Authors: Erik Melton, Amanda English, and Caitlin Kapur

SAS Tax Compliance for Sales Tax is configurable and customizable. It uses an analytics-driven approach to automate the prioritization of audit leads dynamically and systematically. This package offers a simplified implementation foundation, allowing for a greater focus on fine-tuning the analysis of the customer’s data while meeting the customer’s business objectives.

What issues do tax agencies and consultants face?

Each year, state and federal tax agencies lose hundreds of millions of dollars due to the tax gap—the difference between taxes owed and taxes paid. This gap results from both intentional underpayment by businesses and unintentional noncompliance by well-meaning businesses. Tax agencies face the challenge of addressing this growing gap while navigating ever-changing tax laws, shifting industry trends, emerging noncompliance issues, and new fraud schemes. This is all happening while working with limited resources.

For years, SAS consultants have provided customized offerings to client tax agencies to tackle these challenges. Due to the specificity of local tax statutes, tax forms, and reporting requirements, agencies require an increasing amount of analysis and reporting customization. As a result, many of the field-developed offerings put into operation included components tailored to an agency’s strategy to reduce the tax compliance problem. This one-to-one approach significantly limited the reusability of analysis and reports from one client to the next.

How can SAS Tax Compliance for Sales Tax help?

The underlying Tax Foundation in this offering can support multiple agency initiatives. This eliminates a siloed approach and provides a repeatable analytics process for related tax initiatives and tax types. This design also offers a more efficient and accessible way to build and update a compliance detection process without starting from scratch for each new tax initiative.

SAS Tax Compliance for Sales Tax performs analysis by using business peer group analysis, trend analysis, and models to identify businesses most likely to have tax compliance issues. Each analytical component is configurable, allowing users to tune parameters and thresholds as needed. The Tax Foundation also provides multiple plug-in points for custom programs to handle data processing, analysis, alert scoring, and alert management. The included alert scoring uses a data-driven approach, leveraging audit outcomes to weight the analytic flags and prioritize audit leads. This dynamic feedback loop in the scoring process can identify emerging trends and prioritize successful analyses results to tune future audit lead scores.

What are the results?

Results are provided in the form of two tables stored as SAS data sets containing key analytics information. Information such as the analysis that generated the leads, the associated audit at-risk amount, and the overall audit lead score, also known as the compliance risk score. This risk score considers the analysis that triggered any flags, the potential at-risk amount, and the historical or recent performance of those flagged scenarios from prior audits. This score enables auditors to prioritize businesses for audit review. This reduces the time spent selecting and researching audit leads and lowers audit selection costs while improving audit success rates.

Because the results from this product persist as SAS data sets, the audit leads and their related analytics information can be integrated with an agency’s reporting or case management platform, regardless of the vendor or brand. If the agency plans to use SAS Visual Analytics for reporting, for example, SAS Tax Compliance for Sales Tax offers a reporting data model and JSON report templates for two reports. These reports can be used to shorten the report delivery lifecycle while providing intuitive results to auditors and audit managers.

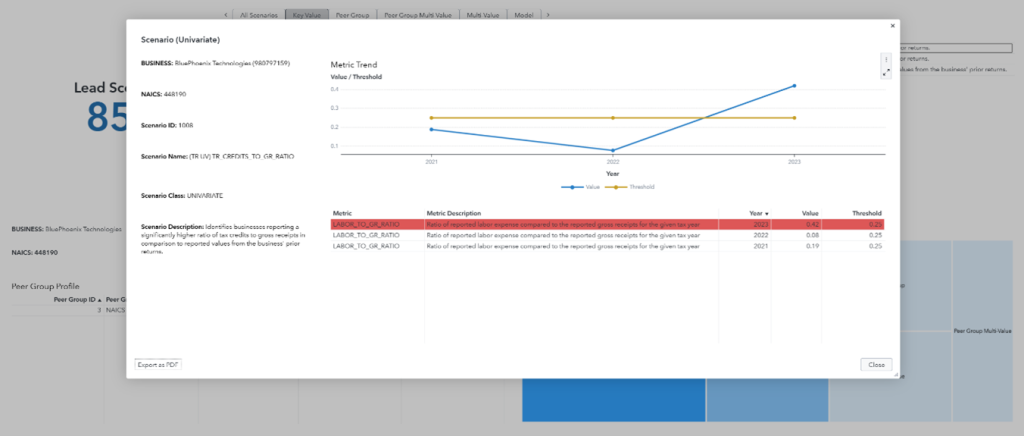

The Analytic Leads Report in Figure 1 provides details on prioritized audit leads, the compliance risk scores, and the analysis contributing to those scores. From there, auditors can drill down into key metrics, filing patterns, and industry peer groups for an effective review process.

The Analytics Performance Report in Figure 2 offers insights into the effectiveness of lead scoring, drilling into the analytic scenarios and their functional value as determined by recent audit outcomes. These results allow end users to easily assess scenario performance and identify emerging trends.

How can agencies use the results?

The results from the SAS Tax Compliance for Sales Tax can help address several key questions agencies are facing, such as:

- Which businesses should be prioritized for audits?

- What factors seem to be predictive of non-compliance?

- What industries are most impacted by changing tax laws?

- What filing trends are emerging across similar businesses?

Summary

SAS Tax Compliance for Sales Tax offers a component for addressing the tax gap and helps agencies overcome their resource constraints through SAS technology, robust analytics, and process automation. Audit selectors can review results quickly. Accurate lead prioritization reduces the time spent on audits that are less likely to have a compliance issue. The decreases in time to value and unnecessary taxpayer interactions provide measurable benefits to the agency while helping them improve taxpayer relations.

LEARN MORE | SAS Models

Amanda English is a Data Scientist in SAS' Applied AI & Modeling division. Before she came to the division, Amanda developed custom tax compliance solutions for 10 years as an analytic consultant in SAS Professional Services. Her work focused on the areas of refund fraud, identity theft, audit, and process controls. She is currently leveraging her consulting experience to inform and build new tax compliance offerings for SAS R&D.

Caitlin Kapur is a Senior Data Scientist in SAS' Applied AI & Modeling division. After spending her initial years at SAS working on healthcare analytics projects, she branched into tax compliance consulting in SAS Professional Services. For several years, she delivered tax compliance offerings related to audit, refund fraud, identity theft, and collections to state tax agencies. In her current division, Caitlin continues her work developing and improving tax compliance offerings.