The Business Forecasting Deal

Exposing bad practices and offering practical solutions in business forecasting

Implications for the Offensive Paradigm The worldview promulgated by the Offensive paradigm is that if we only had MORE – more data, more computational power, more complex models, more elaborate processes – we could eventually solve the business forecasting problem. But this just doesn’t seem to be the case. Operating

Is Complexity Bad? It’s necessary to point out that Goodwin’s article is not arguing against complexity per se, and I’m not either. When you have a high value forecast, where it is critical to be as accurate as possible, of course you are going to want to try every technique

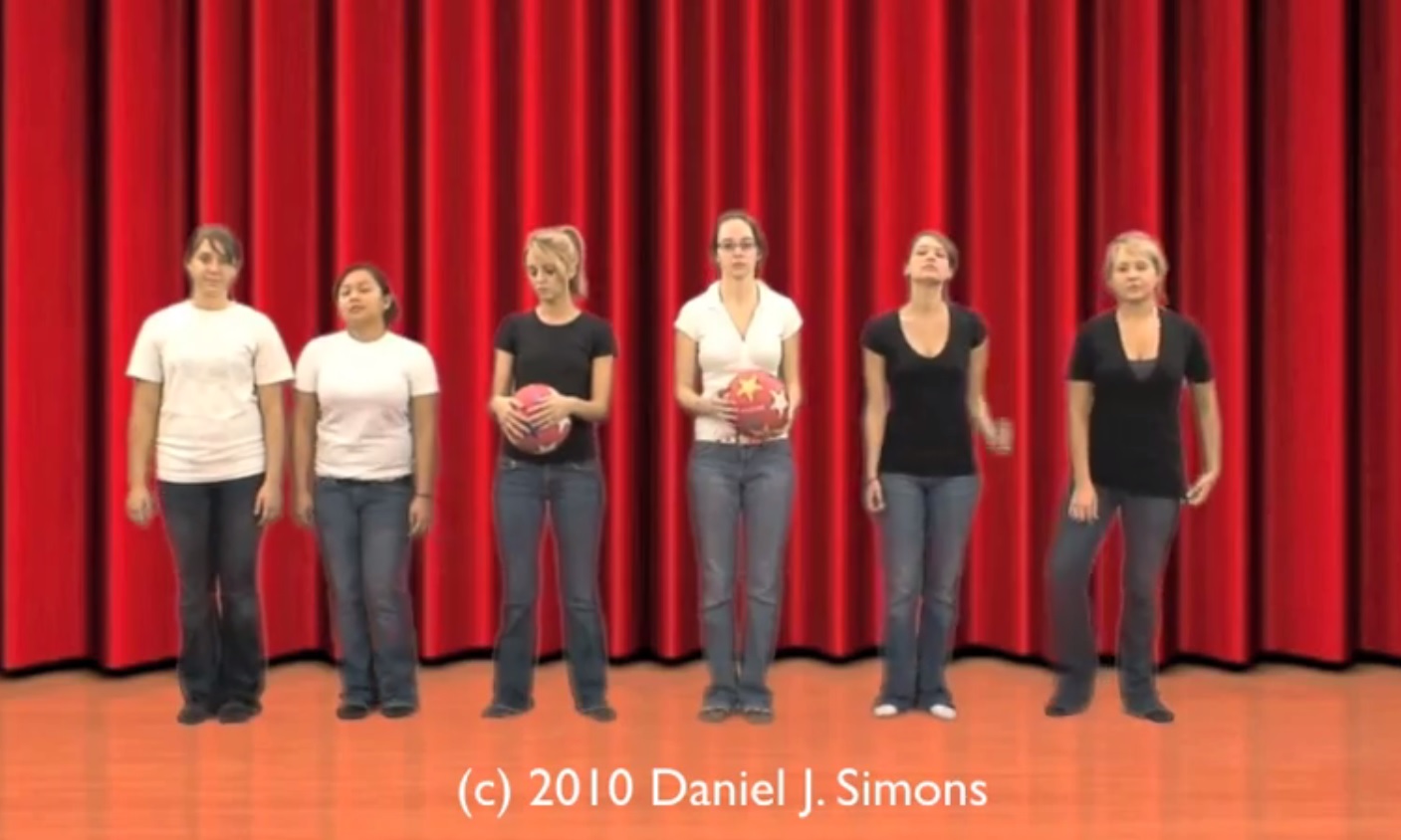

Anomalies: The Beginning of a Crisis While even trained scientists can fail to see things that fall outside what they are looking for, anomalies eventually start to get noticed. But still, for a long time, anomalies within an existing paradigm are seen as mere “violations of expectation.” The response within

The Current Paradigm for Business Forecasting So what is the current paradigm that we, the community of business forecasting practitioners and researchers, are operating under? I’d argue that for at least the last 60 years, since 1956 when Robert G. Brown published his short monograph Exponential Smoothing for Predicting Demand,

In a February 2015 post Offensive vs. Defensive Forecasting, I sought to distinguish two very different approaches to the business forecasting problem: Offensive: The "offensive" forecaster is focused on forecast accuracy -- on extracting every last fraction of a percent of accuracy we can hope to achieve. The approach is

NIJ's Real-Time Forecasting Challenge If you want to show off your forecasting chops, and maybe even make a little money, the National Institute of Justice has just the challenge for you. The NIJ's Real-Time Crime Forecasting Challenge: ...seeks to harness the advances in data science to address the challenges of