Want to be one of the first to get your hands on new, cutting-edge decision intelligence software?

Whether you work in financial services, retail, or education, this may be your opportunity to translate your data from insights into action with a combination of SAS technology on Microsoft’s unified analytics solution, Fabric.

What is SAS Decision Builder?

SAS Decision Builder is a decision intelligence solution, which means that it uses machine learning and automation to augment human decision-making for better and faster insights that drive tactical and strategic business decisions. It’s a cousin to business intelligence and the next step after data engineering and model training, completing the analytics lifecycle to help achieve business goals.

Our platform extends and strengthens Microsoft Fabric, adding to an already-strong suite of data science, business intelligence, real-time analytics, and data migration tools. With SAS Decision Builder, users can:

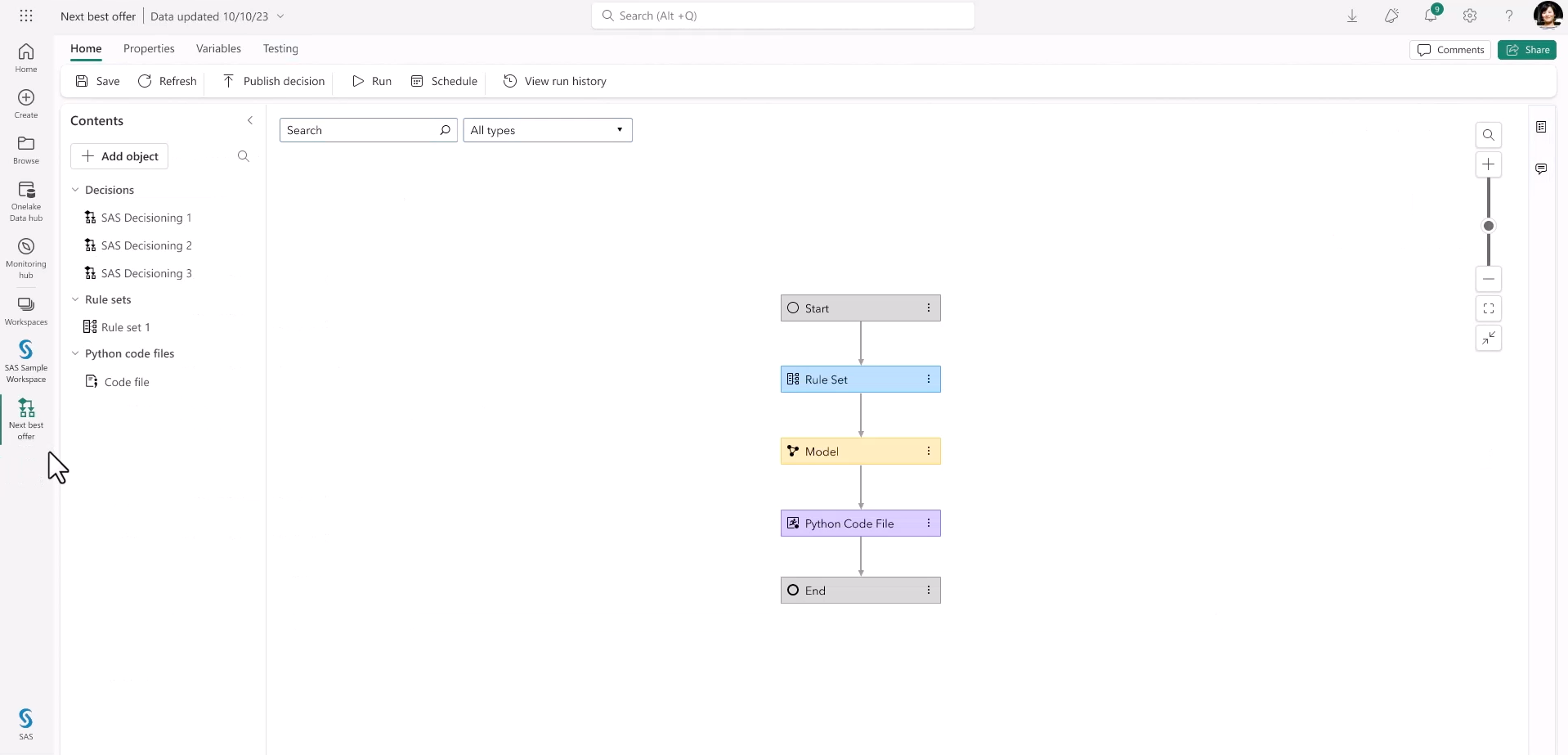

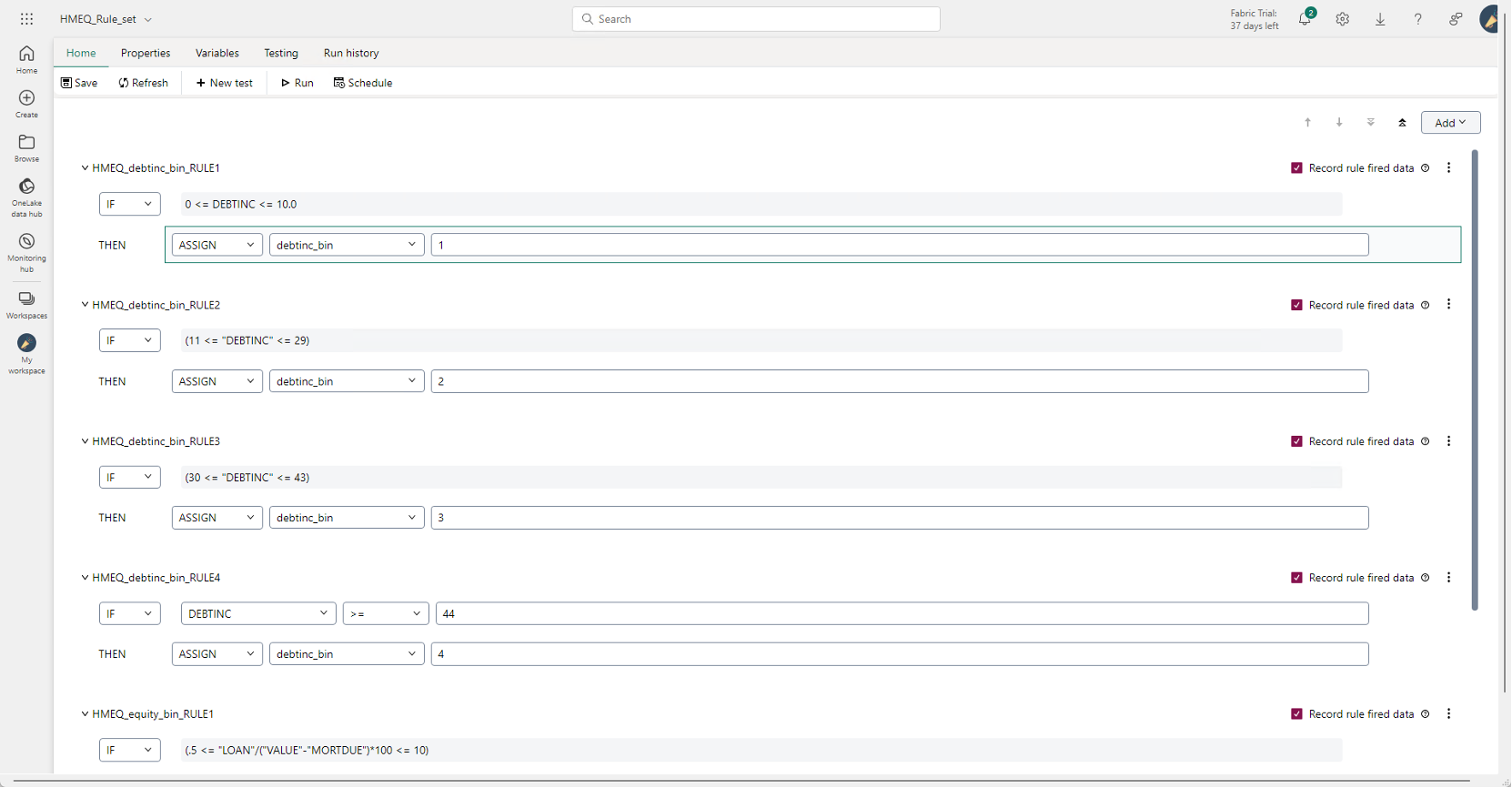

- Access and process data from their Microsoft Fabric OneLake using SAS Decision Builder to construct business rules and decision flows that align with business goals.

- Use decisions to score tables in OneLake and use your results seamlessly in other Fabric tools such as Power BI.

- Test, validate, schedule, run and monitor decisions within the unified Fabric environment using their data to adjust as the market landscape or business needs evolve.

- Manage their decisions ethically with governance features and capabilities.

- Call externally hosted LLMs and your Fabric models and make REST API calls to add additional processing steps using Python code to add additional value for SAS Decision Builder.

Here’s a sneak peek below:

How can I use SAS Decision Builder?

Organizations face daily crossroads when it comes to their operations, making decision intelligence solutions a perfect fit.

One such example are financial institutions that provide loans. They can use SAS Decision Builder to accelerate the approval, rejection, or review process by indicating acceptable credit score ranges that lead to respective outcomes. Consumers receive notification of their loan immediately, while loans that require further review are routed to the appropriate representative. Such a process streamlines a financial institution’s loan approval operations while enabling their human capital to focus on the customers who need the greatest level of support.

Not in finance? Decision intelligence has a wide range of applicable use cases, including within marketing, healthcare, manufacturing, education, and retail. By combining decisioning capabilities with modeled data and business strategy, any organization can get started quickly and realize business impact.

We’re also fielding use cases from your industry to explore the possibilities of decision intelligence. Join our private preview (it’s free to try out!) by indicating your interest to learn more and our team will get in touch.