Whenever I talk to actuaries across EMEA, they are very consistent in the many anchor points they see for actuarial modernization in order to be future-proof. In this article, I would like to share some of them.

Anchor points for actuarial innovation

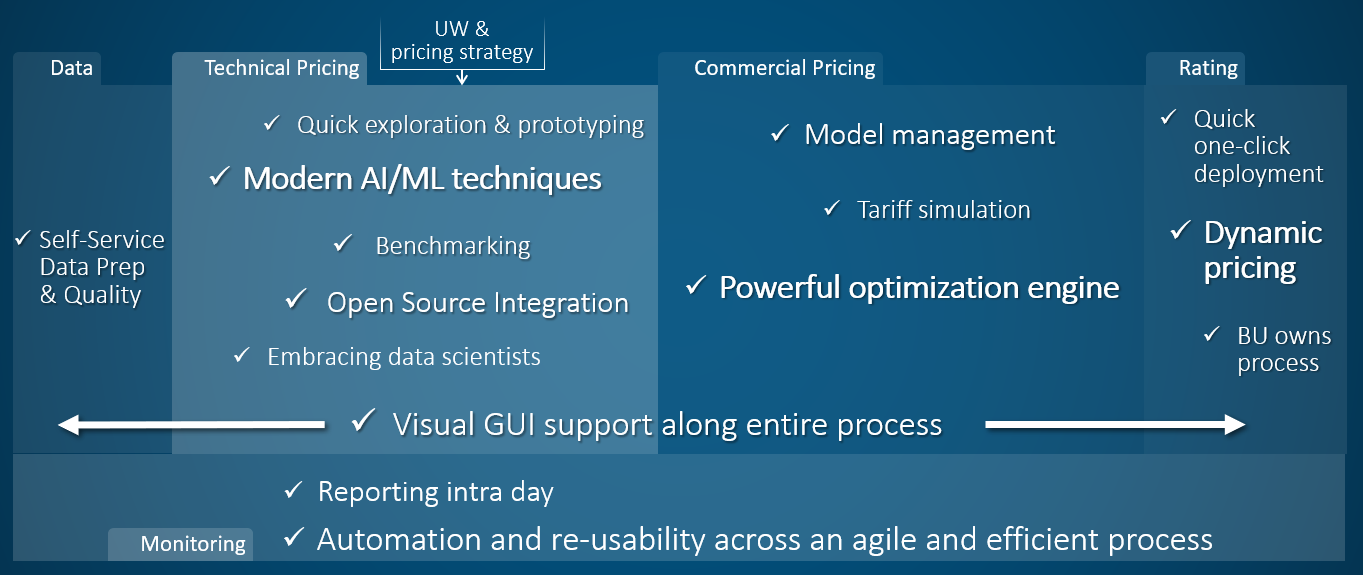

The most time-consuming task is, of course, getting the data ready. As this mostly includes requests to IT and lots of fine-tuning and communication across departments, this step often gets in the way of using data in a more innovative way. Getting the actuary more in the driver’s seat with self-service and visual data exploration is a huge productivity booster.

Technical pricing

Today, technical pricing is mostly a repetition of last year’s work with fresh data and some statistical tweaks. Here is a great chance to bring real innovation to the rate-making. Be more creative in finding potential risk predictors in more and different data, challenge traditional modelling techniques with self-learning and highly nonlinear methods, and use the latest and greatest algorithms from the open source community.

Commercial pricing

When it comes to commercial pricing, actuaries seek to exploit potential in the existing portfolio by using high-performance optimization engines instead of simply sketching Excel scenarios, as we often see today. And they need to manage and govern the ever-increasing number of models they create in a professional manner.

Rating process

One of the most exciting aspects, in my personal view, is extending the role of actuaries in the rating process. Dynamic pricing means that you consider not only the given tariff logic but competitor pricing, underwriting rules, propensity models, optimum discount models or price elasticity, and the like. Technically, this requires that the actuary can deploy tariffs faster, with lower IT involvement. And we use classical actuarial skills in model building in the underwriting process. So underwriters and actuaries will collaborate more intensively.

