Principle 13:

Principle 13:

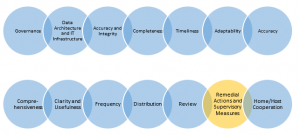

Remedial actions and supervisory measures - Supervisors should have and use the appropriate tools and resources to require effective and timely remedial action by a bank to address deficiencies in its risk data aggregation capabilities and risk reporting practices. Supervisors should have the ability to use a range of tools, including Pillar 2.

The goal of the Principles of BCBS 239 is to provide banks with guidelines for effective risk data aggregation and reporting. In this SAS series on the Principles of BCBS 239, my colleagues have pointed out that regulators and supervisors have an important role to play. For one, ensuring compliance may help avert a future global financial crisis. In this post, I’ll talk about three requisite powers and capabilities they need to successfully evaluate compliance and identify possible deficiencies – freedom, knowledge and advanced analytics.

Freedom. While evaluating compliance, local regulators should provide some data reconciliation checks as well as checks for materiality in calculations. They may also need to define remedial actions and provide incentives (or penalties) to banks for better risk data management and aggregation. For example, in CCAR 2014 stress tests under the Dodd-Frank Act, the Federal Reserve failed four banks based on process, data adequacy and governance even though these banks passed the quantitative tests. In a similar vein, local regulators can also use the Pillar II mechanism for assessing data quality in the estimation of risks and capital adequacy.

Knowledge. Regulators should understand the systems capabilities that are available. Knowing this will help regulators evaluate what is or isn’t possible in terms of setting up an appropriate risk data infrastructure. It will also help them differentiate between institutions – who is investing in the right technologies and who are the laggards?

Advanced analytics. Regulators and supervisors may also need to improve their data assessment by investing in additional data management tools. Such tools would also allow them to sift through the data submissions from a systemic risk perspective.

Appropriate supervision and guidance on the principles would help provide a strong foundation for banks to measure their risks better and thereby improve governance and strategic decision-making.

Read how SAS can help you meet your regulatory obligations. SAS solutions provide an end-to-end framework for addressing and reporting on regulations, predefined stress-testing methodologies and preconfigured reporting capabilities.

1 Comment

Is there a definition on what "risk data aggregation" really means? Does it mean risk data isn't being added up, or does it mean there is a risk [of data aggregation] which is deficient?