Principle 4:

Completeness – A bank should be able to capture and aggregate all material risk data across the banking group. Data should be available by business line, legal entity, asset type, industry, region and other groupings, as relevant for the risk in question, that permit identifying and reporting risk exposures, concentrations and emerging risks.

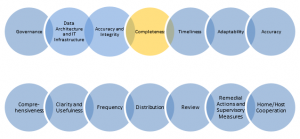

My colleagues and I have written a series of articles about the 14 Principles of BCBS 239 and the use of high-performance analytics to manage risk data and increase the speed of information availability – thereby improving the decision-making process and reducing the probability and severity of losses. In this post, I will talk about Principle 4’s requirement for completeness of your risk data.

To be in compliance, financial institutions are expected to have no risk data material deficiencies including on- and off-balance sheet exposures. Material deficiencies are common when lines of business portfolios are not integrated with the risk data aggregation and reporting system. Often bottlenecks are present when manually produced extracts or spreadsheets are delivered.

A best practice is to have automated processes gather the appropriate exposures with minimal manual processing. The aggregation system ought to have direct access to an appropriate data model and store with relevant information for minimizing errors, increased transparency and reduction of bottlenecks.

There is no expectation of a common metric across the different risk areas: credit, market, liquidity and operational risk. For example, credit risk typically reports in terms of economic and regulatory capital while liquidity risk’s most relevant metrics are the Liquidity Coverage Ratio and Net Stable Funding Ratio. However, results for each risk area must still have clearly defined methodologies so that management can assess and take appropriate action when necessary.

The level of completeness should be known at all times with exceptions identified and explained. A metric that incorporates information from the general ledger - including which portfolios have reported exposures and which business process and computations have been completed - will give a greater degree of confidence in the risk data.

SAS offers an intuitive platform that addresses each of the issues. SAS’ risk engine can aggregate data from disparate platforms; provide workflow for control; detail audit histories; and document risk data dictionaries of all terms, hierarchies and related resources and allow ease of exploration and search. And SAS® Master Data Management integrates all of it. The SAS platform uses business rules to produce metrics showing the level of completeness of all areas of risk. SAS’s platform integrates with the most prevalent competing platforms.

Please follow the other posts in this series.

Learn more about how SAS can help you address BCBS 239 compliance.