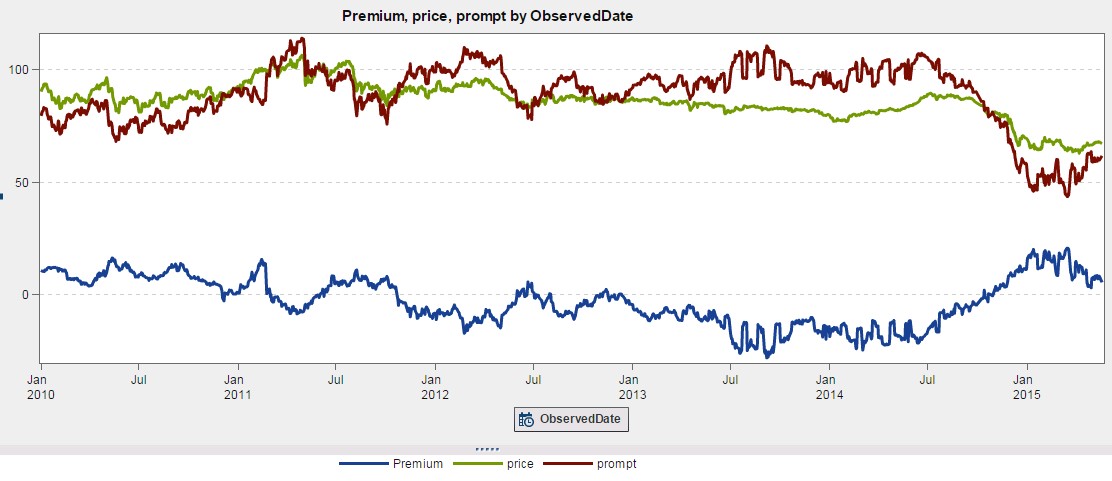

Since our last VirtualOil update in May, oil prices have continued to take a beating. As the chart of the rolling five-year portfolio shows, much of our strip of options is now out-of-the-money and the average value per barrel of that optionality has sunk below $7. No surprise then that

Author

Time for VirtualOil 2.0?

From downtime to upside with oilfield predictive maintenance

Dust off that old aphorism about an ounce of prevention. Oil companies applying analytics for predictive maintenance can see a substantial downtick in the unanticipated equipment repairs that quickly eat into an oil well’s profitability. Maintenance is far from a trivial concern in the oilfield. A pumping oil well is

VirtualOil: volatility and the value of a hedge

This month we take a fresh analytical view of our hypothetical VirtualOil portfolio by comparing the forward price of WTI (the green line) to the prompt month price (red line). The resulting graphic (chart 1) demonstrates the relative stability of the 48-month forward price in contrast to a very active spot