Most people require loans at some point: student loans, car loans, mortgage, etc. Using an online loan service, I scored a great deal on a vehicle. The moment I saw the car, I immediately applied for a loan. To my surprise, I was approved that same day, which allowed me to purchase it before other potential buyers. Online loan applications are automated processes that allow people to quickly receive loans without unnecessary delays. Nowadays, automated decision-making is dominated by machine learning algorithms. However, algorithms require a lot of manual and technical capabilities to be practical and effective. SAS AutoML offers the ability to automate the development of machine learning algorithms. This article will demonstrate the implementation of AutoML in banking loan applications.

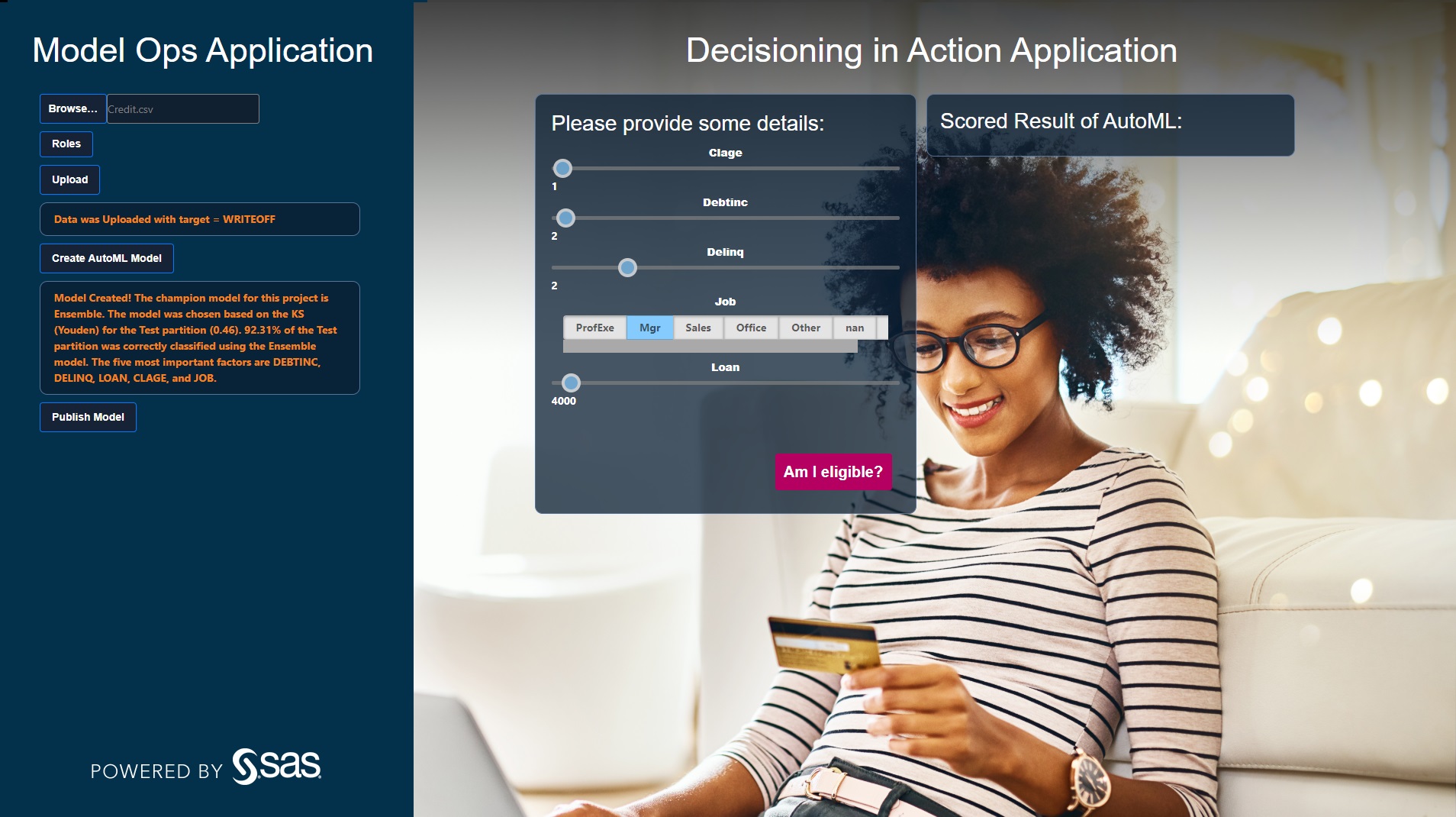

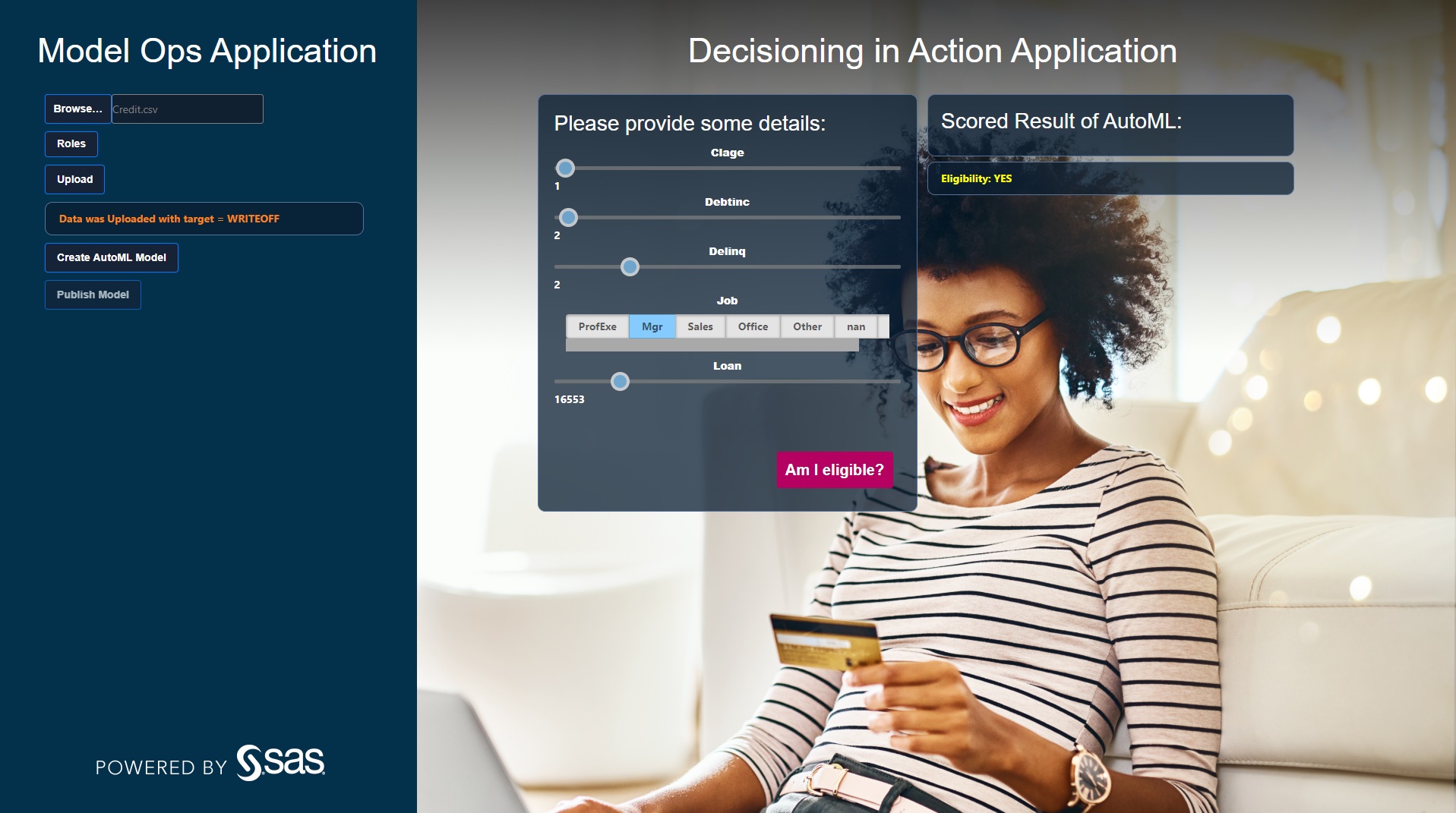

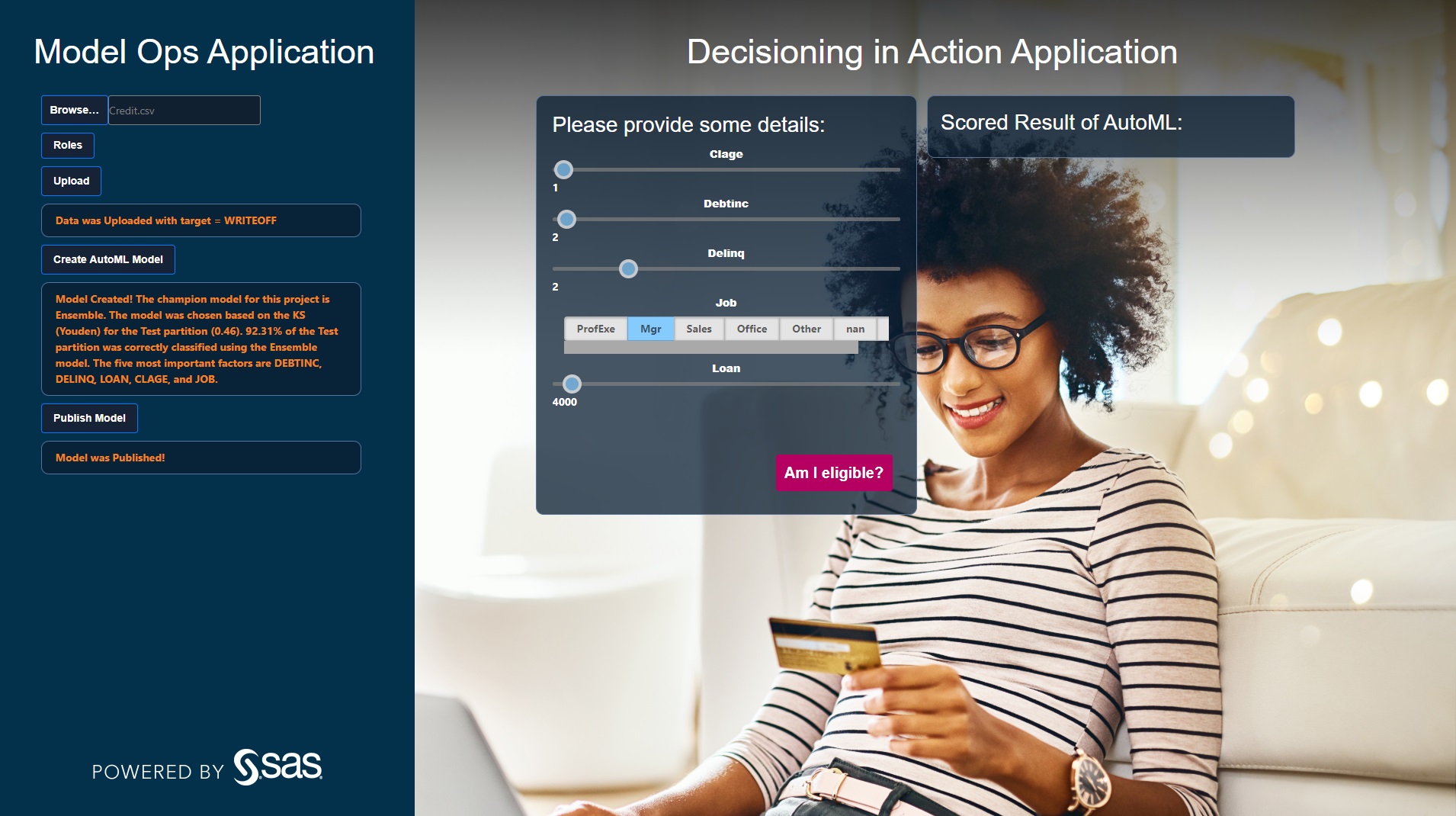

The image above shows two separate applications. Decisioning in Action (right) shows a customer who is trying to apply for a loan application. After filling out their information, one click on the Am I eligible? button can decide whether they are eligible to receive a loan.

Model Ops (left) shows the point-of-view of a data scientist who is tasked to create a model that will decide whether to approve a loan application. The Create AutoML Model button invokes an API to develop automated model.

