What do the following have in common?

- A homeowner inflates the value of his home entertainment equipment stolen during a robbery.

- A parent states they are the primary driver for their child’s car.

- A doctor charges for a non-existent procedure.

- A construction company underreports payroll or misclassifies an employee’s duties.

Answer: Insurance fraud

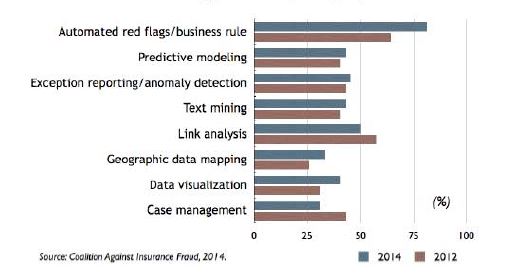

Insurance fraud comes in many shapes and sizes, and technology plays an important part in prevention. In fact, a recent study by Coalition Against Insurance Fraud found that 95% of insurers are using anti-fraud technology. However, most insurers have found that no single technology is sufficient. A combination of techniques is required to identify both opportunistic and organized fraud. The first line of defense continues to be automated red flags / business rules (81%). However, as fraud patterns and behavior become more sophisticated, insurers are deploying more advanced analytical techniques. The next top five technologies were link analysis (50%), anomaly detection (45%), predictive modeling (43%), text mining (43%) and data visualization (40%). The figure below shows the investment in these technologies compared to the investment shown in a similar survey undertaken in 2012.

Other key findings from the report included:

- More than half surveyed indicated that suspicious activity had increased over the past three years.

- Two-thirds of insurers responded that they use anti-fraud technology developed by a software vendor.

- Most cited benefits of fraud-detection solutions including receiving more and better referrals, uncovering organized fraud, and improving investigator efficiency.

Read the full report “The State of Insurance Fraud Technology” to understand how and to what extent insurers are using anti-fraud technology.

The full scale of insurance fraud is unknown. Since the crime is designed to go undetected, the fraud-fighting community can only guess at the extent of crimes committed and dollars lost. Whilst many policyholders still view insurance fraud as a victimless crime, it impacts not only every insurance company but every policyholder due to increased premium rates. The FBI estimates that insurance fraud costs more than $40 billion per year or between $400 and $700 annually in extra premiums for every American family.

CNA and Allianz are just two insurance companies who no longer view insurance fraud as cost of doing business. They have implemented SAS Fraud Framework for Insurance to increase detection rates resulting in reduced loss ratios, competitive edge and lower premium rates for policyholders.

I’m Stuart Rose, Global Insurance Marketing Principal at SAS. For further discussions, connect with me on LinkedIn and Twitter.

1 Comment

Pingback: 10 simple steps to detect more insurance fraud - The Analytic Insurer