For the last two years, I’ve spent time listening to and brainstorming with automakers, their suppliers and other technology companies about how to monetize connected vehicle data. This involves:

- Data that’s offloaded from a roving vehicle fleet (cars, trains, semi-trucks, farm tractors, you name it!).

- Data coming from driving-related mobile apps used to help someone, for example, find a parking space.

- Data that’s really difficult to read because standards haven’t been set in their alphanumeric format.

- Data that’s so big and fast-moving that it’s unrealistic to ingest all of it without bogging down servers in their processing speed or imposing unnecessarily high storage costs.

Why monetize connected vehicle data?

First, let me paint a picture of what I mean by “monetize." Automakers know that their component suppliers want intelligence on the parts of any given vehicle. Suppliers typically lose direct access to their products' usage once they're embedded or installed on vehicles. That means suppliers are at a disadvantage to understand how their parts perform.

They’d like to have intelligence on their connected parts without having to rely on the vehicle manufacturer or on survey feedback telling them "how stuff performed.” The vehicle manufacturer has leverage and could negotiate a per vehicle fee for shared data access to such information.

Imagine how valuable tire usage patterns would be to a tire producer if they knew at all times how their originally-equipped tires performed on their customer’s fleet. Data being created from connected cars and trucks opens up opportunities for all involved parties. Knowing how parts and vehicles can be improved, knowing how to make them safer, knowing how to add more convenience for drivers, all help create a more desired and competitive product.

An example of monetizing connected vehicle data

Here’s an example of monetizing connected vehicle data for mobility strategies. What if you're setting up new on-demand, mass transit options for a city? Is it worth anything to city planners or transportation agencies to keep congestion down and traffic moving? Horribly congested cities like London are investing in new technologies now to solve their traffic problems.

Local travel patterns could instantaneously feed an app that surfaces information, such as, "A shuttle is two minutes away and 12 percent cheaper than the nearest ride-share option." In this case, money exchanges hands between municipalities and technology providers when they let their transportation operating system monitor and inform travelers of faster and more convenient options that are paid for through a mobile app.

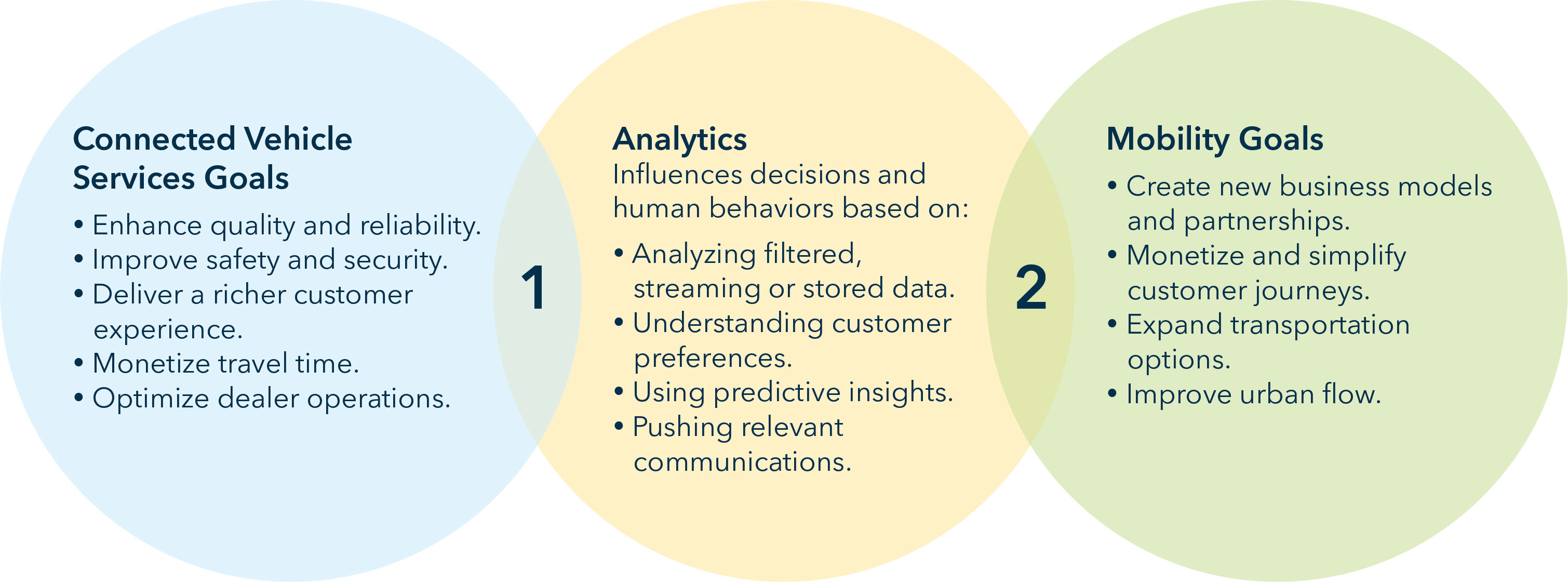

The technology, the permissions, the necessary data management (I could keep going) all benefit from analytical approaches that help reduce uncertainty and point toward ways to monetize the available information. The diagram below illustrates the connection:

While not comprehensive in the goals or use cases, the benefits of the center circle nicely bleed into the pair of circles on the left and right. The diagram get us thinking of ways to drive success for suppliers and their manufacturing customers.

What's next for monetizing connected vehicle data?

Let’s stop here for now. This is the first of a two-part series that addresses the monetization goal related to mobility and connected vehicle services. In my next post, I’ll hit on ten specific growth opportunities for analytics and data monetization. In the meantime, I invite you to read our latest paper that reveals more on this topic: “Analytics Accelerates Monetization Opportunities for Connected Vehicle and Mobility Services.”

There is no doubt that global transportation trends are quickly evolving. These trends push manufacturers, cities and customers to expect more from devices that move them from point A to point B. The options to realize new money are diverse. How organizations realize new money partly relies on studying behavioral patterns and successfully predicting and fulfilling desired financial outcomes.

1 Comment

Very informative. Analytics is playing a vital role these days. This article really helps me a lot.

Thank you.

Automotive Analytics Solution Services - Innodatatics