Generative AI (GenAI) is in its most popular era and many organisations across industry are looking for ways to unlock its potential value.

McKinsey's projections suggest that GenAI could add a staggering $2.6 to $4.4 trillion in value to the global economy. In fact, banking is the number one industry that will have a significant impact in terms of percentage of revenue, according to their report.

This translates into several use cases for improving efficiency and productivity for credit customer journeys. In their latest risk study, Accenture says 95% of executives believe GenAI will “compel their organization to modernize its technology architecture.”

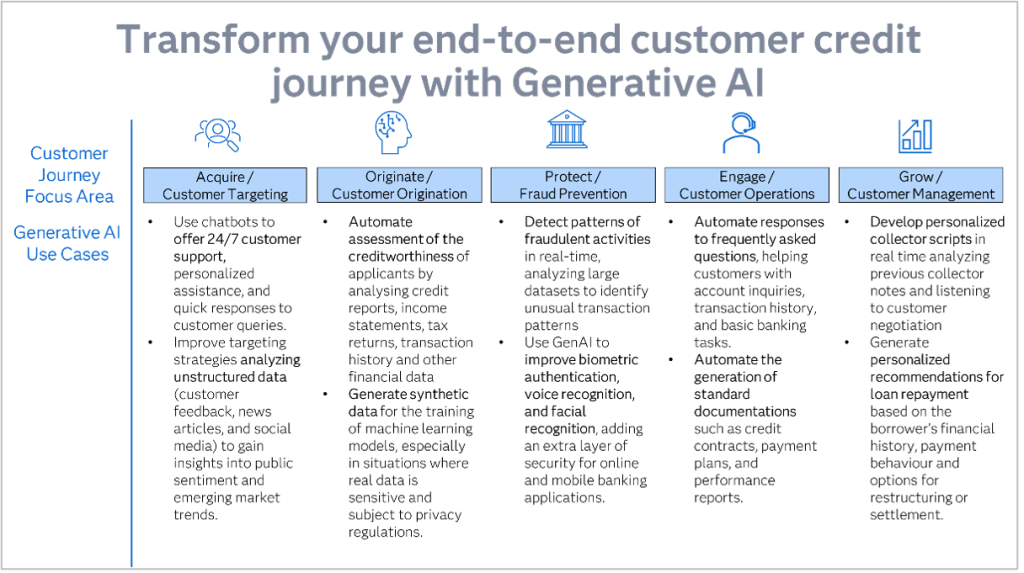

Organisations are currently exploring the potential of GenAI through targeted process adjustments, focusing on incremental technical enhancements. However, to get the full power of GenAI within credit customer journeys, organizations must identify transformative use cases that align closely with their business objectives. These use cases could encompass a range of strategies, including:

Precision customer targeting strategies

- Chatbots for sales and marketing: GenAI can make lending processes more efficient, accessible, and customer-friendly by offering 24/7 support, personalized assistance, and quick responses to customer queries.

- Natural language processing (NLP) for data analysis: NLP models alongside GenAI can be used to analyse unstructured data, such as customer feedback, news articles, and social media, to gain insights into public sentiment and emerging market trends, which can inform targeting strategies.

Customer acquisition and onboarding

- Risk assessment: GenAI can help banks automate lending processes by analysing borrowers’ credit reports, income statements, tax returns, transaction history and other financial data.

- Data generation for training: GenAI can help banks generate synthetic data for training machine learning models, especially in situations where real data is sensitive and subject to privacy regulations.

Robust fraud prevention

- Fraud detection and prevention: GenAI can detect patterns of fraudulent activities in real time. It can analyse large datasets to identify unusual transaction patterns or generate natural language descriptions of potential fraud alerts for fraud analysts.

- Enhanced security: GenAI can be used for biometric authentication, voice recognition, and facial recognition, adding an extra layer of security for internet and mobile banking.

Enhanced customer operations

- Virtual assistants: The use of GenAI-driven chatbots can be extended to provide quick and accurate responses to frequently asked questions, helping customers with account inquiries, transaction history, and basic banking tasks.

- Automated document generation: Banks deal with a significant amount of paperwork, including contracts, statements, and reports. GenAI can assist in automating the generation of these documents, saving time and reducing errors.

Personalized customer management

- Personalized collector scripts: GenAI can be used to develop personalized scripts for collectors. This would result in both productivity increase via better use of collectors’ time and improve customer experience via providing a more personalized communication.

- Personalized re-payment plans: GenAI can also be used to provide personalized recommendations for refinancing or settlement options based on the borrower’s financial history and payment behaviour.