Few of us can have missed the scenes of frantic shoppers searching for that ultimate bargain on Black Friday. This is something fairly new in the UK, having originated in the United States to refer to the Friday following Thanksgiving Day. Legend has it that ‘black’ refers to the first day of the year that retailers operating on squeezed margins would go into profit, leaving the 'red' of loss and into ‘the black’. Black Friday really took off in the US around 2003 when it became the busiest shopping day of the year; and in the UK a few years later. And now Black Friday is followed by ‘Cyber Monday,’ when bargain hunters hit the net in search of the best deal.

Few of us can have missed the scenes of frantic shoppers searching for that ultimate bargain on Black Friday. This is something fairly new in the UK, having originated in the United States to refer to the Friday following Thanksgiving Day. Legend has it that ‘black’ refers to the first day of the year that retailers operating on squeezed margins would go into profit, leaving the 'red' of loss and into ‘the black’. Black Friday really took off in the US around 2003 when it became the busiest shopping day of the year; and in the UK a few years later. And now Black Friday is followed by ‘Cyber Monday,’ when bargain hunters hit the net in search of the best deal.

In fact, according to The Guardian, Black Friday bargain hunters helped to lift UK retailers out of their usual November lull. Online spending went up by 37.5% from last year, while total retail sales were up 2.2% against same time in 2013.

Two new surveys shed light on the rapidly changing behaviour of consumers on both sides of the Atlantic:

- Christmas 2014: Adapting to Evolving Consumer Shopping Habits is the report from a survey conducted by SAS in the UK with retail analysts Conlumino to examine the topic from the retailers' perspective.

- Holiday Shopping Styles: November 2014 is the report from a survey conducted by SAS in the US that shed light on the types of holiday shoppers and their respective habits.

Examining Christmas Shopping Patterns in the UK

The UK report with Conlumino looked at how effective discounting is, what factors affect forecasting, how relatively new phenomena such as widespread online retailing and ‘Black Friday’ are influencing behaviour?

