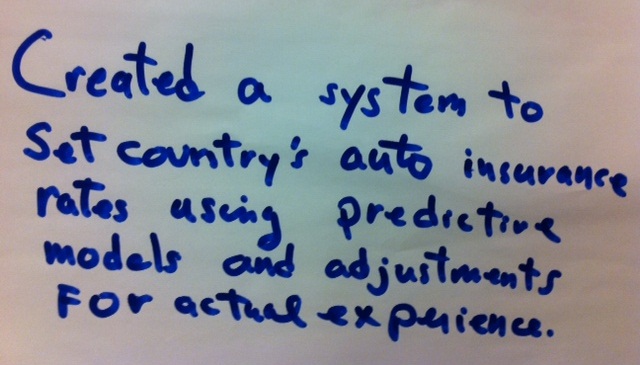

In this Innovation Inspiration, a SAS user has developed the insurance rating plans for a country using predictive modeling. How exciting! Additionally, the system adjusts based upon actual experience. This is quite the accomplishment given the complexity of the ratemaking for even a small geographical territory.

Developing insurance rate plans is a complex process that must take into consideration many risk factors and dynamic changes from the external economic and legal environment. For example, in a typical automobile insurance rating plan, there can be more than 20 variables! This complexity makes it practically impossible for modelers to conduct “comprehensive” multivariate modeling with all of the possible variables. And yet ...

Here is a 2007 NESUG presentation by Matthew Flynn and Jun Yan. They give modelers an offset technique to ensure that they don't bias the outcome. "The major risk when certain important factors cannot be included in a multivariate modeling analysis is that the analysis results can be highly 'biased.' Commonly known factors which will bias the property and insurance predictive modeling results include underwriting cycle and external environmental change (i.e., year), loss maturity,

state/territory, exposure, and distribution channel, to name a few."

Here are other papers that I found on ratemaking and predictive analytics in insurance:

- Modifying Insurance Rating Territories via Clustering - This presentation from NESUG 2010 seems particularly relevant to the work being done by the Post-It Note author above. Quncai Zou and Ryan Diehl, the presenters of this paper, explain that US insurers use territories to define the geographical risk in their insurance plans. According to the authors, the theory is that each territory has very similar geographical ratings - thus simplifying one variable. The problem is that territories haven't been reevaluated over the years. Check out the solution that Zou and Diehl have developed.

- Ratemaking Using SAS® Enterprise Miner™: An Application Study - According to Billie Anderson, the author of the paper, traditional ratemaking methods are not statistically sophisticated. She writes in her paper, "Many lines of business are analyzed using one-way analysis. A one-way analysis summarizes insurance statistics such as a loss ratio for each predictor variable without taking into account the effect of the other variables. One-way analyses also do not take into account any interactions that might exist among the predictor variables." In her 2011 SAS Global Forum paper, She will show you case studies of how to use data mining technology and the new Ratemaking node in SAS Enterprise Miner to build predictive ratemaking models.

- An Analytical Approach to Determining Customer Value in the Property and Casualty Insurance Industry - Here's a slightly different approach to ratemaking: Roosevelt Mosley, from Pinnacle Actuarial Resources, suggests that there is more than just customer risk to price in. He believes that you also have to think of the company's long-term profitability and its goals.

I've given you only four papers from the many SAS user and professional experts. I've also dipped only into the past couple of years. There are perhaps hundreds of examples. Check support.sas.com for SAS Samples, Usage Notes and SAS papers. Also check www.lexjansen.com for the world's biggest stock pile of SAS user presentations!!

Now, go inspire someone else! It's Friday!!

3 Comments

Pingback: Top blog comments last week - SAS Voices

Waynette,

That sloppy handwriting sure looks like mine! I seem to recall being asked (at the SGF in Seattle?) to scribble something on a bulletin board, in the demo room, regarding the most innovative way we have used SAS?

Anyhow, the country was Canada and, while we never wrote it up in a paper, a powerpoint can be found at:

Canadian Loss Experience Automobile Rating (CLEAR)

Art

Hi Art,

I wouldn't say the handwriting is sloppy - I had no trouble reading it. 🙂 Thank you for including your PPT presentation. I know other SAS users will find this very helpful!

~Waynette