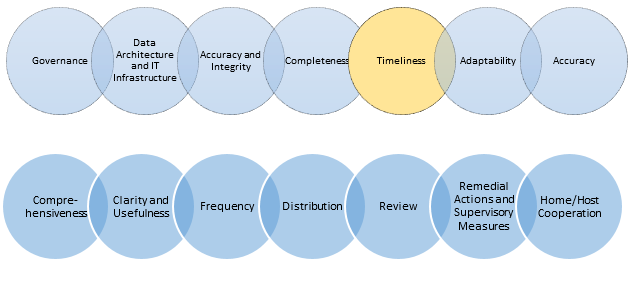

Principle 5: Timeliness – A bank should be able to generate aggregate and up-to-date risk data in a timely manner while also meeting the principles relating to accuracy and integrity, completeness and adaptability. A timely and accurate view of risk exposure, aggregated across credit counterparties and financial products could have