There is growing awareness and discussion about the need to remodel business processes in banks. This is partly in response to the disruption caused by the pandemic, partly because of macroeconomic pressures such as changing interest rates, and partly a way to address changing customer behavior and expectations.

This last issue is why process reengineering should be customer-centric. Banks should orient all processes towards customers. Their goals should be satisfying customer needs and delivering the best possible customer experience at every contact point. This includes both price and service across the entire life cycle of every bank customer.

There is an increasingly important role for analytics in redesigning the customer experience. Banks are using predictive analytics based on models using artificial intelligence (AI), machine learning methods, and real-time decision engines that consolidate all available customer data. This includes risk assessment, analysis of susceptibility to fraud, and potential for cross-sell/up-sell of additional services.

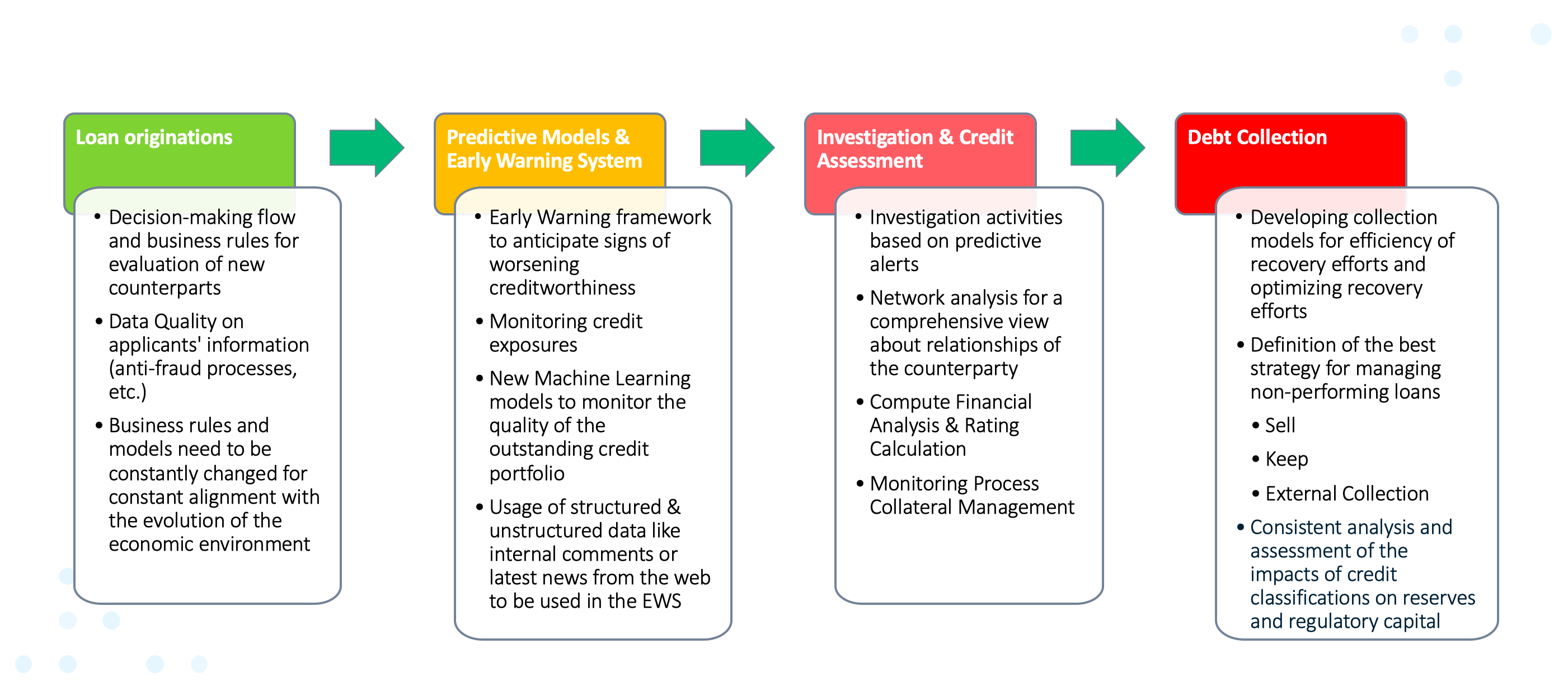

This so-called credit life cycle management ecosystem is rebuilt as a world of data, analytics, and processes, supporting all decisions made in cooperation with the customer. Around 25% of banks have completed or launched the transformation of loan and collection processes in 2021.

Quantitative and qualitative: A hybrid 360-degree assessment

For retail customers of banks, there are relatively low amounts requested and a high volume of customer inquiries. Many institutions, therefore, use fully automated processes, including analytical models, to make intelligent business decisions in real-time based on their own and external data. These models include both traditional and AI models to approach each client as an individual segment.

Financial statements, balance sheets, and profit and loss accounts are prepared with great accuracy by applicant institutions but rarely published. However, credit assessments should consider the most recent data. This may mean extracting unstructured data from the internet or text mining techniques to capture sentiment about a particular company. This approach is not just good practice but also a regulatory requirement of the European Banking Authority. Analytics may also be useful to value real estate for collateral.

More and more organizations are considering the use of so-called alternative data. However, few financial institutions are taking full advantage of geolocation data or PSD2/open banking data streams. For example, there is potential to score customers based on their current locations, adding temporal and spatial characteristics to the model. Geolocation data is also useful information for climate risk analyses.

Predicting customer problems

Another use of analytics is the ongoing monitoring of customers. Reacting to significant deteriorations in the quality of the credit portfolio is risky in today’s reality. Instead, banks should be able to predict what may happen to the portfolio following macro and microeconomic changes. This requires predictive or scenario analysis supported by analytical models – and then rapid remedial action.

When customer relationships deteriorate and customers fail to repay debts, banks may attempt to salvage the relationship through restructuring and debt collection. Analytics is also useful here, especially new AI/machine learning models that allow better, more granular, customer segmentation and selection of the optimal debt collection path. Using PSD2 data can also highlight when the customer may be breaching the terms of their debt collection arrangement.

A credit life cycle management ecosystem in practice

What I have described here is a comprehensive credit life cycle approach. There is plenty of evidence that this provides tangible business benefits. But a report from Deloitte this year suggests that three-quarters of the market is only experimenting with using AI and has no specific vision for its application.

Both the technologies and the methodology have proven their worth and have shown great results and a high return on investment. What’s more, analytics is becoming a common good. It is no longer necessary to build very strong statistical or econometric competencies to benefit from its use. Even AI and machine learning models can be automatically explained.

The implementation of these processes does not have to completely displace current systems. Natural evolution is the best approach to change because it avoids losing valuable knowledge from current systems. However, the digital transformation of risk processes is progressing faster than we might have thought possible just a few years ago. This should please both risk managers, with new tools and business solutions at their disposal, and customers, because analytics support optimization processes on a win-win basis.