All in all, such an innovation program needs to be based on an analytical ecosystem that provides a seamless and robust process experience to actuaries whilst integrating good working third-party tools, where reasonable. Automation, governance and transparency are key. In his article on the evolving role of actuaries for the innovation agenda of insurance my colleague Dr Andreas Becks sketches why not only the actuarial department but also the CEO’s digital transformation agenda and every customer’s experience can fundamentally benefit from a smart analytical ecosystem.

It’s not a flow – it’s a loop!

Dynamic and flexible rate making is a continuous cycle or loop. Work and responsibility do not end when a tariff is handed over to production. There is a constant need to control, adapt and exchange productive models in order to ensure the creation of value in production in the long term.

How can actuaries set up their actuarial department in a more modern and business-oriented way?

Looking at pre-modelling und modelling in technical pricing, a field in which actuaries create value through exploration, innovation and the best possible modelling, how can actuaries find better risk predictors and make use of new data?

First, let’s talk about exploration. As our eyes are the broadband line to our brain, visual methods for data exploration have proven to be more productive and creative in many applications. Also, in rate making we observe that actuaries take a significant advantage from visual data analytics in order to recognize relationships in known and unknown data quickly and intuitively.

Sandboxing for ML turns out to be a significant aid to help actuaries familiarize themselves with new methods and check their value potential.

To boost productivity, agile methods are a key value driver. This also means that actuaries need ways to perform fast prototyping by just clicking models together in order to see if detailed modelling is worth it.

Finally, with easy-to-use ML, actuaries can easily challenge their productive GLM with ML models, compare them and derive insights for further improvement of the productive model, e.g., in the selection of variables.

Decision design for dynamic pricing

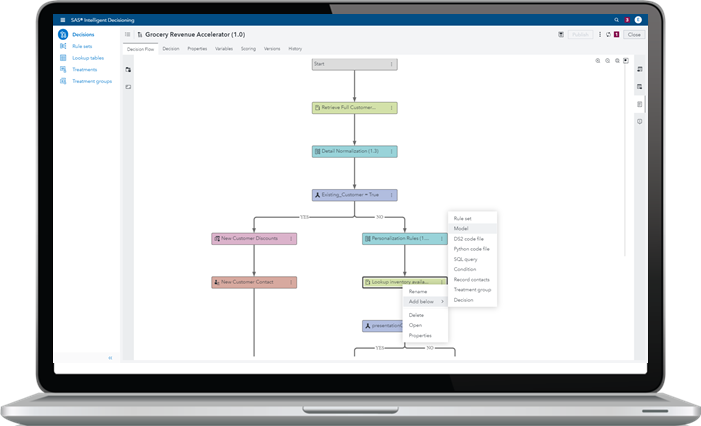

Underwriters and actuaries need to work closer together for dynamic pricing. So how can actuaries actively manage product sales while considering customer behaviour and competitor prices? Dynamic pricing has become the talk of the town in the insurance industry. Dynamic pricing requires actuarial skills because models also get more important in the underwriting process.

This means that you consider not only the given tariff logic but competitor pricing, underwriting rules, propensity models, optimum discount models or price elasticity, and the like. Thus, actuaries need to become more independent from old legacy systems and their drawbacks and need an environment where they can collaborate with underwriters.

By extending the actuary's workbench and changing deployment methods, handing a ratebook over to IT for recoding is not necessary anymore.

The business user now owns this process and becomes responsible to create decision flows for dynamic pricing. This is done visually by combining classic tariff logic with business rules, custom code and analytical models to offer customer-specific prices at the point of sales that match the corporate and underwriting strategy.

The value of collaboration

Using this new way of deployment, IT efforts and costs are reduced significantly. And actuaries can deploy new tariffs and tariff changes with a much faster time to market.

By the way, the role of an actuary and responsibilities for working with other departments – for example, underwriters or marketing – differs from region to region. But look at it as a possibility of collaboration, where assets can be contributed by different parties and put together in a decision flow.

If you’d like to learn more on the changing role of actuaries and the business effects of actuarial transformation, I recommend watching the recording of this live event I recently attended, featuring some esteemed thought-leaders from the insurance industry who shared their thoughts on The New-Age Actuary.