Does the use of artificial intelligence make sense in risk management processes?

The first practical experiences in business show that it does. Banks can use AI to build more models using more variables. This allows them to better segment clients for credit scoring or debt collection processes, preventing financial losses on bad loans. This is especially important in crises such as the pandemic because customer behaviour and savings and spending habits have changed.

The financial markets have noticed a huge change in payment flows. The credit risk has increased, as has the market risk. Financial institutions want to optimize their response to the requirements of a rapidly changing market. So they try to optimize credit policies and processes to allow them to continue to operate effectively while reducing the number of “bad” customers.

Banks and lenders are investing in AI-based scoring accelerator solutions that allow for quick reorganization of loan processes in changing times. These activities are a win-win strategy for both banks and customers.

'Homework' for anyone who wants to use AI to support business processes

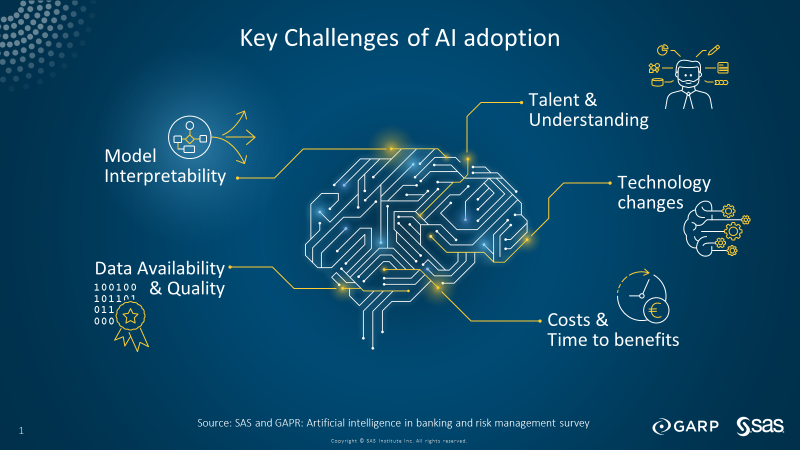

Artificial Intelligence in good hands will certainly bring tangible financial benefits. However, it should be applied in a holistic and multithreaded way. AI algorithms are the heart of the system, but they must be set into a properly prepared environment, architecture and infrastructure. The value from AI will be realized only when the process is operationalized. Close cooperation between analysts, developers, ModelOps, validation and IT is crucial.

AI mechanisms must have access to a long series of historical data to support self-learning. This means they work best in profitable business processes that are proven and rich in data. It is better to leave difficult, complicated and incomprehensible processes for later, to avoid disappointment. We must also be realistic and not expect miracles. It will take time to learn how to use AI.