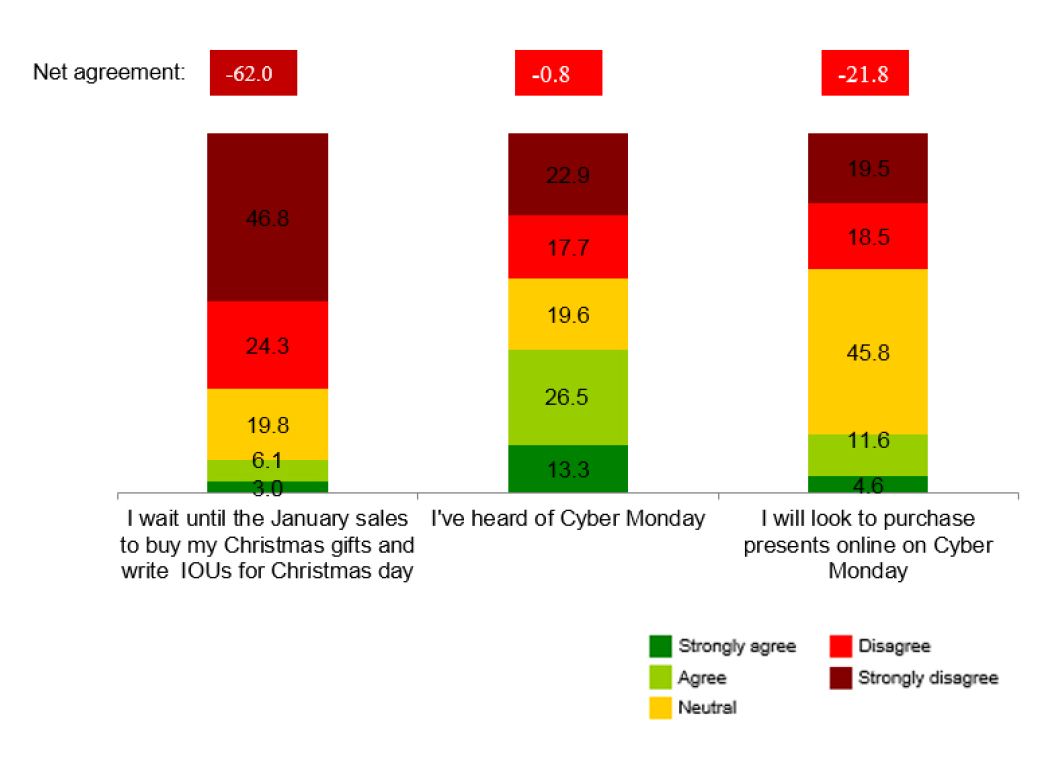

Maureen Hinton, Global Research Director, Conlumino, said: “Having been first introduced to the UK market by Amazon just a few years ago, Black Friday and Cyber Monday have been increasingly embraced by UK shoppers. Americans traditionally view the Thanksgiving weekend as the start of the Christmas shopping season and – whilst UK shoppers don’t share that connection – the pro-activity of UK retailers with their heavy marketing and deep discounts, allied to the rising influence of e-retail, has played well to an enduring sense of austerity. According to our research, just under a fifth of shoppers have long planned to purchase Christmas gifts online on Cyber Monday as part of their Christmas shopping cycle, highlighting that the success of the weekend is down to a strong cocktail of impulse-led and planned purchasing behaviour.”

Maureen Hinton, Global Research Director, Conlumino, said: “Having been first introduced to the UK market by Amazon just a few years ago, Black Friday and Cyber Monday have been increasingly embraced by UK shoppers. Americans traditionally view the Thanksgiving weekend as the start of the Christmas shopping season and – whilst UK shoppers don’t share that connection – the pro-activity of UK retailers with their heavy marketing and deep discounts, allied to the rising influence of e-retail, has played well to an enduring sense of austerity. According to our research, just under a fifth of shoppers have long planned to purchase Christmas gifts online on Cyber Monday as part of their Christmas shopping cycle, highlighting that the success of the weekend is down to a strong cocktail of impulse-led and planned purchasing behaviour.”

However, our research with Conlumino also showed that some consumers may regret their impulse buys; with almost three in four saying that online purchases should be allowed to be returned in store. We could term this pattern ‘Return & Run’ where shoppers simply return unwanted items or ‘Shop & Drop’ where they make new purchases at the same time as returning unwanted goods.

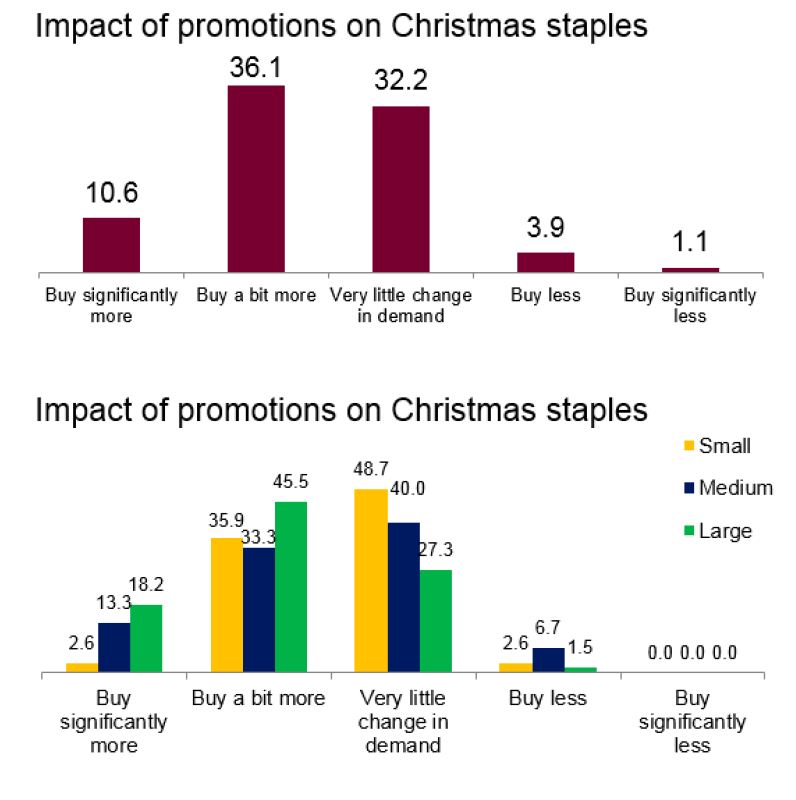

“Nonetheless”, adds Maureen Hinton “over two-thirds of UK shoppers feel that Christmas discounting is losing its impact, which is hardly surprising given that the last few years have seen retailers engaging in more and more promotional activity throughout the year. Against this backdrop, it will take deeper levels of discounting on the products and brands that shoppers actually want to effectively drive demand; over half of consumers are planning to shop around for the lowest price once they’ve picked their Christmas gifts. The weather is also a major concern for retailers … with 69% of large retailers saying that it has a medium-to-high influence on performance.”

