Welcome to the dreaded week when procrastinators embrace their fates as responsible taxpayers. While you and I may be paying our taxes, to no surprise, as much as $2 trillion in the underground economy will go unreported this year in the U.S. While that number may seem shocking, and the percentage is higher than some countries, it's still low compared to countries like Greece, Italy and Romania, where 30-48% of all business is part of the underground economy. No wonder Greece is failing at yet another bailout.

It's one thing to let economists, even ones that study this on an ongoing basis, weigh in on the problem of the underground economy. However, the IRS themselves admit that the "tax gap" is at least $450 billion and only 83.1% of taxes owed are reported and paid. Or at least was, the last time they reported on it in 2012. I can't wait to see how much it's grown by the time they update it early next year. Stay tuned!

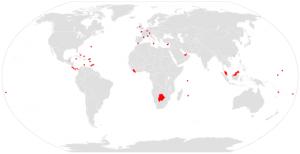

Okay, so it's one thing to talk about this in big numbers, another to bring it home. What the heck is this underground economy anyway? The answer is many different things. It ranges from a construction company that does part of its business through official bids and payments, but also does "side projects" with cash payment for a significant discount, to individuals working a second (or first) job for cash "under the table" with nothing reported. It's restaurants that use "zappers" to delete some of their credit card transactions, to people that rent out houses or rooms on AirBNB, HomeAway and VRBO and don't report it as income. But it's not just little people and small businesses playing these games. It's just that the big boys play it differently - through methods like shell companies and offshore tax havens that range between dodgy and outright criminal. In recent weeks, that was pushed into the limelight as the "Panama Papers" were released. Fallout from that has already taken down Iceland's Prime Minister.

All of this avoids not only the federal taxes, but state income and sales tax as well. That doesn't just hurt some big government that might be thousands of miles away and wasting your money, but hits home very directly. The school your children goes to becomes underfunded, cuts teachers and hurts education and the future. The bridges around the state are in severe disrepair, crumbling, and sometimes just falling into the river.

Why is this a significant and growing issue? Well, part of it comes back to a sense of right and wrong within a given country. This comes back to that study I mentioned earlier that showed how badly Greece is doing. Countries in northern Europe tend to rank the highest in this area - think Finland, Sweden and Norway. A high sense of community and social responsibility equals a low rate of fraud, tax evasion and underground economy. Now think for a moment. How many people do you know that shave a little off their taxes? If not now, in the past. The answer is telling. Another great example is a recent study that showed 1 in 5 employees worldwide would sell their work passwords to a third party. The U.S. fared well below average in that respect, with a full 27% willing to do so.

What can be done about this, outside of trying to teach morality in school? Start using government and external data wisely. Bring together sets of information that data aggregators like TransUnion have, along with information from utilities, government social programs, licenses and taxing agencies. Then, layer strong analytics on top of it. Start drilling down from that $2 trillion in high level economic activity that's missing and begin finding the gaps. Belgium took this approach to help deal with fraud in their version of a sales tax, known as value added tax, or VAT, and eliminated 98% of the problem. The HMRC, an equivalent to the IRS in the UK that handles income and sales (VAT) tax also undertook similar steps. The problem is real, quantified and growing. Instead of saying "Hey Brother, can you spare $2 trillion", let's go find it and collect it.

Care to join the conversation? Reply to this blog directly, or reach out on Twitter @carlhammersburg

5 Comments

"Another great example is a recent study that showed 1 in 5 employees worldwide would sell their work passwords to a third party. The U.S. fared well below average in that respect, with a full 27% willing to do so."

Did you mean to say above average?

Regards

Dmytro,

Good point, and have I should have been clearer in how I referenced that study. You are correct that the US is well above average in responding to the survey that they would sell passwords. I was attempting to make the point that honesty and social responsibility are critical to preventing fraud and tax evasion and reducing the size of the underground economy. In that context, the U.S. fell well below the average in terms of honesty, as fewer individuals would not sell their passwords. However, what I'm thinking needs to come out clearly and accurately in my writing, and I will take that to heart as I write future pieces.

Regards,

Carl

Excellent article, I agree your observations, in principle. But, I can't say if your figures are correct for Romania. Yes, we need public transparency and accountability of businesses and public spending. And, from those who manage public policy and creates the law, we need, also, a simplified and realistic taxes system. What I know it is that, to make all of this, it is much easier than you can think. But, this is impossible, because, till now, some want to exist tax heavens, a complicated system of taxes (VAT is one of examples) and weak law enforcement structures. Indeed, in this case, it is about those who control a great amount of money and they can impose law, heads of public structures and global policies in impoverished states where politicians can be easy corrupt. All the best

Ion,

Thank you for the thoughtful reply. I encourage you to click through to the following study, where I pulled my numbers from (Page 78 for Romania):

http://ec.europa.eu/taxation_customs/resources/documents/common/publications/studies/vat-gap.pdf

It's the same study that I linked to within the article. Between 2000 and 2011, the estimates for Romania ranged from a low of 34% to a high of 49%, with 48% as an economic calculation of the VAT gap for Romania as of 2011, the last year of the study. As you mention, VAT is extremely complex and works very differently from taxation on sales here in the US. It's one reason why there is also an estimate of 100 Billion Euros in just VAT fraud across all of Europe, and why Belgium decided to specifically target VAT carousel fraud.

Tax havens are spot on in terms of your identification of the problem. Whether it's the type of behavior unearthed in the Panama Papers, or even the system of gaming that Ireland and some other European countries have used to shift business and corporate headquarters. The current trend of huge U.S. corporations buying smaller foreign companies, then performing an inversion, to declare that they are headquartered and domiciled in that foreign country to dramatically reduce tax rates while still doing the vast majority of their sales and deriving income in the U.S. is another great example. Currently legal in technical terms, but likely a loophole that will go away.

It's been disappointing to see my home country slide in the wrong direction on this issue, and I try to compare and contrast behaviors when I spend time in Europe, Latin America, Africa and countries like Australia and New Zealand. There isn't a perfect solution, but it does require the right structure, enforcement mechanisms, willingness to fight corruption and at times, global cooperation to achieve more.

Thank you for taking the time to read my blog, giving the issue deep thought, and responding.

Cheers,

Carl

Pingback: Celebrate (?!) Tax Day - State and Local Connection