Construction is the second largest industry in the world with a market value of $12.5 trillion, accounting for 13% of the world’s GDP. Financial services are the only industry ahead of construction, with a market value of $22.5 trillion.

There are many differences between the two industries, but the most glaring are data management and digital transformation. The financial services industry was forced to adapt to global markets, leveraging data amassed from millions of daily transactions to make decisions related to credit, fraud detection, customer experience and new services.

The construction industry, on the other hand, has been constrained by its own dynamics. A new building cannot be designed and built within seconds like a check deposit. It takes time for projects and permits to be approved and concrete to cure. While construction companies may feel like they’ve reached an optimal point in terms of efficiency (barring Mother Nature and government regulations), these feelings are not entirely accurate.

Like the financial service industry, construction has amassed a huge amount of data. While this data might not be stored in large mainframes, it resides in many other systems, including:

- Building information modeling (BIM) systems.

- Project, program and portfolio management systems.

- Enterprise resource planning (ERP) systems.

- Manual spreadsheets and drawings.

- Payment tracking and management systems

- Earned value management systems

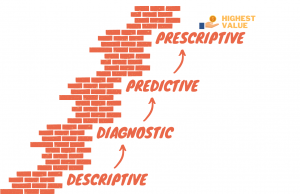

One of the barriers that the construction industry faces is the limited sight of the capability of this data. Most of the models and KPIs built are descriptive or diagnostic in nature.

They can be descriptive because they’re focused on telling what happened in the past, and diagnostic because they can tell you why something happened. And that’s why dashboards can be perceived as the culmination of what construction data can bring to an organization.

The real value for construction companies will come from predictive and prescriptive analytics. Unlike the average industry consensus which considers those steps still years away from becoming reality, there are many predictive and prescriptive scenarios that can be pursued today. In more cases than not, construction companies have what it takes to get there. Here are three examples:

The real value for construction companies will come from predictive and prescriptive analytics. Unlike the average industry consensus which considers those steps still years away from becoming reality, there are many predictive and prescriptive scenarios that can be pursued today. In more cases than not, construction companies have what it takes to get there. Here are three examples:

1. Reporting and predictive insight

Today’s construction companies are building dashboards and providing their project teams much more visibility into what is happening on projects. Some organizations are even providing close to real-time insights. The next step is to predict what could happen and at what level of certainty. This is where the power of using data and predictive modeling begins to show value. Extracting data and transforming it for use in predictive modeling is the next step forward. Using an analytics platform with ETL (extract, transform and load) capabilities will allow for analysis of data trends and facilitate prediction.

2. Schedule optimization

The use of historical performance data to better plan new projects is an important step forward in construction planning. By analyzing the types of work performed and the original duration, models can be built to better predict duration and likelihood of on-time completion. Using that data, construction companies could score work types and strings of activities to produce more likely finish predictions. Once a baseline schedule is built, companies could apply that same concept to predict how realistic that plan is which is valuable knowledge for construction companies.

3. Real-time location analytics

Studies have shown that productivity in construction hasn’t improved in many years, however, the complexity and risk have greatly increased. Using location-based technology and analytics, it’s possible to better understand where a worker spends time while on site. With this understanding, construction companies can better stage work and equipment, allowing the worker to spend a larger amount of time where the work takes place for that timeframe, thus increasing productivity.

This technology also has the potential to close the gap between trades so that there’s no time lag between one part of a project being completed and the next tradesperson coming in to do their work. For example, if a wall is completed and ready for paint on Monday, but that information isn’t communicated until Friday, that means the painter isn’t brought in to do their job until the following week. That’s a productivity loss and cost increase – and it happens thousands of times on large projects.