This is the first of two articles looking at how to listen to what your customers are saying and act upon it – that is, how to understand the voice of the customer.

This is the first of two articles looking at how to listen to what your customers are saying and act upon it – that is, how to understand the voice of the customer.

Over the last few years, one of the big uses for SAS® Text Analytics has been to identify consumers’ perceptions and attitudes from the language they use. This is commonly called sentiment analysis, opinion mining or voice of the customer analysis.

Voice of the customer analysis can have significant value for organizations looking to listen to and understand the customer’s “voice” (e.g., from surveys, social media, complaints or web chat) to improve operations and help direct strategy. This approach can, ultimately, help improve customer satisfaction, net promoter score (NPS) and loyalty while reducing churn and dormancy, thus increasing revenues.

There are however a number of challenges to doing voice of the customer analysis well, especially as the focus often seems to be the “sentiment score.” This binary polarity of the positive/negative score is limiting and has a number of challenges:

- Customers have different personalities and emotions and communicate in very different ways. Should “amazing” mean a higher sentiment score than “good”? Should someone who swears or uses sarcasm get a more negative sentiment score than someone who says “I was rather disappointed you let me down”? The language a person uses is as much about personality as it is sentiment.

- The polarity of the sentiment score is often too simplistic; it does not consider your businesses objectives and the brand experience you are aiming to deliver. Rather than producing a score, it’s often more useful to assess what people think of your brand’s products and services and their features. For example, for an airline, features might be check-in, on-board service, price, quality of food or timeliness. These opinions can then be weighted by your brand’s priorities if you want an overall score.

- Ultimately thought needs to be given to how the sentiment score will be used. Is it for reporting, or could it be used for alerts when it rises or falls? The top-level score on its own is not particularly useful. If a benchmark is the objective, a net promoter score (NPS) may be a more useful metric.

With the voice of the customer analysis in hand, we can then focus on gaining insight into the root causes of satisfaction and dissatisfaction, for example, improved feedback on product design or refined handling of customer interactions.

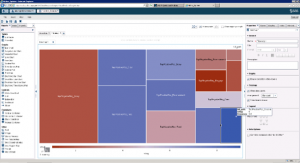

A simple example of this is shown in the screenshot, which shows frequency of positive

A simple example of this is shown in the screenshot, which shows frequency of positive

and negative feature mentions, color-coded by the average NPS. This shows a positive check-in experience is associated with higher NPS, and although customers are negative about food, this doesn't seem to effect customer NPS scores as much as delays or lost baggage.

Further analysis of feature sentiment can identify the causes of the low satisfaction. For example, poor check-in experience may be caused by perceived poor service quality; queuing time; design of automated check-in machines; problems with baggage allowances; or time for first-class passengers to get to the lounge.

For voice of the customer analysis, your source documents could include surveys (e.g., NPS), complaints, web chat or social media. It’s often worth starting with the internal sources, like surveys and complaints, as these can be directly attributed to a known customer. This will mean that you can also use structured data about these customers and their behavior in your text analysis; the combination will be more powerful than just the text alone. Even in an anonymous NPS survey, the structured questions will help with assessing the causes of dissatisfaction.

Whatever the document source, as part of the definition stage it’s worth reading a small sample of documents. This will give you an initial impression of how the documents fit with your analysis objective. At this stage you should just be aiming to assess how language is used. For example, how long are the documents? Are the documents written by customers or employees? Is the language formal or informal?  Do they contain much sarcasm? How concise (or verbose) have the authors been? What’s the quality of spelling like? How technical is the language? Are many abbreviations used? If speech to text technology (or web chat) has been used, does the text differentiate between speakers?

Do they contain much sarcasm? How concise (or verbose) have the authors been? What’s the quality of spelling like? How technical is the language? Are many abbreviations used? If speech to text technology (or web chat) has been used, does the text differentiate between speakers?

So we have started to define our problem. Next time we’ll explore an approach to voice of the customer analysis that moves beyond the rather narrow view of sentiment polarity and focuses on listening to the voice of the customer so you can make decisions that will improve the customer experience.

Read the second article in this series, Voice of customer analysis (Part 2), now.

Learn how to deliver exceptional customer experiences with voice of the customer analysis.