Fraud knows no boundaries. It’s one of the biggest challenges related to tax governance around the world.

Tax crimes have serious consequences – tax losses, tax base erosion, national security risks and economic disruption. The effect is far-reaching.

Governments are strained to fill the gap between revenues and spending and may have difficulty funding vital programs and services to the public. Citizens who meet their tax obligations carry the unfair burden of tax cheats.

More data helps investigators discover unseen fraud

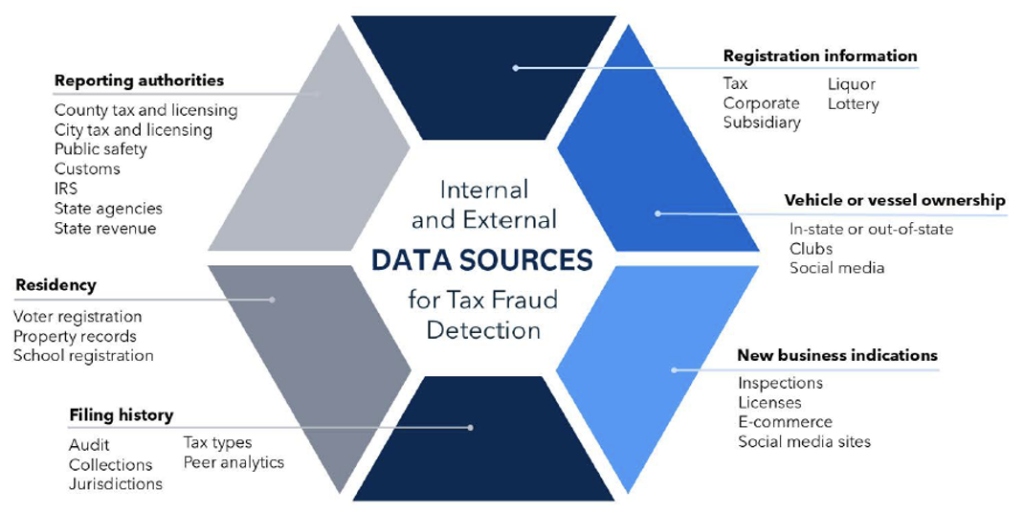

Tax agencies have a secret weapon in the fight against fraud: data. They’ve got stacks of it – tax filings, audit reports, registration details – to name a few. But all that data alone may not give you a taxpayer’s full story. What’s the missing link? Data sharing.

Imagine this: tax agency data teams up with other sources – reported income, deductions, credits – and possibly less visible but valuable data from different governmental departments, open-source data and third-party information.

Together, these data sources become a powerhouse for tax fraud analysis. Agencies often request this information manually during audits, but its full potential lies in proactive use. It’s like turning on the lights in a dark room – suddenly, everything’s crystal clear.

Data sharing across departments and agencies can significantly expand tax investigation efforts such as finding hidden behavior patterns, detecting underreporting and providing opportunities to increase voluntary compliance.

Teya Dyan, Principal Tax and Revenue Compliance Consultant for SAS

The dynamic fraud detection duo

Data is a powerful ally in the fight against tax fraud. When we combine shared data with internal records, magic happens. It helps us assess risk more accurately, spot fraud early, and distinguish between intentional evasion and honest mistakes. It’s like having an investigative dream team armed with nuanced insights – that’s what shared data delivers.

But here’s the twist: agencies used to struggle to access shared data. Often, there are delays in obtaining data, which slows down investigations. Limited data sharing makes finding those elusive connections between suspected fraudsters harder. Streamlined access to shared data turbocharges investigations, saves valuable investigation time and investigators, reduces redundancies and lets investigators focus on the highest-priority cases.

Let’s dive into the tech side of things. First, advanced analytics is essential for fraud detection. Second, machine learning paired with analytics is a must-have. Think of machine learning models acting as digital detectives, quickly spotting anomalies. Third, network analytics. Think of it as a board connecting the dots in tax fraud cases.

Advanced analytics and machine learning can help significantly on two fronts: find fraud more accurately and flag fewer false positives.

Ensley Tan, Principal Public Sector Consultant for SAS Asia-Pacific

The outcome? Smarter, more targeted decisions are possible when these technologies are combined. Fraud schemes and evasion patterns that are easy to miss will be revealed.

Strategies for success

To make the most of shared data, several considerations must be made.

- Establish data governance, security and analysis best practices: A well-defined framework ensures data validity, protection measures are in place and responsible data access (need-to-know). Cataloging and automated processes will provide timely, accurate and actionable data.

- Create a strong investigative and analysis framework: This agile, continuous process strengthens fraud prevention and adapts to emerging trends in taxpayer behavior. Clear governance is needed. The benefits include the ability to interpret critical data relationships, increased departmental collaboration and improved transparency.

- Integrate analytics and business rules: Combine advanced analytics with business rules to automate fraud detection tasks for intelligent decisioning. Tools like model tuning and feature engineering optimize resources and speed up decisions, leading to faster investigations and better enforcement.

- Maximize insights using analytics models: Machine learning and AI provide real-time insights and predictive modeling, quickly identifying fraud patterns and forecasting risks. Continuous monitoring prevents model decay, ensuring ongoing effectiveness. Integrating business rules with machine learning allows dynamic risk assessment, giving agencies up-to-date data throughout investigations.

- See the big picture and fine details: Advanced data analytics for fraud detection must be comprehensive yet manageable, allowing agencies to see the big picture without missing details. Risk scoring assigns risk levels to taxpayer data components, helping prioritize cases based on fraud likelihood. These scores can be broken down to show contributing data components, aiding investigators in understanding and interpreting the data. Investigators can examine each data point within the risk score, streamlining case development, evidence collection, and report writing, thus maximizing efficiency and effectiveness.

- Understand the risks and challenges: Breaches, misuse and inaccuracies are big concerns. Security lapses compromise sensitive information, and outdated data can lead to errors. Privacy concerns may hinder data sharing, affecting collaboration.

Unlimited potential awaits with shared data

When effectively harnessed, shared data accelerates fraud detection, improves taxpayer compliance and enables preventive action.

Analytics uncover complex fraud schemes, while predictive models allow proactive issue resolution. As a result, workflow efficiency increases, false positives decrease, and high-risk cases are prioritized.

Transparent data governance and transparency support legal proceedings and maintain taxpayer trust. Robust governance ensures controlled data access and vetted information, maximizing benefits and protecting sensitive data. Investing in data governance and shared data enhances investigative capabilities and impacts tax compliance and fraud prevention.

What’s trending in the tax world