore of paramount importance. And with this in mind, here are the three simple steps banks must take to avoid being the lead item on national news for all the wrong reasons.

- Step 1: get the earliest warning of an increase in default probability.

- Step 2: use sophisticated asset and liability management (ALM) analytics daily.

- Step 3: become fit for the future by transitioning to integrated balance sheet management.

1. Spot the early warnings and act accordingly

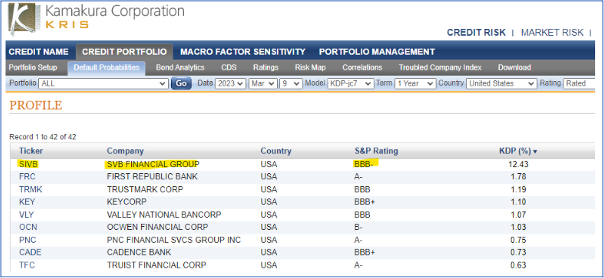

To successfully accomplish step 1, firms need access to hyper-accurate information that gives a clear picture of market conditions. Were there warning signs before the SVB collapse? According to our systems, there were. As conditions rapidly deteriorated during SVB’s final week as a functioning bank, subscribers to Kamakura Risk Information Services (KRIS) received early warning of the dire situation prior to the bank’s demise. The underlying data model highlighted how the default probability elevated to nearly 12.5 percent prior to the FDIC’s intervention.

The chart below is from March 9, 2023.

Kamakura provides quantitatively derived corporate credit models to quantify the risk of more than 40,000 public companies using a multi-factor, bottom-up approach. KRIS leverages the same reduced form approach developed by Professor Robert Jarrow, a renowned authority on risk management, for ratings and bond pricing/spread analytics.

2. Use ALM daily

Likewise, this risk and resiliency prediction from Troy Haines, SAS SVP of Risk Research and Quantative Solutions, now rings prophetic: Asset Liability Management (ALM) is taking center stage in 2023. In an era of uncertainty and volatility, it is essential for banks to equip themselves with sophisticated balance sheet management solutions to effectively manage deposits and cashflows daily.

The SAS ALM solution uses an assumption-based approach to generate what-ifs and produce a detailed, forward-looking view of cashflow, liquidity, and interest rate risk based on today’s static position as well as dynamic balance sheet simulations.

3. Manage the balance sheet effectively

Banks are required to manage numerous prudential risks, including (but not limited to) capital, leverage, liquidity, funding, net interest margin, funds transfer pricing, and interest rate changes. In SVB’s case, it was the Federal Reserve’s progressive rate raises which caused the value of a major bond portfolio to contract by $15bn. This, in turn, triggered a chain of events leading to the bank’s ultimate implosion.

Risk leaders need to be intimately acquainted with their firms’ balance sheet, and take a proactive approach to asset, liability, and capital management practices. Implementing a dedicated Asset Liability Committee, composed of senior executives to control, supervise, and manage a bank’s balance sheet and the risks contained within, is a best practice approach to maximizing profitability and avoiding catastrophe.

The forensic investigation into the recent bank failures will take time to conclude. However, it’s not too early to suggest that this 3-step approach could have played a beneficial role.