Good news...an analytics survey last year found that 72% of insurance executive agreed that analytics is the biggest game-changer in the next 2 years. Bad news...compared to other industries the adoption rates of analytics in the insurance has lagged other industries.

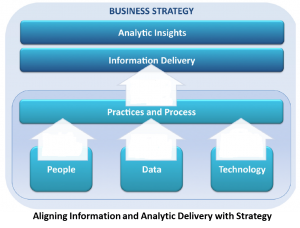

To reverse this trend and help insurers travel down the path to becoming an Analytic Insurer they must consider four things:

Data:

- What data is accessible and obtainable?

Technology:

- What type of analytic tools are needed and available?

People:

- What type of resources are required? What are the right skill sets?

Processes:

- What best practices or processes will facilitate the implementation of an analytic strategy.

Organizations new to analytics should start with small proof of concept and pilot projects and build on success to gain support throughout the organization. This will lead to buy-in from senior executives, increased funding and more ambitious projects. A win-win for everyone.

There is no “one size fits all” when it comes to analytic execution. To find out how you can transform your organization into the Analytic Insurer download a copy of the white paper “Building a strategic analytics culture: a guide for the insurance industry”.

To survive and thrive in the competitive insurance industry, carriers must implement analytics.

There are no more excuses.

I’m Stuart Rose, Global Insurance Marketing Director at SAS. For further discussions, connect with me on LinkedIn and Twitter.