Digitalization, big data and AI are changing the role of insurance and, therefore, the role of actuaries. A lot of reports – like McKinsey’s Insurance 2030, Deloitte’s “The Exponential Actuary," or the Big Data and Insurance report by the Geneva Association (a leading think tank of insurance CEOs) depict aspects of the future actuarial profession. A good way to summarize all these perspectives is to look at the main needs and issues of insurance CEOs on their digital transformation agenda.

The insurance CEO agenda

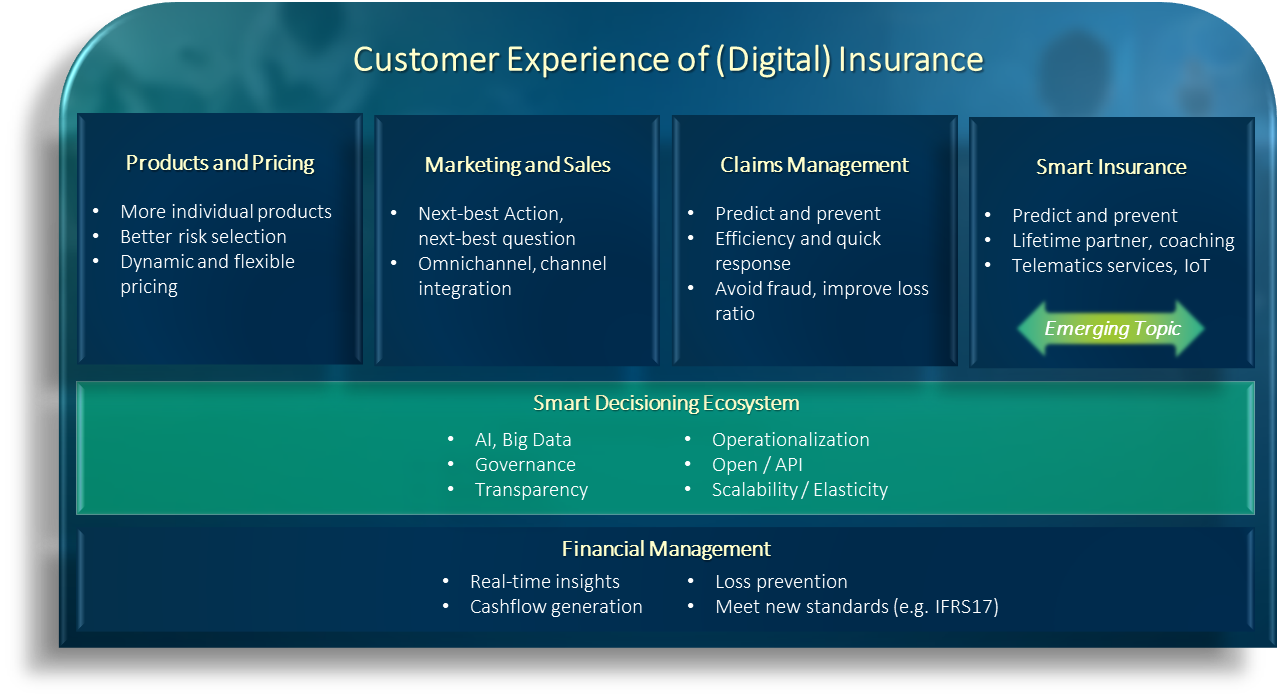

It all comes down to creating the customer experience of future insurance. Based on what modern consumers are expecting in terms of flexibility, agility, access to products and services, and of course communication, the new vision also respects that insurance customers are not thinking in organizational silos but expect a consistent experience across the whole insurance life cycle. Customers want a consistent experience whenever they communicate with the insurer or when the insurer offers products and services to them.

There is a clear trend towards tailored, individual and flexible products. This means that in products and pricing, actuaries need to design more dynamic, usage-based products. New data sources, AI and machine learning can help to perform a much more precise risk selection – which is also a chance for insurers because it enables them to insure what has been uninsurable before. Regulatory authorities review AI or machine learning using explainable AI and governance methods that make these procedures transparent.

Promise becomes truth

Claims management is where the promise becomes truth. Here, insurers strive for straight-through processing for rapid responses to claims. This takes into account models that predict the severity of a damage, the likelihood of fraudulent behaviour, probability of legal challenges or customer value to determine the next best action.

All these touch points are linked from a customer perspective, so interaction and decisions cannot be restricted to a certain silo. If my claim was rejected, the marketing department had better start a customer loyalty measure rather than giving me an upsell offer. If an insurer offers flexible products with optional tariff components, this can be the basis for more customer touch points along the life cycle.

The field of smart insurance brings big data, wearables and IoT to health and life insurance, meaning that all flexibility, agility and interaction of a digital P&C insurer will affect life actuaries, as well.

In the European market, we observe a strong strategic evolution (some may say revolution) from pure risk protection towards predicting and preventing risks. Large insurers are on their way of seeing themselves as a “lifetime partner” rather than the ones who pay for damages. The field of smart insurance brings big data, wearables and IoT to health and life insurance, meaning that all flexibility, agility and interaction of a digital P&C insurer will affect life actuaries, as well.