With shoppers becoming ever more unpredictable in their buying and returns behaviour, Black Friday no longer guarantees a healthy profit for retailers, even with the appeal of bargains, same day deliveries and ‘Click & Collect’ services.

With shoppers becoming ever more unpredictable in their buying and returns behaviour, Black Friday no longer guarantees a healthy profit for retailers, even with the appeal of bargains, same day deliveries and ‘Click & Collect’ services.

Matching product promotions to different consumers is very complicated, but the good news is that data analysis provides the answers. Unfortunately, 44% of retailers said they still rely on gut feel for forecasting demand, and nearly half (47%) said they promote the same goods every year. Big data analytics extracts key insights from the data so retailers can accurately forecast demand for different products among different consumers, and ultimately deliver consumer satisfaction.

Searching for the ‘Average’ Shopper in the US

Meanwhile, over the Atlantic the search for the typical shopper was taking place. The US survey report details a view taken from the consumer’s perspective. We found that she’s almost 46 years old, she shops for 13 people and plans to spend $1,119 (£720) on gifts. She will also indulge her significant other to the tune of $299 (£190).

The survey revealed seven dominant holiday shopping styles: the Black Friday Warrior, the Budget Buster, the Practical Shopper, the Perfect Gifter, the Cybershopper, the Last-Minute Hopeful and the Humbug (listed in descending order based on the average amount spent on Christmas gifts):

- Black Friday Warriors (21%, average spend $1,422/£923) enjoys going to the shops and being part of the crowd. Has the longest gift list.

- Budget Busters (11%, average spend $1,132/£724) generally end up over-spending, don’t mind paying more for convenience.

- Practical Shoppers (21%, spends $1,108/£709) saves, sticks to their budget and does all of their shopping at once.

- Perfect Gifters (19%, spends $1,056/£676) spends time searching for the perfect gift, loves to indulge family and friends.

- Cybershoppers (19%, spends $955/£611) finds shopping stressful and is not inclined to take advantage of the Black Friday deals.

- Last-Minute Hopefuls (5%, spends $955/£611) the least stressed group, they leave it all until Christmas Eve, picking up bargains and gift cards.

- Humbugs (5%, spends $941/£602) are the opposite of Black Friday Warriors. They think Christmas decorations appear too soon, dislike crowds, don’t indulge loved ones and won’t pay for convenience. They are stingy, delay until the last minute and shun sales.

Alan Lipson, SAS Global Retail Industry Strategist said: “Our research suggests retailers should target the budget-conscious shopper during the Black Friday weekend. Alternate promotions are in order as the season progresses. Effectively appealing to different consumer segments – especially during the holiday season, when consumers aren’t shopping for themselves – is a complex puzzle. Analysing data is the only way to solve it.”

For a slightly different take on these findings, read this blog post written as a poem by Pamela Prentice titled, How many holiday shoppers will brave the crowds on Thanksgiving? Pamela, SAS's Chief Research Officer, is a talented writer and is apparently a budding poet as well.

Two Markets with Similar Challenges/Opportunities

On both sides of the Atlantic, the way consumers behave has changed, as have their purchasing patterns, how they react to discounts and promotions and how they shop both on and off line. Making sense of these changes to manage the challenges and capitalise on the opportunities is increasingly difficult. That's where the differentiating power of analytics can make a difference.

Retailers of all sizes are using marketing analytics to gain a fuller view of customers from online behaviours, social media sentiment, transactional data and other sources of data. Armed with that data, they are using real-time decisioning to inform customer interactions both online and in stores. These technologies better equip retailers to deliver customer experiences that make a difference on Black Friday, throughout the holiday season and all year long.