Some see the insurance industry as lagging in new technology adoption. But a recent study by Coleman Parkes of 236 insurance industry decision makers reveals that this generalization isn’t necessarily true.

Insurers around the globe are, in fact, racing toward generative AI (GenAI) adoption – with 9 in 10 planning to invest over the next year.

As experts in analyzing risks based on massive volumes of sensitive personal data, insurance companies are poised to gain tremendously from GenAI capabilities. But only those who pursue the opportunity with eyes wide open to both benefits and risks will succeed.

Insurers need to address GenAI governance, privacy, ethics and fraud

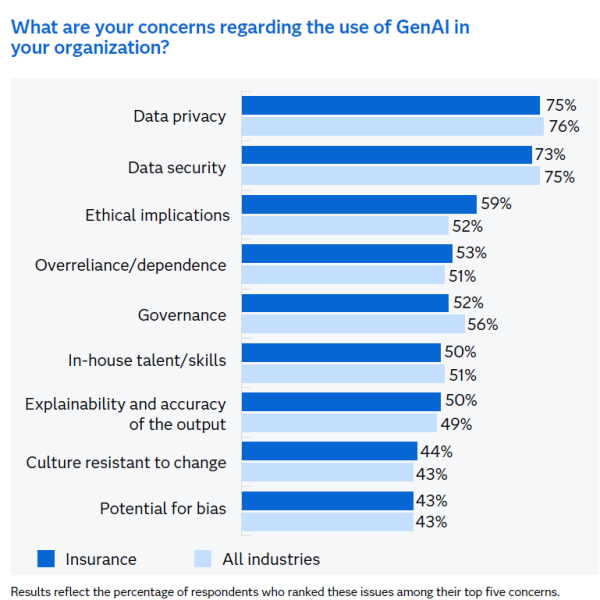

Similar to other industries surveyed, insurers cite data privacy and security as two of their biggest concerns about GenAI. This is a critical matter, especially since insufficient protection of business assets or customers’ personal data could open the door to a multitude of fraud and cybersecurity risks.

Yet just 6% of insurers who are considering the use of large language models (LLMs) have privacy risk measures in place. Many (43%) plan to develop their in-house capabilities for privacy risk detection, while 38% are inclined to buy a third-party solution.

GenAI training begs for attention

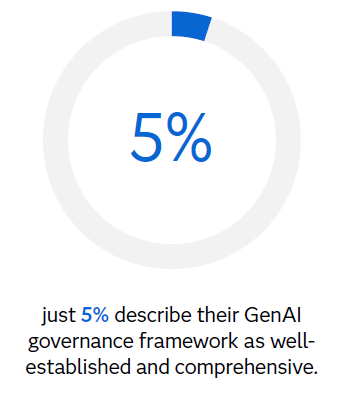

Many insurance firms lack sufficient training on GenAI governance and monitoring, with most saying their training has been “minimal.” Further, governance expenditures are 10% (or less) of total spend – and governance frameworks are being developed as they go.

Insurers should consider whether this level of governance training – and budgeting for GenAI governance frameworks – is adequate for the risks involved.

Governance technology, transparency and accountability

When it comes to GenAI governance, many insurers (37%) say technology limitations are an issue for their firm. Almost a quarter (24%) cite a lack of transparency and accountability as the biggest blockers to effective governance and monitoring. Complicating matters, all insurance companies must address non-negotiable AI regulations. But these are evolving and vary greatly across regions.

Insurers can use GenAI to achieve business goals – if implementation keeps up

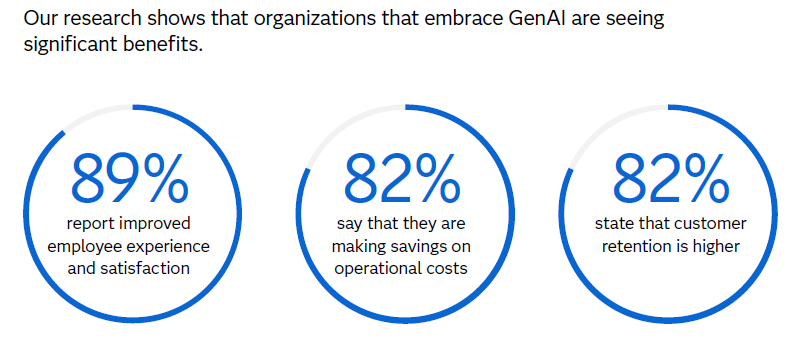

The Coleman Parkes survey uncovered three top ways organizations are using GenAI to improve their business. The research shows that organizations embracing GenAI (across all sectors) are seeing big benefits through:

- Greater customer retention.

- Improved employee experience and satisfaction.

- Reduced operational costs.

At issue: Most insurers appear to be working toward GenAI compliance at the same time they’re implementing the technology. All the while, AI regulations are being implemented in major insurance markets globally. To keep up, insurers need to address statutes around algorithmic bias, AI accountability, and more.

Coordinated efforts to monitor GenAI are needed, too. This involves regularly evaluating whether the technology’s results are effective and efficient at meeting business needs.

Innovating with synthetic data generation will carry insurers into the future

Synthetic data generation is a type of generative AI technique using algorithms to generate data that mimics real-world data. Synthetic data is valuable across industries, especially those that routinely need to safeguard large amounts of protected, sensitive personal data. By using synthetic data, organizations can address concerns around privacy and fairness while avoiding the time, cost and complexity of collecting and managing real-world data.

One promising area for insurers involves using synthetic data to fight bias. In a similar vein, synthetically generated data can help insurers tackle risk management and compliance requirements.

Where insurers need to focus

As with all businesses, insurers must work hard to maintain a stellar reputation while using technology ethically to address business demands. At the same time, they must be prepared to juggle multifaceted customer, regulatory and stakeholder concerns.

The Coleman Parkes study highlights many different aspects of GenAI where insurers need to focus. For example, insurers would be wise to evaluate:

- What they’re spending on GenAI governance and monitoring – so they can determine if the budget needs to be increased.

- Whether their level of staff training is sufficient for the risks involved, and whether training is in line with regulatory requirements.