On a recent CBS Sunday Morning episode Dr. Phil McGraw of “Dr. Phil” fame was featured. During the segment he talked about shifting his focus from golf to tennis. To paraphrase, he said golf drove him crazy because he couldn’t bear down, run faster, sweat harder and be better. I had to smile because I’ve been there!

On a recent CBS Sunday Morning episode Dr. Phil McGraw of “Dr. Phil” fame was featured. During the segment he talked about shifting his focus from golf to tennis. To paraphrase, he said golf drove him crazy because he couldn’t bear down, run faster, sweat harder and be better. I had to smile because I’ve been there!

I’ve been playing golf for going on fifty years now and I am playing better than ever, even though I practice less and less. That would seem counter-intuitive to everything said about golf. Isn’t it supposed to be the sport you give your life (and soul) to in order to get better? When I was a big, strong, strapping kid I use to try and hit the cover off the ball. My handicap soared into the mid-20s. My father used to watch me and he’d always say two things: “Let the club do the work” and “Learn to play like and old man.” Of course, being the obstinate, hard-headed young man I was, it took me until I became an old man to I realize what he was saying.

Let the club do the work: Hitting harder does not translate into better. Each club is like a tool for a specific set of goals. If you slightly change the way you swing the club will make the ball do different things. Knowing when to slightly change your swing is the key to making the club do the work.

Play like an old man: An old man tends to know his limitations on the golf course. That wisdom tells the old man there is a very slim chance he might hit it 220 yards over the water to the middle of the green. His best shot would be to layup short of the water and a chip to the green. When you play the percentages in golf, your handicap drops dramatically.

I bring this up because I tend to see a lot of supply chain people trying to be like Dr. Phil on the golf course. They think if they bear down, run faster and sweat harder, they will improve their supply chain metrics. Given that, let’s use my father’s suggestions as a supply chain guide to further the metaphor: “Let the club do the work” and “Learn to play like an old man”.

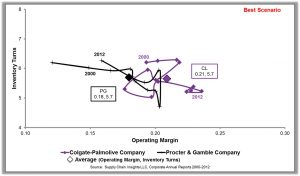

Many of you know Lora Cecere of Supply Chain Insights. She has done some ground breaking research on how shifting focus on metrics can make performance whipsaw back and forth as supply chain practitioners focus on either execution or financials. Let me say, I absolutely love Lora Cecere’s Turns versus Margin Graphs! They remind me of the tracks that the Tasmanian Devil of Bugs Bunny fame would have left. For those who have not seen the graph it looks like this:

Within this graph companies, over time, have a “track”. Good supply chain management companies tend to migrate toward the goal of having high inventory turns and high margins. However, the majority of companies whipsaw back and forth between high margin / low turns and low margin / high turns. Those “tracks” look like the tornado surrounding the Tasmanian devil.

Over the past 30+ years that I have been in and around supply chains they seem to have a pendulum process that swings back and forth between supply chain metrics (turns, etc.) and financial metrics (GMROI, etc.). Instead of the Tasmanian Devil it reminds me more of the moth and a flame. Finance will let the supply chain drive down inventory to get the required turns, but as soon as margins are affected the constraints come off and the inventory rises. However, it doesn’t have to be that way.

Let’s go back to the golfing analogy. I equate the supply chain’s efforts to get supply chain metrics under control is a lot like I use to play golf - grip it and rip it! The idiosyncrasies found in the supply chain, just like golf, make swinging harder amplify errors.

Let the club do the work

Getting one KPI like Inventory Turns, artificially low is like trying to hit the cover off the golf ball. Some people have described golf as a game of finesse. It is and this also is the same in supply chains. Getting the inventory turns in line without the understanding of how it affects other KPI’s is like trying to hit a golf ball 300 yards. It may travel that far, but it most likely is going out of bounds. Artificially low inventories without a well thought out plan will create lower margins due to out of stocks and expedited ordering. You need to have a plan as to what is a “reasonable” inventory turn goal in your company and your industry. If you don’t have a plan you are going accept someone’s high turn estimate in a meeting and kill margins.

Just like in golf, a small shift in the way you swing the club allows that club to give different outcomes. It is not so much that the entire inventory drops to achieve better inventory turns. That’s not the goal. If you can shift costs attributed to habitually overstocked items and place that money on understocked items the total inventory is right sized. Aligning supply chain with financials instead of simply attaining a supply chain “efficiency” goal will allow you to fine tune your efforts. At that point you are making small corrections instead of massive shifts. This letting the club do the work supply chain methodology will keep you aligned to your goals and know when you make one a change in your supply chain swing the result is expected across all KPI’s.

Learn to play like an old man

When it comes to supply chains how much improvement is really attainable and what are the fallouts to all KPI’s? Hitting a 220 yard shot over the water onto the green is a pretty cool shot, but how often are you really going to hit it perfect, and what are the penalties if you miss?

The most successful supply chain practitioners are those who match risk and reward. I remember sitting in a meeting with a supply chain manager whom I learn later was not very successful. He said he wanted to attain an inventory turn rate of 10 in the next year. It was quickly understood that the number was pulled out of a hat and had no research on the company or industry. This guy wanted to hit the green from 220 yards over the water - every time! His company was at 4.5 turns a year and the industry was around an 8 turns. Given the situation not only would the turns not be met, but all financials were going to take a hit. Playing like an old man here would have helped. Go for attainable then measure the risk of how it will affect the other supply chain and financial goals.

The takeaway… Golf and supply chains are all about finesse. “Gripping it and ripping it” like John Daly will make you whipsaw back and forth between an artificially efficient supply chain and faulty margins. The key is to stop and measure how your KPI’s, both supply chain and financials, interact and adjust your system holistically. Let your KPI’s do the work and play like the wise person you really are!

Oh, by the way, I play golf about 12-15 times a year and consistently shoot in the high 70s and low 80s. I let the clubs do the work and play like an old man because I finally am one! Oh, and tennis? - that’s too much of a workout!

5 Comments

I am a huge fan of golf, and love the analogy Bob. Is this pic from the Tail of the Whale in Puerto Vallarta, Mexico?

Hi John! Yes....that's it. I've never played there, but the picture kind of summed up the risk-reward of golf. You'll have to tell me....did you par the hole?

Ha! Sadly no, I did not par the hole. That wind is tricky and much stronger that expected!

If you think of Golf as a metaphor for supply chain you might like this article comparing S&OP to a Golf swing coach

https://soptime.wordpress.com/2013/12/10/think-of-sop-as-your-supply-chain-golf-swing-golf-coach/

Excellent find Jon!! I didn't know that article was out there. It has some great insights.