As the world moves toward a low-carbon future, the power and utilities industry faces significant financial and reputational risks due to the potential stranding of resources and assets. This transition to carbon-free energy sources could render carbon-intensive assets – such as coal- and gas-fired power plants, coal mines and hydrocarbon reserves – obsolete, resulting in considerable financial losses for companies dependent on them.

New tools and models are required in the electric power sector to accurately estimate the magnitude of climate-related financial risks and asset stranding. This sector is experiencing significant transformation driven by regulatory policy, technological advances, changing consumer preferences, market forces and infrastructure obsolescence. As a result, utility companies need to be agile and use analytics to navigate these changes and mitigate potential risks.

We’ll explore these trends and how analytics can help utilities manage the risks associated with stranded assets in the electricity sector.

Stranded asset risk refers to the potential financial loss a company or investor may face due to market conditions, technology, or public policy changes that render a resource or infrastructure uneconomic to extract or generate. This phenomenon can have significant financial and economic implications, as it may result in the loss of value or the inability to recover the costs of the original investment.

Navigating environmental regulations and consumer demand

As environmental regulations become more stringent and renewable energy targets are adopted, the retirement of fossil fuel-based power plants becomes inevitable. The development of new technologies such as solar panels, wind turbines and battery storage makes generating electricity from renewable sources cheaper and more efficient. Consumers increasingly demand cleaner and more sustainable energy options, leading to a shift away from fossil fuel-based electricity generation.

With analytics, utilities can gain insights into the factors that affect their operations, such as changes in energy demand, fuel prices and regulatory developments. Moreover, analytics can help utilities identify the most cost-effective ways to retire fossil fuel-based power plants and replace them with renewable energy sources. By analyzing large amounts of energy usage and production data, utilities can determine which renewable sources are most viable for their region, identify the optimal locations for the new renewable energy facilities, and determine the best ways to integrate them into the existing energy grid.

How advancements in technology play a part

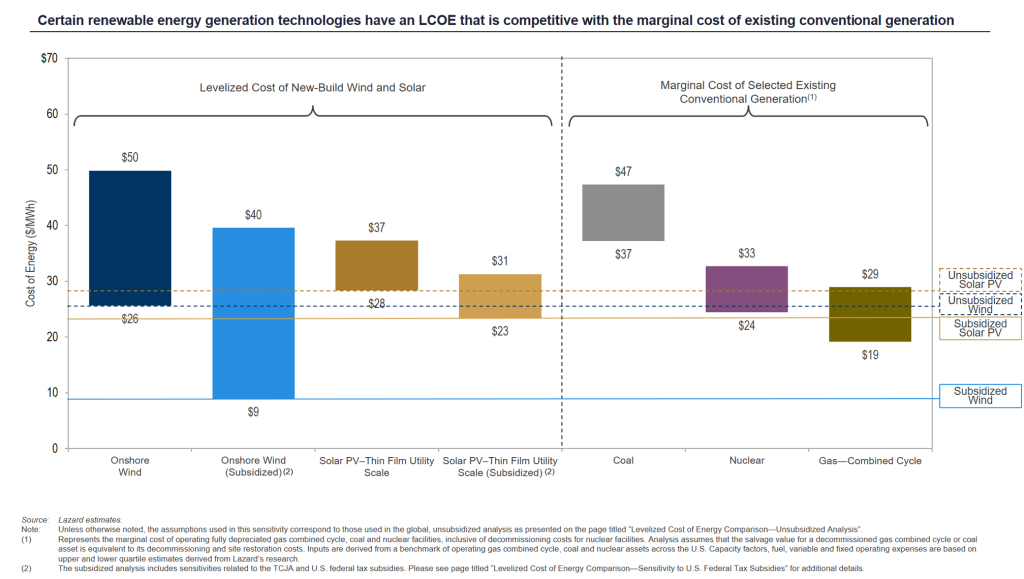

New technologies such as solar panels, wind turbines and battery storage have revolutionized how we generate, store and distribute energy. These advancements have made generating electricity from renewable sources cheaper, more efficient and thus increasingly competitive with traditional fossil fuel-based energy sources. Lazard's annual levelized cost of energy (LCOE) analysis indicates that onshore wind and utility-scale solar technologies remain cost-competitive with coal, nuclear and combined cycle gas generation, even with subsidies factored in (Figure 1). This analysis shows that the marginal cost of these renewable technologies is lower than that of traditional generation methods.

AI and machine learning can help utilities optimize the performance of existing assets, extending their usefulness and reducing the risk of premature stranding. For example, SAS® Asset Performance Analytics can identify and address potential problems before they occur, reducing unplanned downtime. Furthermore, SAS Energy Forecasting can enable utilities to generate load forecasts for applications in scheduling maintenance operations, coordinating upgrades, assessing system adequacy, negotiating forward contracts and developing cost-efficient fuel purchasing strategies.

Applying analytics in a dynamic market

Along with regulatory changes, technological advancements and other environmental concerns, the shift toward renewable energy sources is driven by various market forces such as the declining cost of renewable energy technologies, growing demand from consumers and investors for energy companies to adopt sustainable business practices, and concerns about energy security and geopolitical risks associated with reliance on fossil fuels. The fluctuating prices of fossil fuels and the availability of cost-effective renewable options have made operating some power plants economically unviable.

Using analytics, utilities can proactively identify and manage potential risks associated with stranded assets, such as those caused by natural disasters or financial downturns. This enables utilities to take action to minimize risk and protect assets and customers from potential losses. Utilities can use SAS Grid Guardian AI to get direct capital expenditures to address power delivery system weaknesses, preventing outages and improving service quality, including SAIFI, SAIDI, and CAIDI values, while reducing the risk of reportable OSHA events. Additionally, SAS advanced analytics solutions provide utilities with a systematic approach to minimize revenue leakage, optimize multiple processes, address credit and collections, and generate a higher return on investment.

Don’t forget about scalability!

Effectively managing stranded asset risks requires utilities to have scalable analytics systems that can efficiently and accurately process large amounts of data in real time. This ensures that potential risks can be identified and addressed promptly, increasing the efficiency and effectiveness of risk management efforts. SAS Risk Engine provides utilities with a tool for informed decision making using energy risk analytics to explore multiple market and portfolio “what if” scenarios and gain an integrated view of internal and external data.

Wrapping it all up

As the electricity sector continues to evolve in response to regulatory policy, technological advancements and changing consumer preferences, the risk of stranded assets is becoming a top concern for utilities and investors. Utilities can mitigate risk by taking advantage of analytics by understanding their stranded assets’ value, predicting their future performance, optimizing operations and managing associated risks. The power of analytics can prepare utilities to adapt to the evolving market and safeguard their financial and operational stability.