![supply_chain_improvement_2[1]](https://blogs.sas.com/content/sascom/files/2015/12/supply_chain_improvement_21.jpg) Over the course of my career as industrial engineer turned supply chain planning advocate I've had the opportunity to work hands-on with many manufacturing and supply chain planning solutions. This has included solutions offered commercially by the usual suspects of ERP and post-SCM consolidation supply chain solution providers. Most of these are first generation planning suites that prioritize integrated downstream planning over best-of-breed capabilities, or were best-of-breed when they were conceptualized and developed decades ago. They do not reflect the needs in demand and supply-side planning that is emerging in next-generation planning solutions.

Over the course of my career as industrial engineer turned supply chain planning advocate I've had the opportunity to work hands-on with many manufacturing and supply chain planning solutions. This has included solutions offered commercially by the usual suspects of ERP and post-SCM consolidation supply chain solution providers. Most of these are first generation planning suites that prioritize integrated downstream planning over best-of-breed capabilities, or were best-of-breed when they were conceptualized and developed decades ago. They do not reflect the needs in demand and supply-side planning that is emerging in next-generation planning solutions.

In particular, demand-side planning capabilities continue to evolve into next-generation solutions that outperform the first generation offerings. Improved capabilities for demand sensing, demand shaping and demand shifting are now available and have become common topics in business forecasting conferences.

Best Fit forecast model selection capabilities have emerged that go further towards automatically optimizing, or fine tuning, the model selected to maximize forecast accuracy. Not just selecting the best forecasting model as the first generation solutions do, but dynamically creating the best model and fine tuning it by optimizing forecast algorithm coefficients and model parameters to drive further accuracy.

New product forecasting (NPF) has evolved past the first generation, "like modeling", technique for analogous forecasting. Next-generation NPF drives more forecast accuracy and value using a structured judgment approach. This is an attribute based approach towards NPF that uses advanced analytic techniques in data mining, similarity analysis, clustering, forecast model fitting and analogous forecasting. The result is better accuracy through the combination of statistical analysis and domain expertise.

Multi-tiered causal analysis (MTCA) has been developed in order to leverage improvements in causal forecasting and demand signal repository data. MTCA links shipment forecast and consumer demand leveraging point of sale (POS) data. MTCA is also applicable beyond the consumer products industry where leading indicators similar to POS data may be leveraged.

Many of the first generation vendors have put "lipstick on the pig" and are claiming to have such advanced capabilities. They cannot honestly back these claims up with verifiable results in the form of a proof-of-value exercise. Other vendors are attempting to refresh their solutions via a "re-platforming". Lora Cecere, CEO at Supply Chain Insights, provided commentary on the challenges that SAP is currently facing with APO, and Oracle (Numetrix) and Manugistics (JDA) have already suffered.

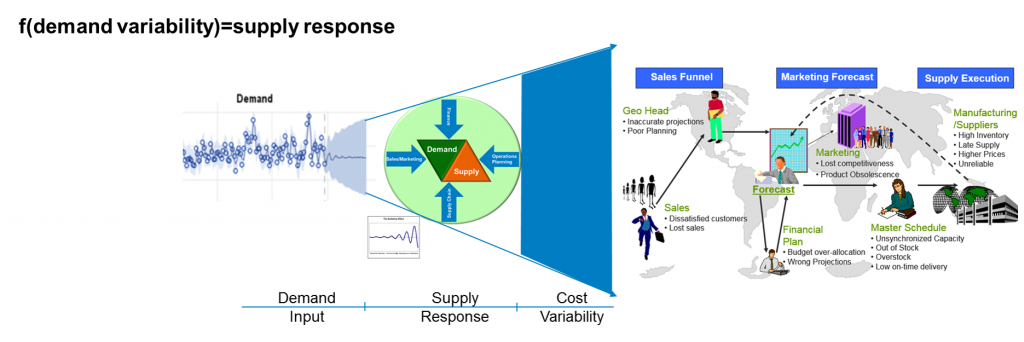

Vendors who are weak in demand planning try to compensate for, or justify, their outdated technology approaches with the old adage, "all forecasts are inaccurate," proclaiming, "just give me a starting forecast and I'll apply superior supply planning." A twist on that mentality is that enough hiccups will occur on the overall supply chain journey that an accurate demand plan is not required. Supply planning will fix the anomalies that present themselves and therefore forecast accuracy as a process input is not critical.

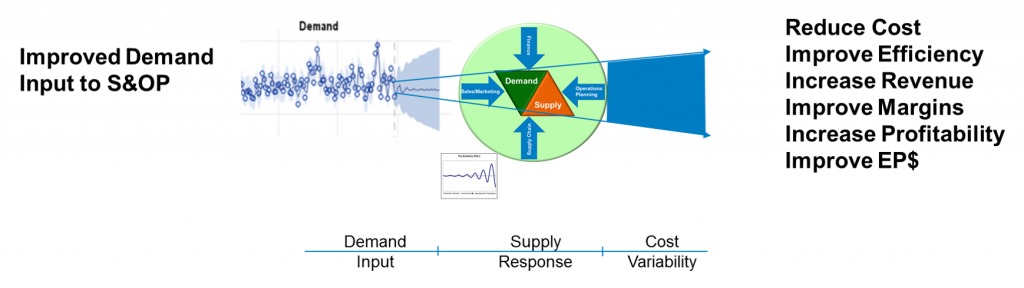

I am reminded of a public policy systems analysis class project I completed back in the nineties for my post graduate degree. The topic was waste reduction and the effect that waste reduction programs and policies have on the front end of the municipal waste systems. The goal was reducing the amount of waste we inject into the environment as a means of reducing the overall requirement for waste processing. We see this in practice today in our lives....bio-degradable and re-engineered packaging, along with recycling seriously reduces the strain placed on our landfills and environment. This provides a great analogy for the discussion. Better forecast accuracy via next generation forecast technology reduces the "corporate waste stream." A better forecast feeding our supply chain processes allows us to have a tighter supply response to demand.

Corporate waste is the inefficiency of our operations and all the associated trappings. Think of the resources wasted, costs incurred, processes executed, excess and obsolesce write-offs or markdowns when we process the wrong products in the wrong places at the wrong time as a result of inaccurate forecasts. Revenue lost due to stock outs of the right product, where you used resources to Plan-Source-Make-Deliver-Return the wrong product. Regardless of how good your supply planning solutions are, this is not the right mentality. Back to the municipal waste reduction analogy... reducing the waste that is injected into the overall system to begin with is a superior approach for waste reduction. Similarly, maximizing your demand side input with better forecast accuracy using next generation demand planning will reduce the corporate waste stream created.

Reserve your supply chain resiliency and response capabilities for making the right part at the right place at the right time. Avoid bloating your supply chain and consuming resources by making the wrong part at the wrong place at the wrong time. A superior demand side input drives tremendous value. Supply side oriented solution advocates and vendors who diminish the value of the superior demand side input are not serving you well. Oliver Wight consultants said it best in the book, Demand Management Best Practices, organizations must get the demand input right before synchronizing demand and supply. New demand planning capabilities have emerged via next generation demand planning solutions that are complimentary to your existing investments in supply chain planning and ERP, drive tremendous value and can be implemented with attracted ROI and payback. For a different take on a related theme check out Charlie Chase's blog, Value of demand forecasting —“relying only on supply responsiveness is a recipe for failure...are you supply centric, demand centric or holistic”.

Image source: One Network Enterprises