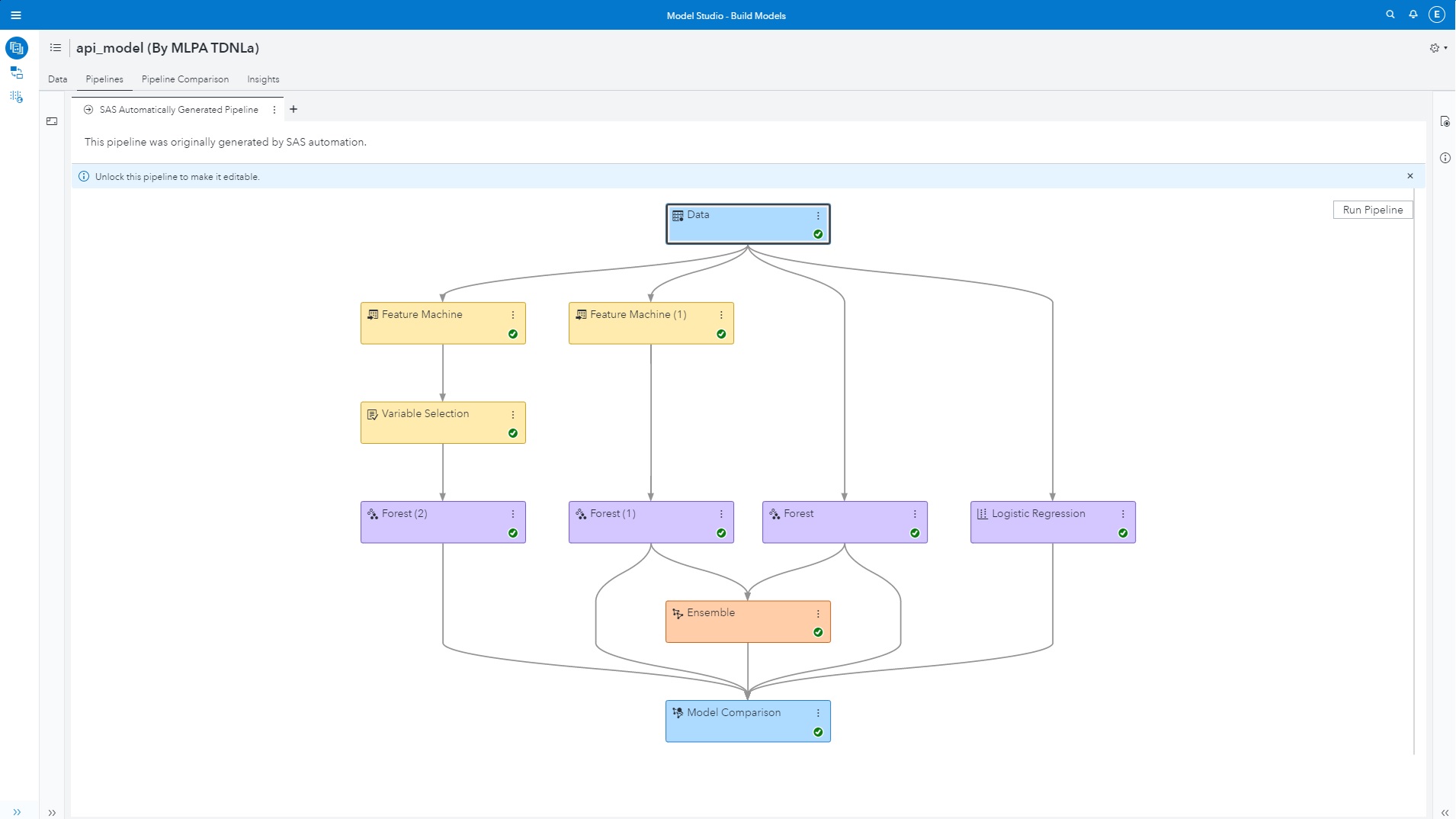

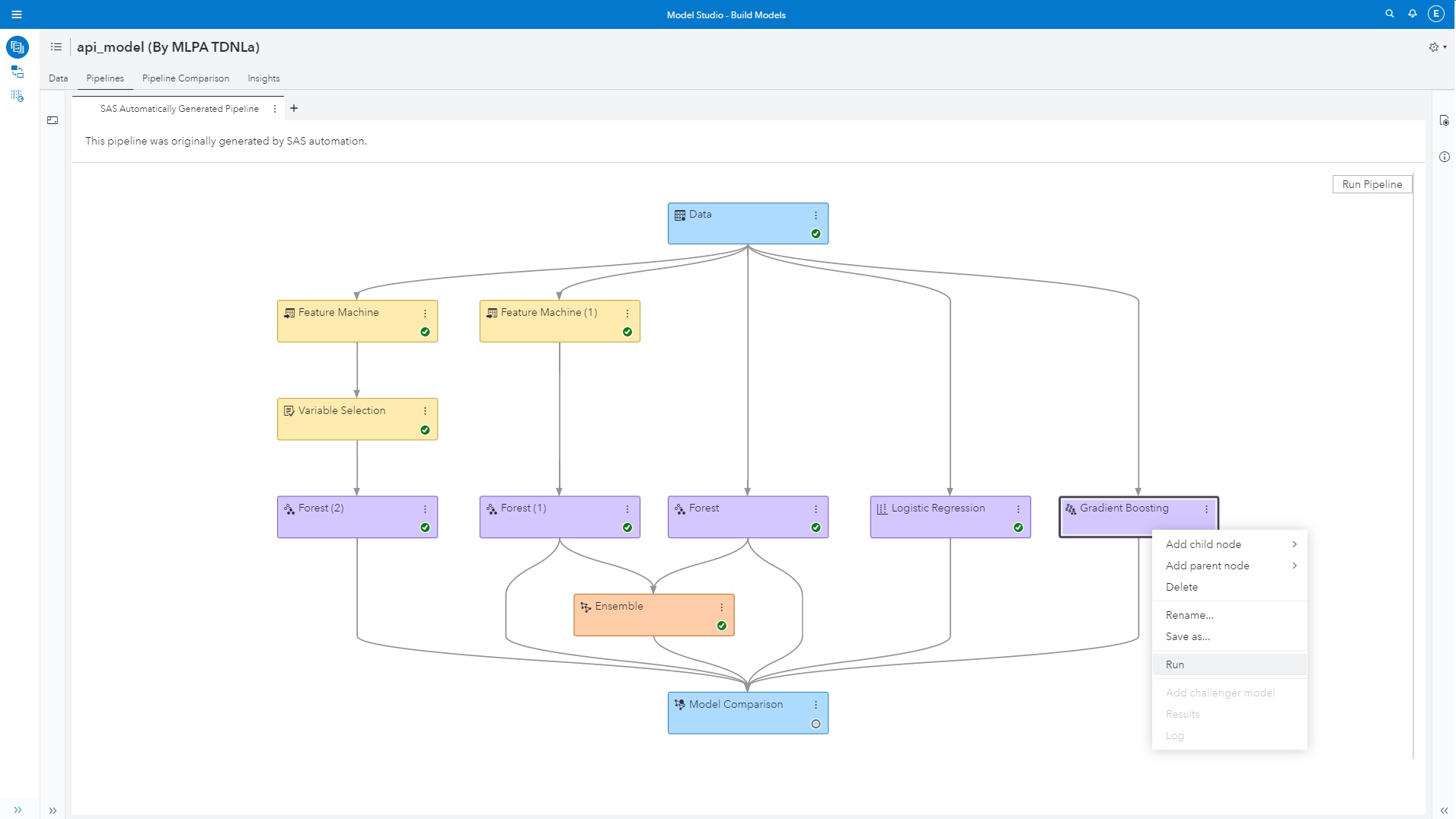

However, the model is not a "black box" in many ways. AutoML could be configured before creation, such as how long to train a model(s). In addition, algorithms created by AutoML can be viewed and customized.

The ability to view and change models makes AutoML less of a "black box" algorithm and more of a "model recommendation" for data scientists to refer to. Models can be governed, monitored, and deployed (in containers, cloud servers such as EC2 instances, and so on) using SAS Model Manager on SAS Viya by simply clicking on Publish Model.

Note: SAS Model Studio, the tool that developed this model, requires a SAS VDMML license. SAS Model Manager, where models are registered for governance, monitoring, and deployment, is available with a SAS MM license.

Conclusion

Developing a loan approval application is a sensitive task since automatically approving loans to customers who will default can be costly for a lender. SAS enables quick and easy development and exposure of decision-making models from a single source. A simple and robust environment can make decisions less prone to errors. In case you are wondering how the application was created, the section below generalizes the main components and how SAS interacts with the application.

