In this blog series, Humans of SAS Services, we're highlighting some of the people who make our customers successful – our experts in the field at SAS Services. Our goal is to give you a feel for the human side of SAS, apart from the features and functions of our software. After all, it’s the people who make our company click.

We’ll kick off this inaugural blog post with Jim West. Jim works in our compliance and anti-money laundering (AML) area leading a team of consultants. Jim has been with SAS for seven years. His previous experience was with Citi and Mercer.

Can you share a little about your team and how your services organization works with our AML software customers?

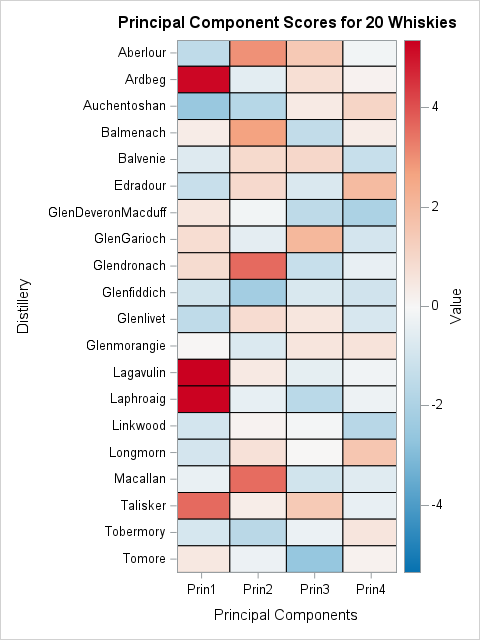

SAS US Professional Services has two primary anti-money laundering teams – the implementation team and the analytics team. The implementation team, which is led by Scott Wood, primarily focuses on implementing SAS Anti-Money Laundering onto our clients’ servers (or on a hosted solution on the SAS cloud). They also set up all of the ETL scripts required to map transactions from the client’s core banking system (which can be any type of system they may use) to the core SAS Anti-Money Laundering database structure.

The analytics team that I lead, on the other hand, focuses primary on making the SAS solution operate as effectively as possible. That includes developing a variety of AML analytic models and processes. Increasing the efficiency of the SAS Anti-Money Laundering system almost always starts with the development of a robust segmentation model since segmentation is generally the foundation of risk-based AML transaction monitoring. This is generally followed by things such as AML behavior scenario design; model validation and threshold parameter tuning; initial threshold setting; anomaly detection, etc. Our analytic consultants are experienced AML practitioners. Many of them have worked in the banking industry too, so they’re extremely knowledgeable about how to meet regulatory requirements using SAS Anti-Money Laundering.

What are customers saying about their biggest compliance analytics issues? It’s an evolving space; how does your team help them be proactive instead of reactive?

With the implicit blessing of US regulators (such as OCC), we’re receiving more and more requests to develop machine learning and artificial intelligence solutions – particularly model-based scenarios and event processing (that is, post-alert hibernation and prioritization). Financial institutions are always looking for more effective methods to detect “bad” behavior among their customer populations and the external entities they use for transactions.

Our team has the benefit of being able to use the SAS Viya architecture to develop complex machine learning models that can be used to detect AML topologies and patterns of behavior that would be near impossible to detect with traditional rule-based AML scenarios. If banks fall behind the times with their monitoring programs, SAS works to help them catch up by implementing pragmatic approaches to anti-money laundering detection and compliance analytics.

What’s the unique value-add the SAS compliance analytics services team offers our customers?

Very few of our software competitors offer best-in-breed AML transaction monitoring solutions and have highly experienced, in-house compliance analytic consultants who know the system and products inside out. In other words, we offer one-stop shopping for our customers.

Financial institutions that use our competitors’ AML monitoring programs usually need to contract with expensive outside consulting firms to assist them in designing and developing segmentation, customized or model-based scenarios, anomaly detection, hibernation, and any other process not directly included in the product. With SAS, the software implementation and analytics consulting services are blended seamlessly – our teams work closely together every day.

Covid-19 has had a major impact on face-to-face engagements. How has your team adjusted to these restrictions while still meeting our customers’ needs?

Honestly, the pandemic has had less of an impact on our teams than you would expect. This is because SAS was already using VPN and VDI to connect to clients’ development servers, so there was not much of a reason for extended onsite visits. While we historically spent more face-to-face time during the design portion of projects, I feel like most financial institutions are starting to feel comfortable using remote meeting technology and video conferences to fill this gap.

SAS has been involved in the compliance analytics space for years, and industry analysts recognize many of our solutions as market leaders.

Learn more about SAS Services