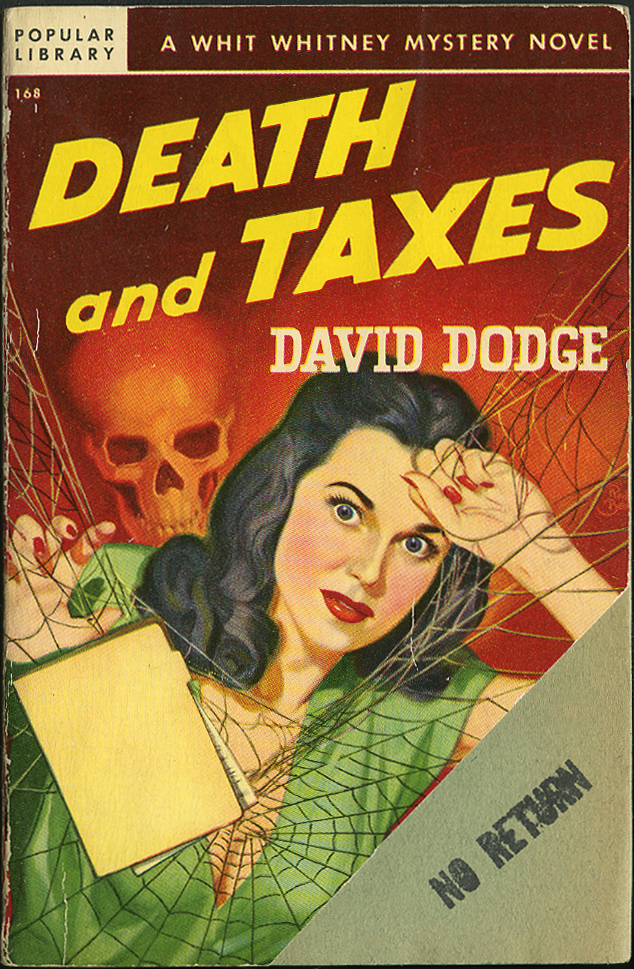

Happy Tax Day, America! Today marks our annual ritual of filing tax returns in the United States. And complaining about taxes. And cursing the IRS (even though it's misguided to shoot the messenger, in my opinion). Think you know a lot about taxes? Let's travel back in time to 1913, when