Broadband has become widely available and 5G is up and running in many countries, meaning more and more people have access to the internet via different platforms. With good quality internet connections either at home or via mobile connections, consumer behaviour has changed rapidly.

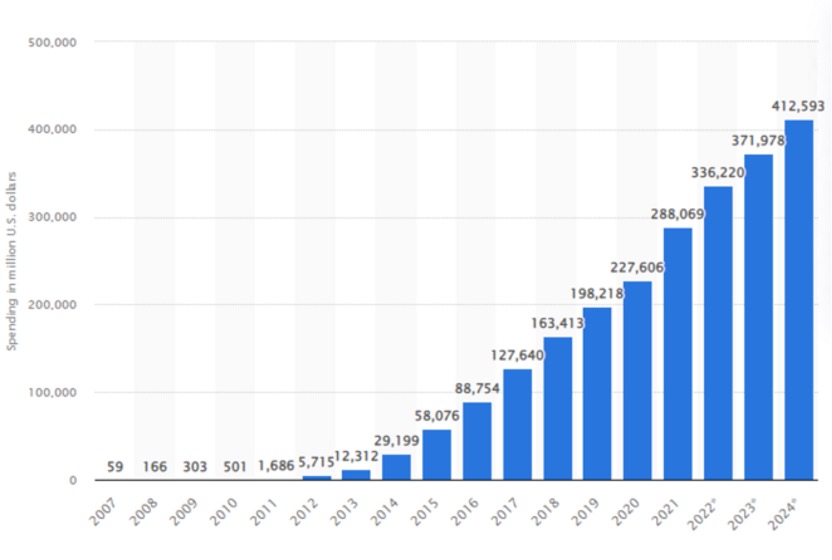

Viewing time has increased rapidly over the last few years and advertisers were sure to quickly follow.

According to a report from Cisco in 2018, consumer internet video traffic will grow 4.3-fold from 2017 to 2022. In the same report, Cisco predicts that internet video traffic will be 82% of all consumer internet traffic.

But with over three billion people in lockdown in 2020 and 2021, screen time increased exponentially and screen time, including time watching videos and playing video games, has grown dramatically. In 2021, global video ad spending came in at just over $81 billion, almost doubling from 2019 when digital video spending reached $45 billion.

Although the world is opening up again and, in many areas, consumers can go about their daily life outside, they are still embracing their digital life. As a result, there has been a strong growth curve that predicts a healthy future for mobile ad spending and digital advertising.

Consumers continue to spend more time online, shifting most consumer attention between mobile apps and streaming services.

Is the global ad spend bubble going to burst?

At the beginning of 2022, it was hard to predict how current inflation, the global political situation and a rise in the cost of living globally will affect the economy and future ad spending. eMarketer already predicts that the strong growth curve will cool off in the coming years.

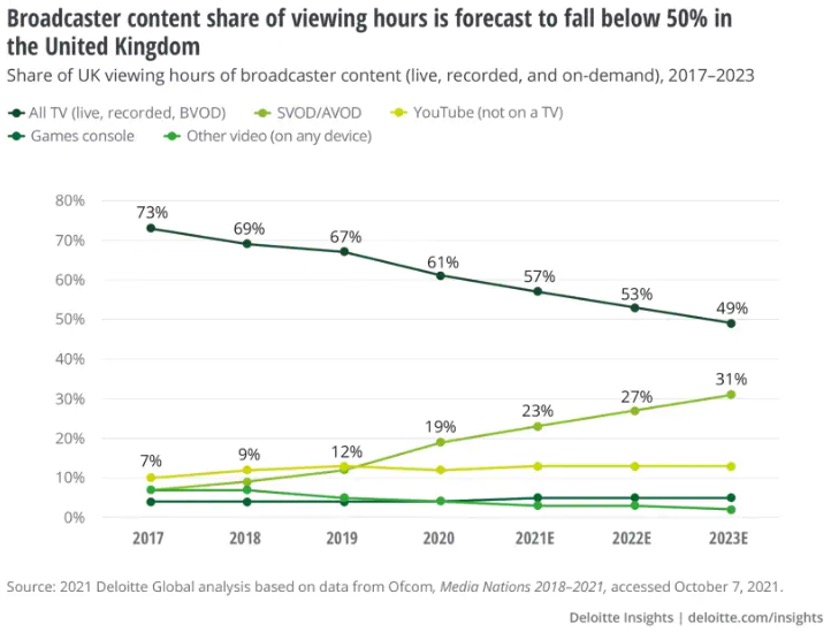

What we can certainly predict is that traditional linear TV ad revenue will continue to fall. According to Deloitte Insights, the traditional TV broadcaster's share of viewing hours among UK consumers will fall to 53% in 2022 and 49% in 2023.

Advertisers know where and how to find their consumers. They also know that video ads are effective since they catch the viewer’s attention with movement and sound and video has become a vital part of their marketing strategy.

Advertisers know where and how to find their consumers. They also know that video ads are effective since they catch the viewer’s attention with movement and sound and video has become a vital part of their marketing strategy.

The growth of streaming services

Netflix, Amazon, Hulu and Disney+ are dominating the market. The adoption of streaming services has accelerated during global lockdowns. In 2020 the market for streaming services grew by a sharp 37%, according to Screenrant.

