Are you happy with the ROI on your analytics investments? Recently we’ve seen an upswing in organisations investing in analytical platform capabilities. One can assume the goal of these investments is to turn transactional data into a strategic asset. However, analytics alone will not do it. Unless your organisation is ready and able to invest significant resources in both acquiring and exploiting insights, you’ve potentially bought a ve ry expensive analytical toolkit. It’s not until you use those insights for determining the next best step, identifying the next analysis question to ask, or making better decisions faster, that your analytics data can be considered a strategic asset.

ry expensive analytical toolkit. It’s not until you use those insights for determining the next best step, identifying the next analysis question to ask, or making better decisions faster, that your analytics data can be considered a strategic asset.

Does this sound familiar?

“We’ve got the money to build the model, but not to … actually get it into production”

- Quote from a University of Wollongong research study.

A research team at the University of Wollongong in Australia, recently conducted an external study to determine whether or not those who have enhanced their analytical capabilities are executing on the insights discovered.

Their study focused on the resource investment behaviour of line managers. Why? Because the assumption is that the line managers’ demand for analytics-based insights is an important driver of analytics-enablement and related improvement in organisational performance.

Interestingly enough, their main finding was that mechanisms to ensure effective exploitation of the analytics investment are often not provided.

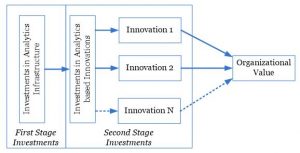

It’s clear that to ensure sound ROI for your analytic platform, you need to consider a two-stage investment process: An infrastructure investment phase and an innovation investment phase.

Based on this two-stage model the study found three valuable insights:

- For those building out analytics platforms, predictive analytics seems to be the laggard in this investment process.

- Top performing organisations expend more effort to acquire insights and more effort to exploit insights than underperformers. This is resulting in significantly higher levels of performance and innovation in these top performing companies.

- Key organisational requirements to enable business analytics-enabled insights include:

- Executive support.

- Business analytics team support.

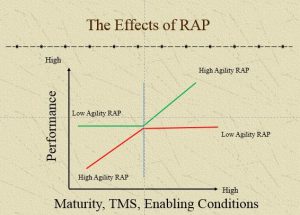

- A high resource allocation process. As a business invests in an analytics platform and changes the way it operates to embed a culture of analytics where innovation is encouraged, it will increases in analytical maturity. As a result, the business generally sees a higher return on their investment in analytics (see the green line in Figure 2). The critical link driving this successful outcome is balancing governance and innovation with investment and the ability of the organisation to adopt change.

While the study shows there’s still some work to be done in terms of building mature analytics platforms, understanding the key levers to success will help ensure that any investments in the future provide the quickest, most successful route to ensuring your data becomes that strategic asset required to survive in a dynamic, disruptive market.

Following the two-stage investment process will help make sure resource allocation for insight exploitation is considered up front. Ensuring a high resource allocation process will ensure the ROI on that analytics investment is realised.

For more information on the method and results download the full paper: Generating Value from Investments in Business Analytics.