A customer's initial onboarding journey is often the most interaction they will ever have with a company. This series of touchpoints provide the applicant with their first insight into what being a customer will be like. Unfortunately, disjointed and unconnected processes often create gaps for customers to fall through or for bad actors to exploit.

With Covid-19 further expediting Communication Service Providers (CSPs) digital transformation journey and increasing regulatory oversight in areas such as affordability checks and identity theft, the challenge to streamline and automate the customer onboarding journey has never been more significant. Layers of legacy systems often mean that even the simplest changes are like untangling a huge knot. It impedes innovation in organisations striving to be agile when dealing with changing trends and risks.

Meanwhile, risk and fraud pressures continue to increase. While it initially looked like CSPs had overestimated the provisions needed for bad debt during Covid-19, the end of government stimulus combined with an inflation-driven cost of living crisis is now resulting in increased bad debts across both consumer and business portfolios across all industries. Furthermore, research by the Association of Certified Fraud Examiners (ACFE) also shows that, in these stressed times, there is an increased prevalence of committing fraud. This is exhibited in the increase in opportunistic fraud committed by individuals who had never previously committed fraud and organised criminals seeking to exploit unsuspecting victims. In another recent fraud blog, both were detailed as fraud trends that may shape 2023.

To combat this issue, organisations should view the journey through the eyes of the customer to transform touchpoints into a seamless journey that improves the customer experience while reducing risk. Here are two ways to do that:

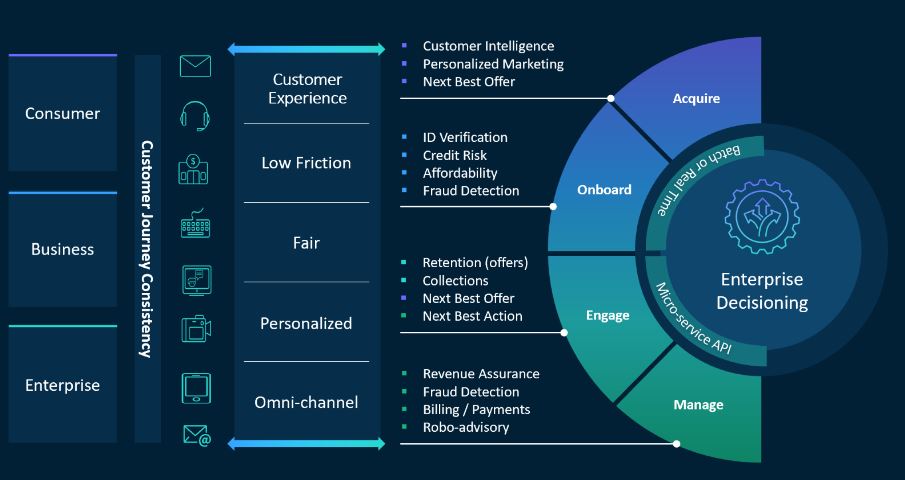

1. Use a joint enterprise decisioning platform

CSPs have abundant data from multiple internal and external sources, making it vital to harness the data to gain insights and take actions that can drive business growth. SAS Viya helps CSPs orchestrate data in real-time to provide increased insight into the customer’s intentions, whether good or bad.

Utilising a joint enterprise decisioning platform allows previously separate departments to work from the same data and create an interconnected decisioning process that improves outcomes for both the customer and the CSP. A CSP in our Asia-Pacific region has reduced manual intervention in the mobile pay monthly risk assessment process by over 75%, combining data from multiple departments with machine learning and automation. This has improved straight-through processing, reduced operating costs, and reduced bad debt and fraud losses due to more accurate decision making.

An example of multi-purpose data is using Open Banking information to validate income from a credit risk perspective while verifying the applicant’s identity, which may forgo a need to ask for additional ID and thus reduce friction during onboarding. Axcess Financial is using the SAS platform to orchestrate real-time integration with multiple 3rd party data providers that have reduced fraud by more than 70% and decreased customer journey friction by reducing identity verification requirements for certain applicants.

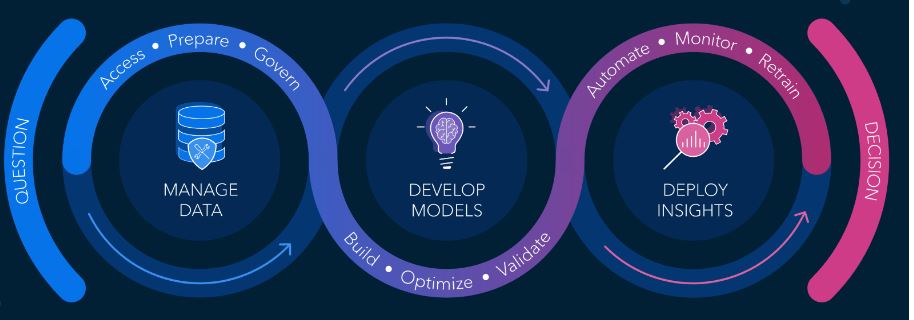

2. Lower the knowledge barrier to use these tools

A unified decisioning process should be augmented with machine learning (ML), enhancing risk-based decisioning while delivering a low-friction customer experience during onboarding. SAS Viya provides a low code UI for training and deploying analytical models that can be combined with business rules to act in real time with the right balance of advanced automation and human oversight.

Whether you are a data engineer, data scientist, decision analyst, investigator, reporting analyst or all of the above, SAS Viya provides a single web-based UI that enables seamless collaboration across departments, super-charging continuous innovation.

Where are CSPs heading?

Thanks to advanced analytics, credit risk management and fraud detection have matured over the past decades, but many CSPs are only at the start of their journey. They are sitting on a treasure trove of recent and historical data but don’t have the infrastructure and tools to unlock its value.

There is no silver bullet for managing risk because the world changes. CSPs can streamline the use of their data from an ever-growing number of sources to make real-time decisions and build in more layers of protection to make them more resilient to existing and emerging threats.