Deployment (Bonus)

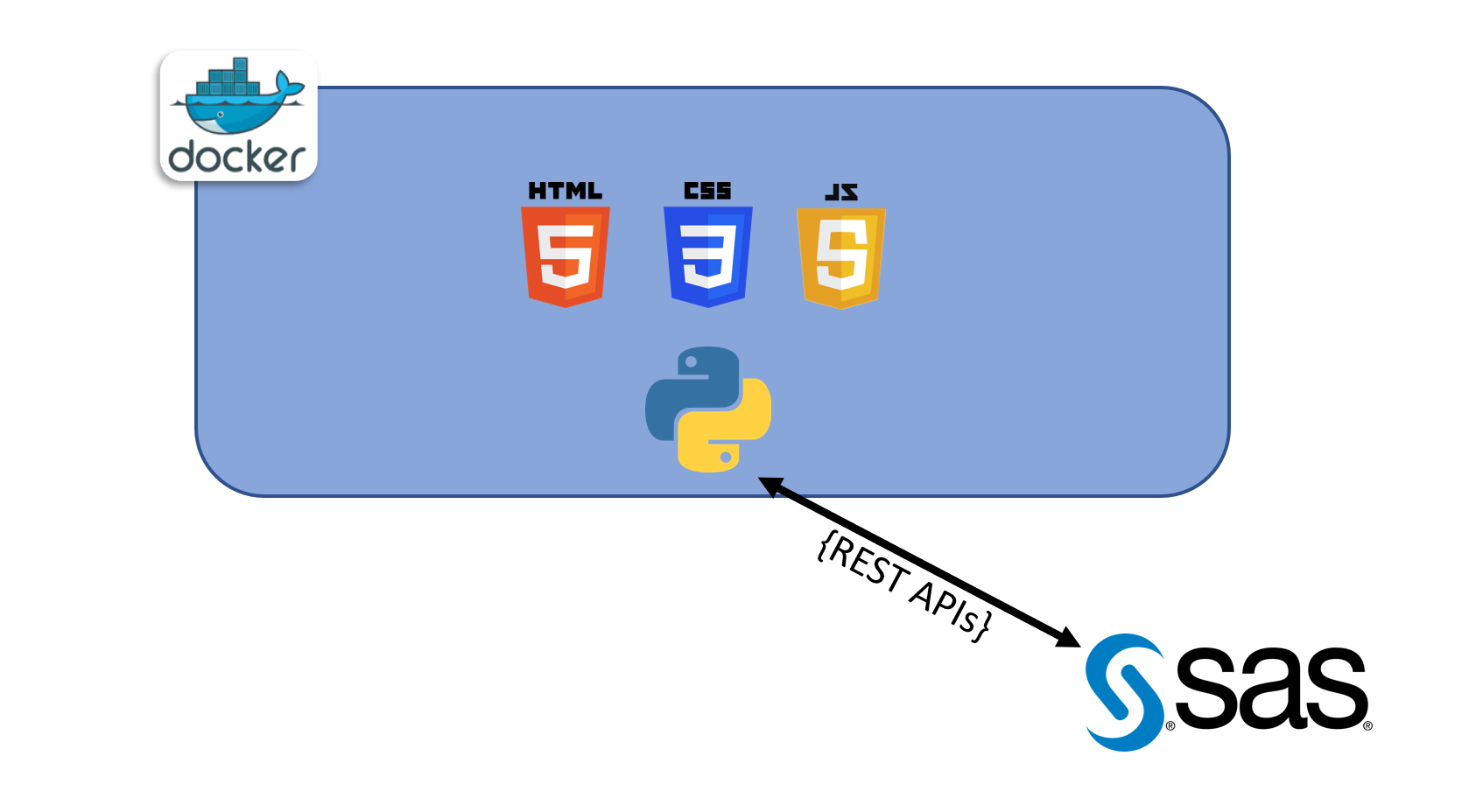

The diagram below describes the steps it took to develop the application. For the front-end side of the application, HTML, CSS and Javascript were used to populate, design, and make the web content dynamic. On the other hand, Python language was used for the back-end to run a lightweight web framework and transfer data between the front-end & SAS environment via REST APIs. Javascipt could have been used for the back-end to call SAS functions as an alternative because API calls can be executed from many languages. The application was containerized and can be easily deployed from other machines with docker platform.

1 Comment

Hello there!

Congrats on the post. I find the information here very promising for my purposes.

Is the source code for this implementation available anywhere?