The 'New Age actuary'

The risks insurers cover and the ways they underwrite, sell and distribute, and manage claims are changing. It all comes down to automating decisions across business functions and customer touch points. What is the right tariff structure? How severe is the damage? How do I best cope with a certain customer?

And the requirements for data-driven decision making are similar: Make use of new methods from AI and ML, be able to decide in real time, operationalize the decisioning process quickly, and offer transparency and accountability for customers, management and regulators. Digital transformation calls for a smart decisioning ecosystem for the whole insurance organization. What does all this mean for the actuarial role profile?

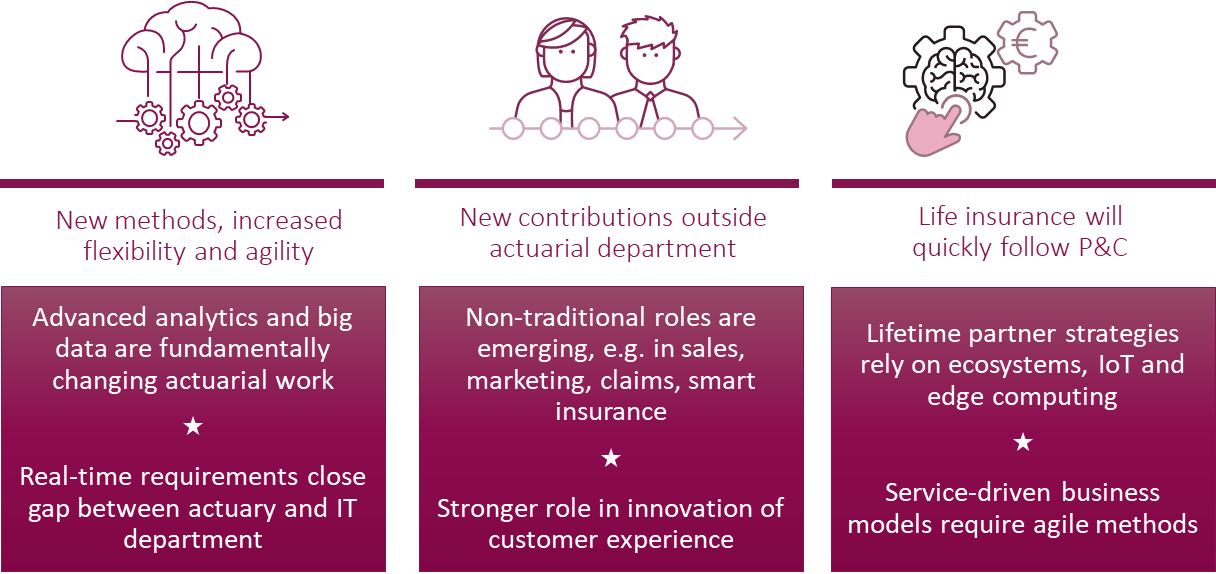

In summary, advanced analytics and big data are fundamentally changing actuarial work. Machine learning, with its data-driven and often difficult to interpret techniques, increasingly complements classical actuarial methods. In his article on actuarial transformation my colleague Michael Rabin sketches how the actuarial role in the traditional field of rate making changes. He also shows that underwriters and actuaries move closer together and realize real-time quoting processes. In effect, the deployment not only of tariffs but a lot more models for real-time decisions becomes part of the actuarial work.

It is becoming more common for actuaries to work in nontraditional roles and contribute to other areas of the business, as well as help the insurers to innovate.

Expansion of actuarial roles

It is becoming more common for actuaries to work in nontraditional roles and contribute to other areas of the business, as well as help the insurers to innovate. Whether it is modelling the sales and distribution processes and identifying characteristics of the most effective agents, scoring of driving styles using telematics data, or improving the claims process, actuarial competencies that combine deep business know-how with mathematical and statistical excellence are valuable across all insurance processes.

Digitalization and new regulatory requirements dramatically extend their role to more strategic tasks way beyond the traditional risk assessments. Actuaries are now part of insight generation and decision making from pricing to claims, marketing and sales, and accounting. At the same time, this means that the required skills also need to include strong communication power to explain what they are doing to executive management, customers, regulators and other relevant stakeholders. And the knowledge to operationalize their prediction and forecast models.

The future is collaboration

While all this holds especially for P&C insurers, life insurance will quickly follow as lifetime partner strategies rely on digital ecosystems, real-time data, IoT, edge devices like wearables, and connected patient health care technologies. This emerging field calls for agile adaption to the market and short innovation cycles for products and services.

With this new role, methodological innovation, openness and agility, new and orchestrated processes and tools need to be set in place to ensure governance, repeatability and transparency. And maybe even more important, a new collaborative way of working that brings actuaries, underwriters, marketing people and claims managers closer together requires a common ground: an ecosystem that bridges people with different skills, fosters creative processes for gaining insight, enables highly reliable processes for production and gives consistent access to a whole bunch of technology. Therefore, actuarial innovation needs a consistent smart decisioning ecosystem.

If you’d like to learn more on the changing role of actuaries and the business effects of actuarial transformation, I recommend watching the recording of this live event I recently attended, featuring some esteemed thought leaders from the insurance industry who shared their thoughts on The New Age Actuary.