Principle 8:

Principle 8:

Comprehensiveness - Risk management reports should cover all material risk areas within the organization. The depth and scope of these reports should be consistent with the size and complexity of the bank’s operations and risk profile, as well as the requirements of the recipients.

One of the four themes of the BCBS 239 principles is completeness of information – banks should be able to aggregate all material risk data and measure and monitor the comprehensiveness of that data. In a recent panel discussion, Vic Warnement from American Express points out a very good reason for complying with the principles. He said, “Over and over again, regulators ask the same question: How do you know?” High-performance analytics helps you answer that – quickly and accurately.

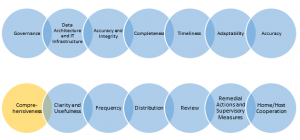

This is the ninth post in our series on the principles of BCBS 239. In this post and the 13 others, we discuss the value of high-performance analytics in complying with the guidelines for risk data aggregation and reporting.

For Principle 8, the Basel Committee on Banking Supervision requires banks to provide comprehensive (based on the size and complexity of the bank’s operations) reports on all material risks - credit , market , interest rate , funding liquidity and operational risks. The primary risk measures used to manage these risks are exposure concentration, interest income at risk, regulatory capital and value at risk (or similar measures) for the market risk portfolios.

In additional to these traditional risk areas, banks are also measuring and reporting, to a much lesser extent, reputational and strategy risks. These risks are harder to report, because there are no standard quantitative measures for such risk types.

Size and complexity drives scope and depth

The principle of materiality drives the risk areas on which a bank focuses. For example, the JP Morgan Chase London Whale case, where a large concentration of exposures to Index CDS was built by a single trader who omitted reporting on gross and net exposures. Management couldn’t see the build-up of the positions because exposure concentrations were hidden behind inaccurate VaR and P/L numbers.

In another example, assume a bank is the servicing agent for its own mortgage portfolio, composed entirely of residential mortgages, and an external portfolio. The risks material to the bank would be:

- Interest rate risk and prepayment risks on the hold to maturity (HTM) mortgage portfolio and on the mortgage servicing rights (MSR) on the servicing portfolio.

- Market risk on the available for sale (AFS) mortgage portfolio.

- Funding liquidity risk, if the bank is funded by short term deposits.

- Operational loss risk on the mortgage servicing operations.

SAS solutions for comprehensive coverage of risk management reports

SAS’s suite of risk management solutions measure and report on all the traditional risk measures in ALM, credit, market and operational risk areas. The primary challenge in capturing and reporting material risks is the lack of a single risk data warehouse. SAS offers a solution to this key problem by offering the Banking Detail Data Store (which is the single input source for all of SAS’s risk analytic solutions), and the risk reporting repository.

SAS’ solution offering includes an integrated risk data model which is designed to store all traditional risk measures in a star schema for a comprehensive reporting of all quantitative measures for the hierarchy that a bank might be interested in. Coupled with SAS® Visual Analytics, the reporting repository can be a powerful solution to report all material risks.

Please follow the other posts in this series.

Learn more about how SAS can help you address BCBS 239 compliance.