There was a large increase in paid subscribers during 2020 and 2021. Based on the latest data from JustWatch, Netflix is still the leading subscription video on demand (SVOD) service in the US with 25% market share, followed by Amazon Prime with 19% market share and Disney+ and Hulu catching up with 13% of the market share. Apple TV+ is still trying to catch up with only 5% of the market share.

The latest research from BARB, the UK’s TV audience measurement currency, the number of UK households with two or more SVOD services rose to 43.3% in Q4 2021.

But is this trend sustainable?

We saw the trend of consumers switching from linear TV to paid TV and then SVOD services. With more streaming services offering original content, consumers have a lot of choices. But they also must make a choice with their pocket when choosing their streaming bundles.

When looking at surveys on why consumers have canceled an SVOD service, the cost was the highest factor.

Advertising-based video on demand (AVOD) is on the rise.

Hulu has already proven that an ad-supported streaming service can be successful. Disney+ has announced that it will launch a cheaper, ad-supported service later this year. Now even Netflix, who only recently said an advertising-funded model is not on its plans, has changed its mind.

In the UK, ITV is launching ITVX later this year. Its new streaming service is the UK’s answer to the global trend of offering ad-supported streaming services.

ITVX will be the first streaming service in the UK to offer viewers the flexibility to access free content with ads and an ad-free paid subscription, all in one place. Currently, ITV Hub offers approximately 4,000 hours of content. At launch, ITVX will have 15,000 hours of content.

This trend for new advertising-based video on demand (AVOD) services will certainly continue in the coming years. It’s almost like the perfect storm for the rise in AVOD services as consumers have to cut down on spending to cover increasing energy bills in the coming years.

With the increase in AVOD, digital video ad spending will not only take a cut from digital ad spending, but it will also continue to cut into linear TV ad budgets.

What are viewer expectations?

Whether viewers pay for the content or watch for free, they expect a good quality viewing experience.

A study by Ericsson a few years back found out that slow loading and buffering increased viewers’ stress level and increased heart rate by 38%! A delay-free, quality viewing experience triggers a positive emotional response.

As an advertiser you surely do not want to increase your customer’s stress level and have a negative trigger associated with your brand.

The video ecosystem is extremely complex. Streaming providers must be able to provide a good viewing experience across all screens, platforms, and internet connections.

When you run an AVOD service, customer loyalty is low. You will lose viewers with video start failures and low bit rates. The competition is only a click away. When a viewer starts watching content on an AVOD service and the pre-roll is bad quality, they will assume the rest of your content is low quality too.

Conviva, a streaming analytics company, studied the effect of buffering on engagement and found for viewers who didn’t even make it through 5% of the content, pre-roll ads tallied an average buffering ratio of 1.59%, illustrating how poor-quality causes viewers to tune out. The significant swings in ad quality point to technology issues that advertisers and publishers alike need to investigate and invest in solving, because ad issues cause content abandonment and lost revenue.

New focus on advertising technology

The AdTech industry is in the midst of a resurgence.

With Google’s influence declining across the entire digital sector due to several lawsuits, plus the deprecation of the 3rd party cookie and everchanging privacy laws, the fragmented advertising industry is reevaluating existing business practices.

There was quite a buzz with recent M&A in the AdTech sector. It looks like AdTech is hot again.

Media companies need to focus on their tech stack, and building in-house takes too long and is too expensive.

To compete and get a slice of that digital ad-spend pie, Media companies need to simplify the buying process for their agencies and advertisers and offer something unique.

Buying off-the-shelf software will not cut it. The companies that will stand out are those that have a good tech team in-house that can further develop their tech stack in partnership with established software vendors that provide flexibility and open APIs. This will enable those companies to build out their unique offering with a unique platform. For example, Disney+ just announced that it will further build out its AdTech stack. ITV in the UK has built PlanetV on top of its ad server where agencies can buy ad inventory directly from ITV.

The amount of quality first party data that streaming companies can collect will be key for success. Understanding viewing behavior and preferences are additional data sets that will be crucial for the future strategy of content and programming as well as engaging with viewers.

There is a unique opportunity for organizations to establish their own walled garden with 1st party data with user IDs and household level IDs creating unique audience segments attracting advertisers.

Why is SAS a good partner for digital advertising?

SAS offers a wealth of analytics tools for adtech, such as in-depth digital forecasting, content and ad analytics, and a digital marketing platform to better manage the viewer subscriber journey and delivery of a personal viewing experience.

SAS Match 360, owned by an independent tech company rather than a Media behemoth, is a platform-agnostic, first-party ad server. It has a framework for growth, offers full flexibility with open APIs and is proven at scale by delivering quality video ads during live sports events.

SAS Match 360 is fully integrated with SAS’ customer data platform, marketing planning and strategy, and customer journey optimization technologies to streamline the entire customer engagement process.

Matej Novak, Director CPEx & Optimics, an official SAS partner says:

We had a huge success with SAS 360 Match on the Czech Market partnering with 5 out of the top 10 Czech Publishers. Its versatility and true independence is highly appreciated by the publishers who want to be truly in control of their own inventory, unrestricted with vendor policies. The ad server is also very versatile which means the publishers can offer a wide variety of products and business models. And its S2S integration (without any rev share fees) with SSPs with native support of prebid make it also a great tool for programmatic.

For further information, please visit SAS 360 Match or contact Steve Perks or Cornelia Reitinger.